EFG Hermes, an EFG Holding company and the leading investment bank in the Middle East and North Africa (MENA), in collaboration with the Dubai Financial Market (DFM), inaugurated the 18th Annual EFG Hermes One-on-One Conference on March 4th, 2024. The signature event, which today stands as the world’s largest investment forum dedicated to MENA, will run until March 7th, 2024, at the JW Marriott Hotel Marina.

Read more: EFG Hermes conference explores investment potential in MENA markets

Highlights from the opening session included:

- A keynote speech by EFG Holding Group CEO, Karim Awad

- An on-stage interview with Mahmoud Mohieldin, UN Special Envoy on Financing the 2030 Agenda for Sustainable Development, conducted by Sally Mousa, Senior Presenter at Forbes Middle East.

- A panel discussion titled ‘Beyond Automation: Harnessing AI, Transforming Industries for Growth and Efficiency’ featuring Wael Fakharany, CEO of Edenred UAE, and Renier Lemmens, Group CEO of Geidea, moderated by Patrick FitzPatrick, Editor-in-Chief and Managing Partner of The Enterprise Company.

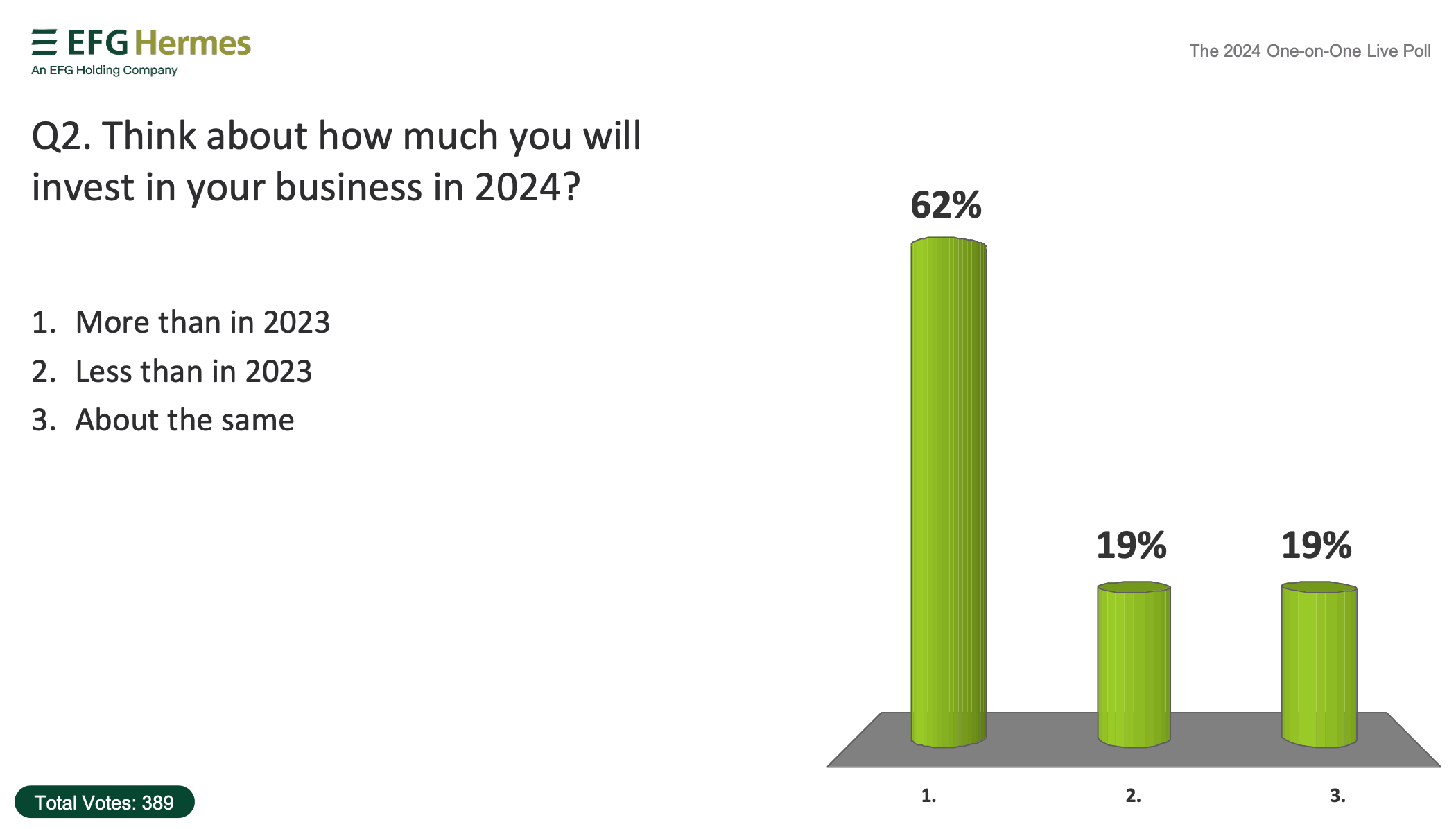

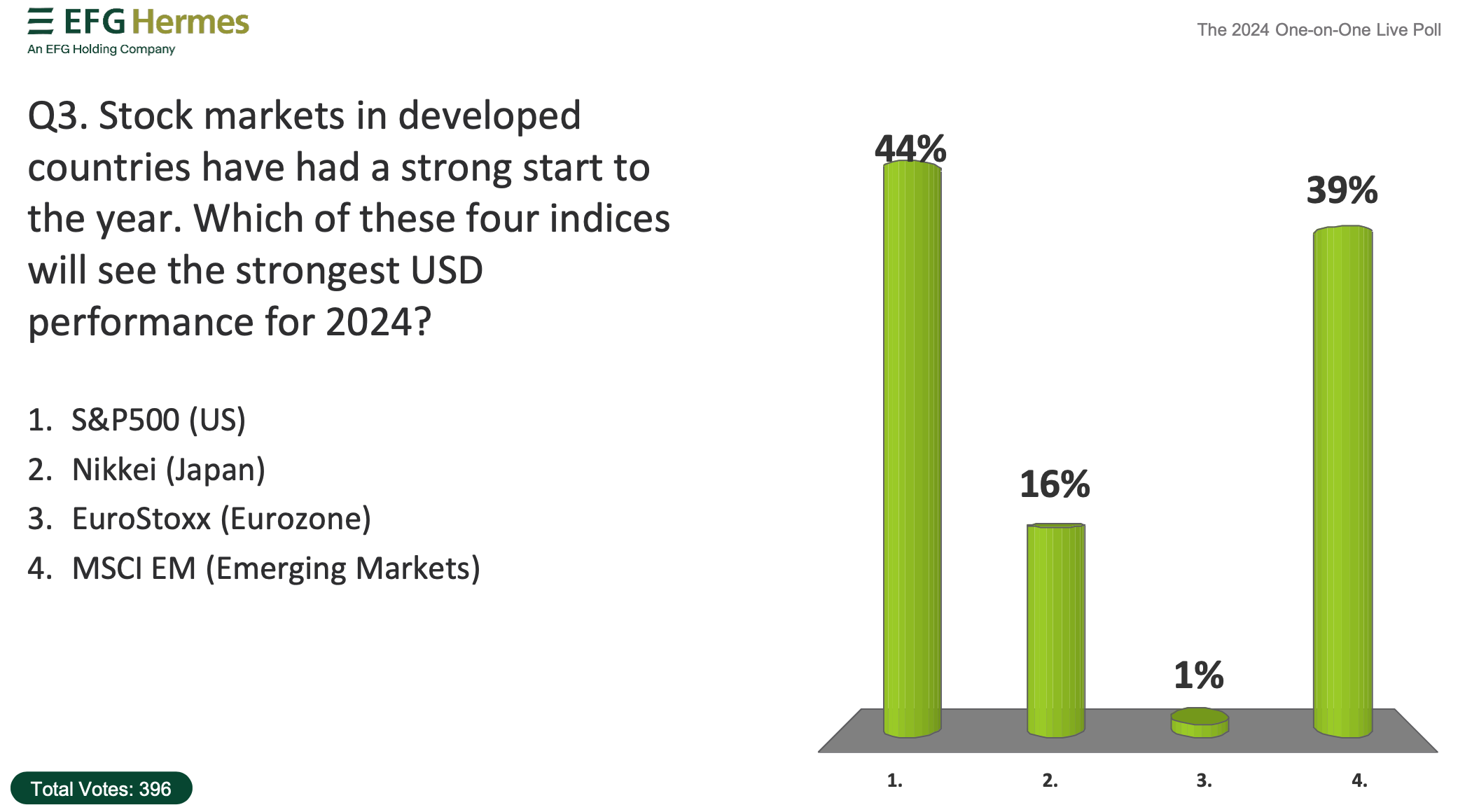

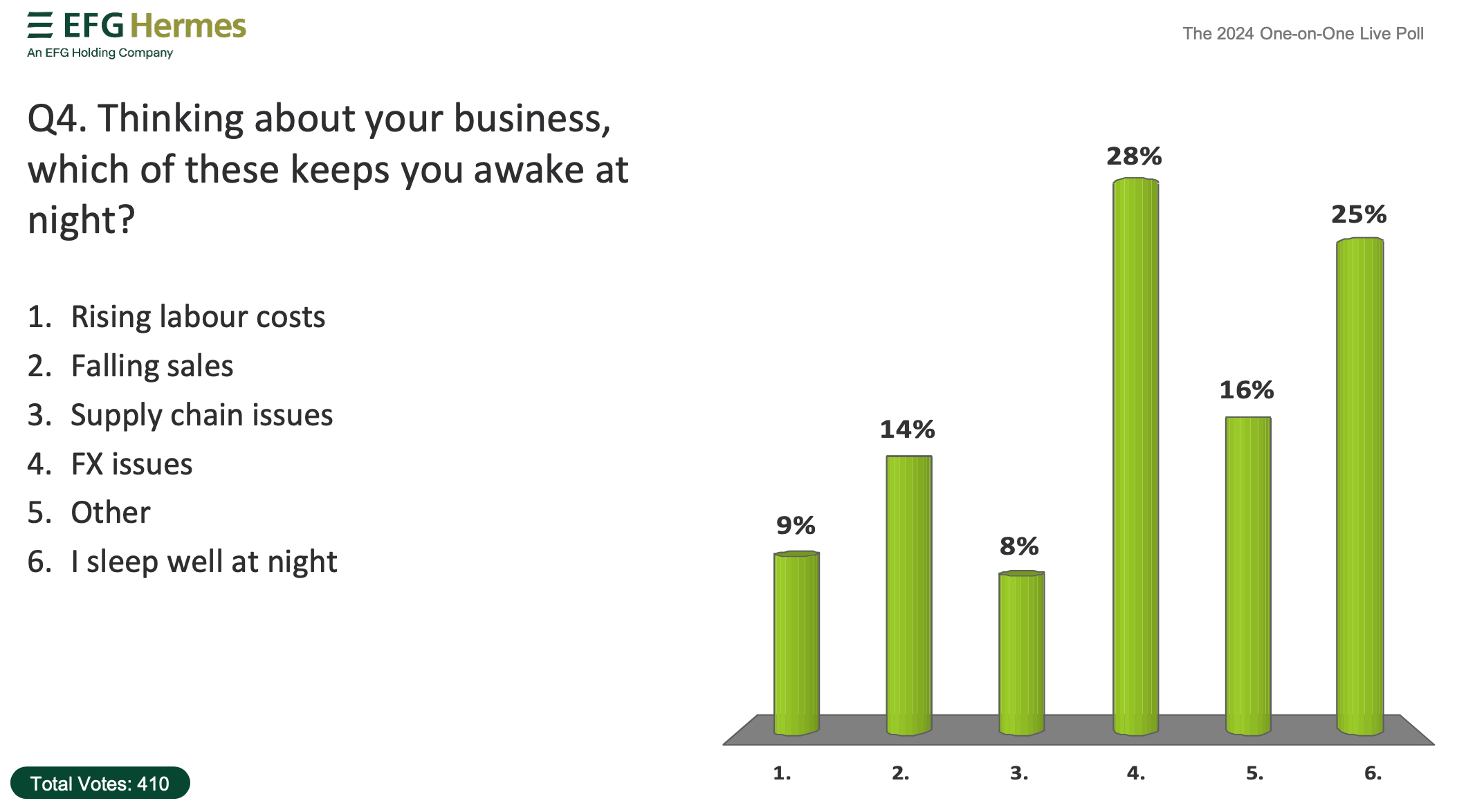

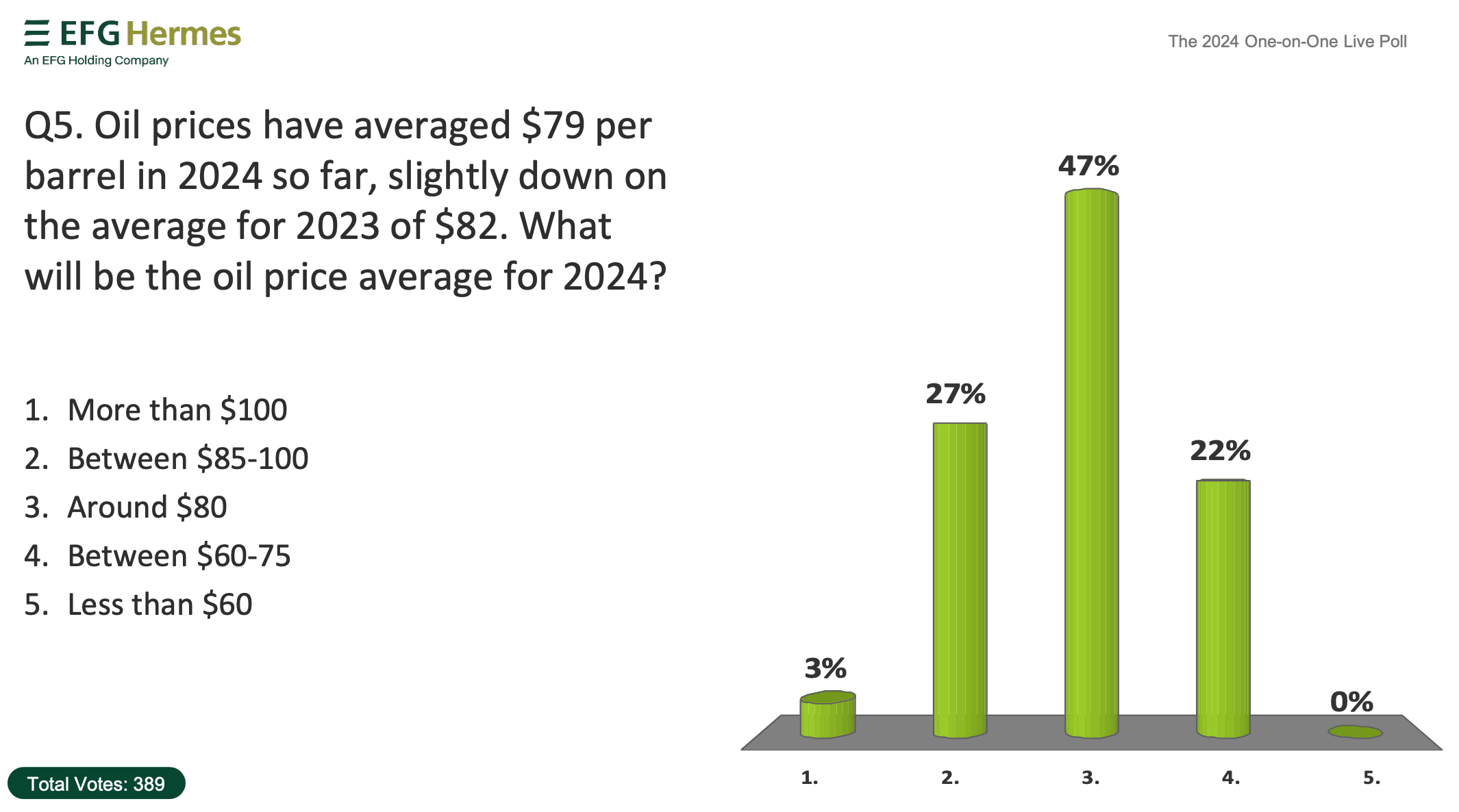

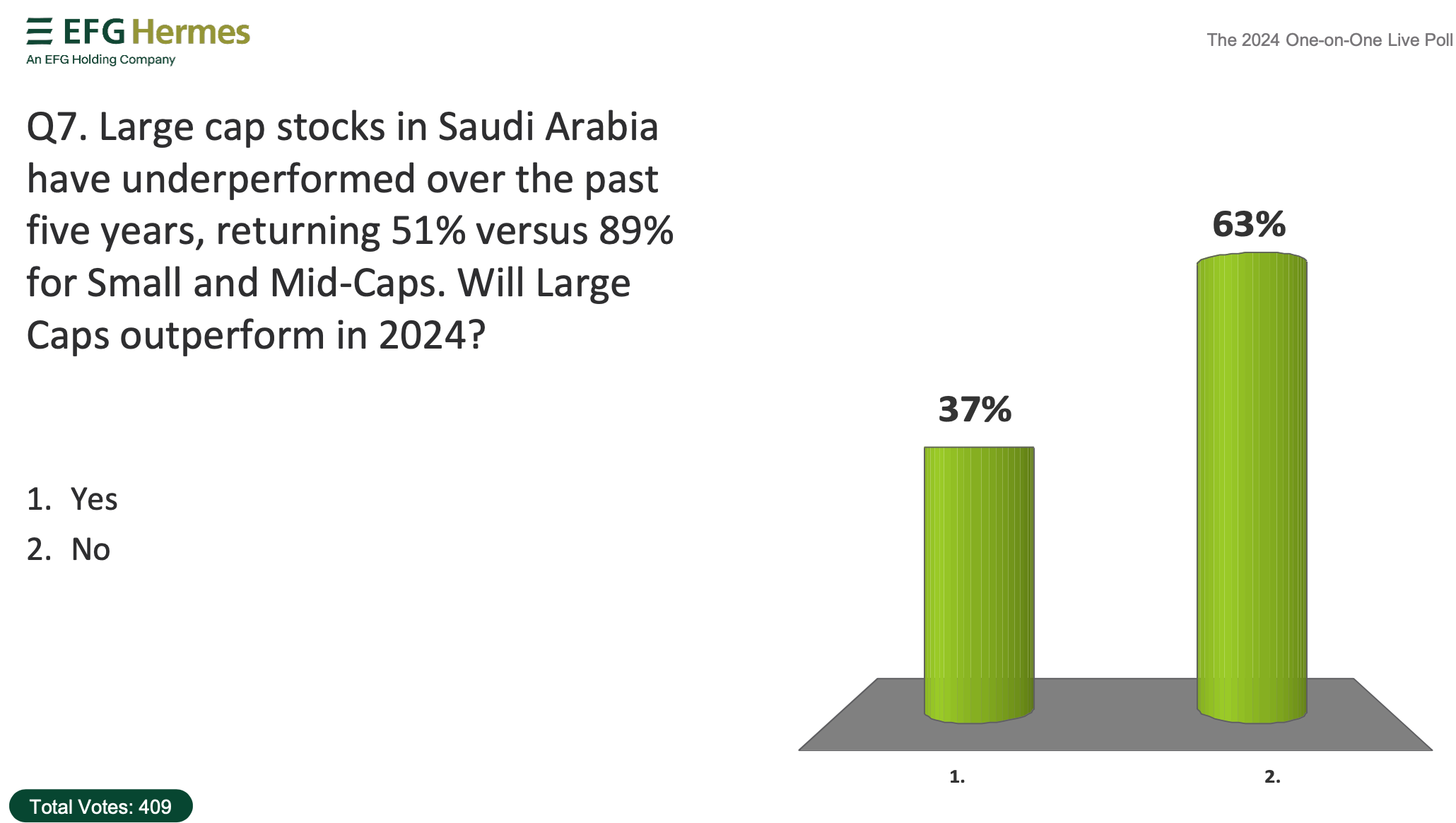

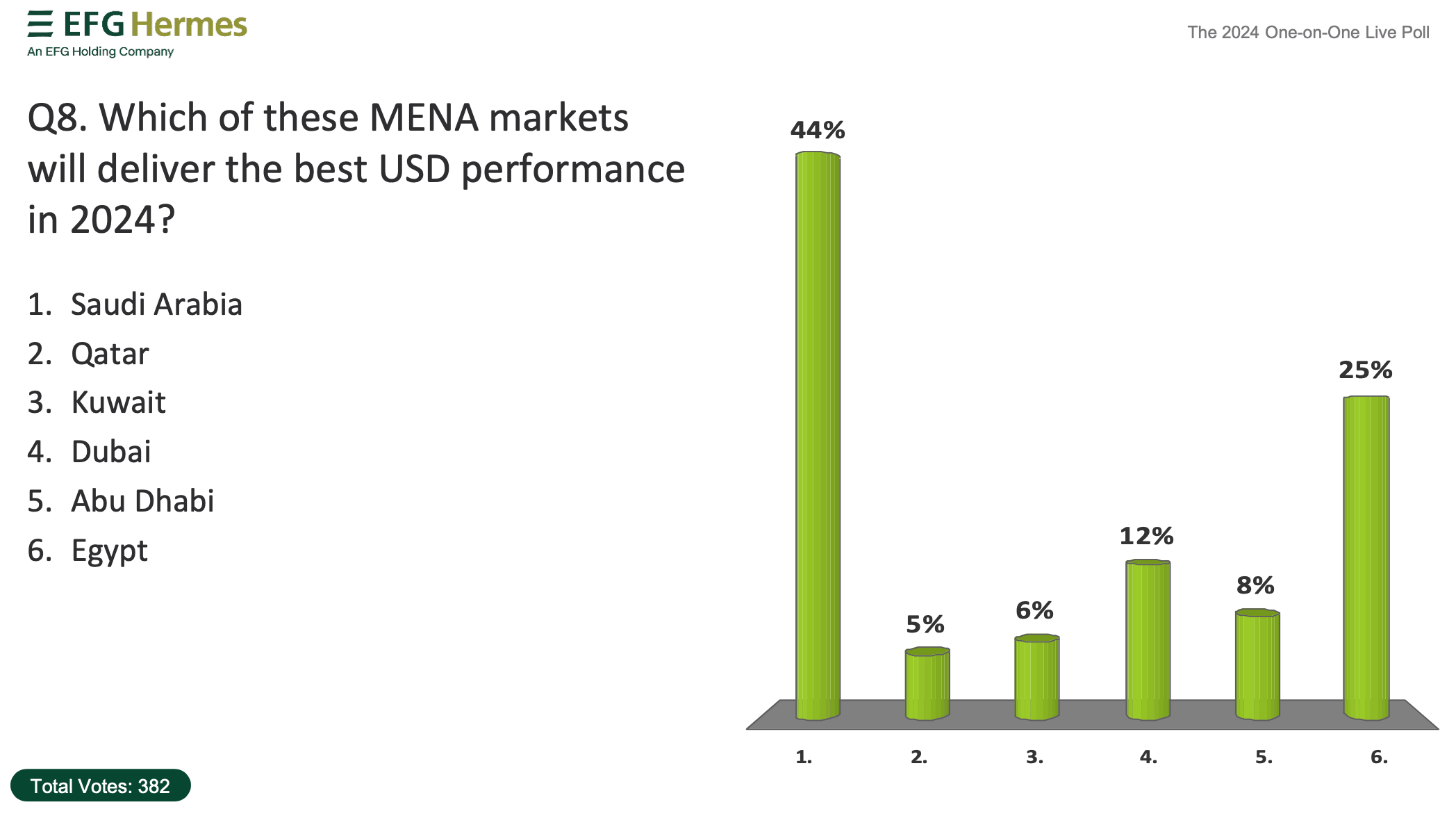

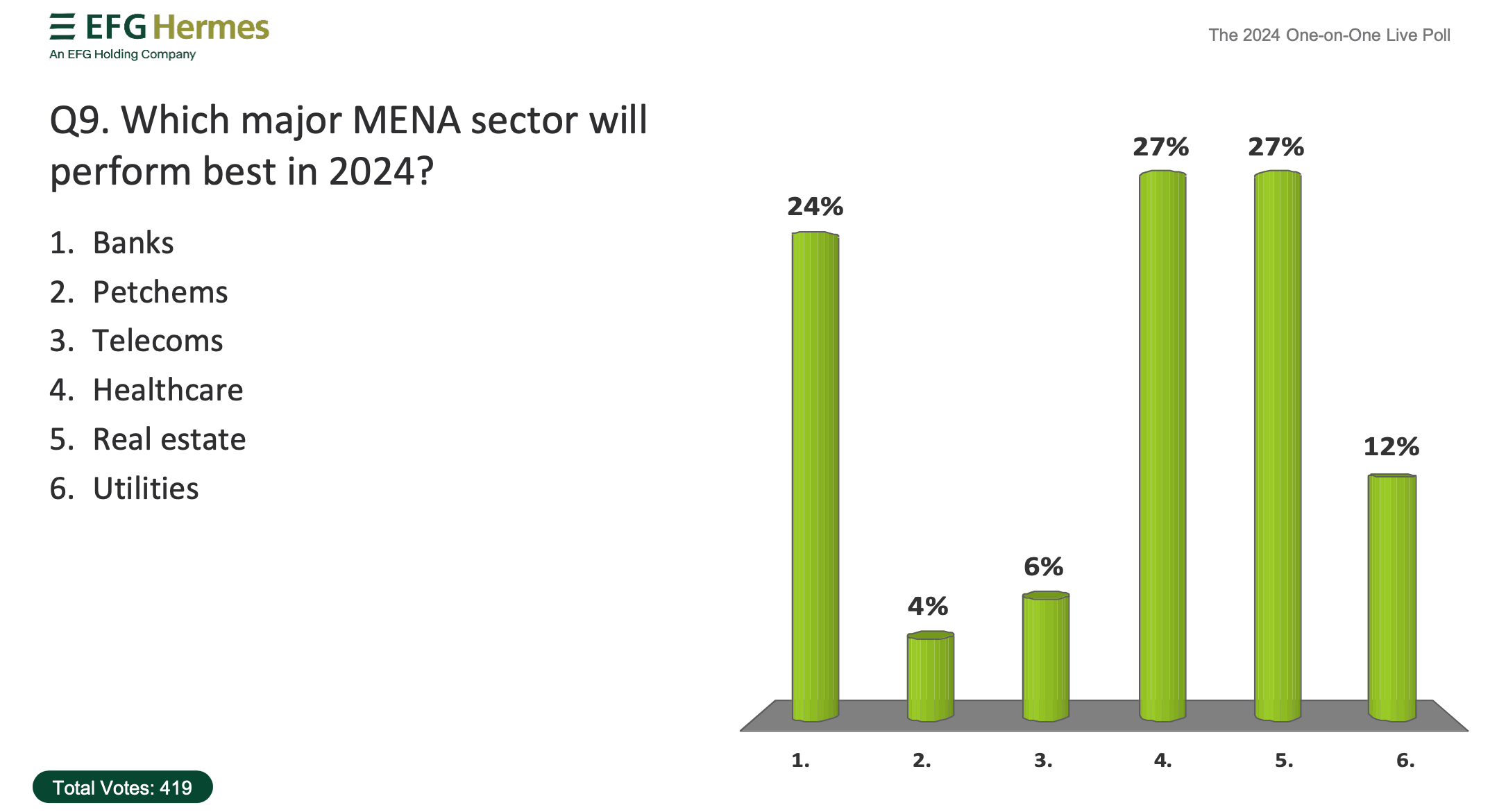

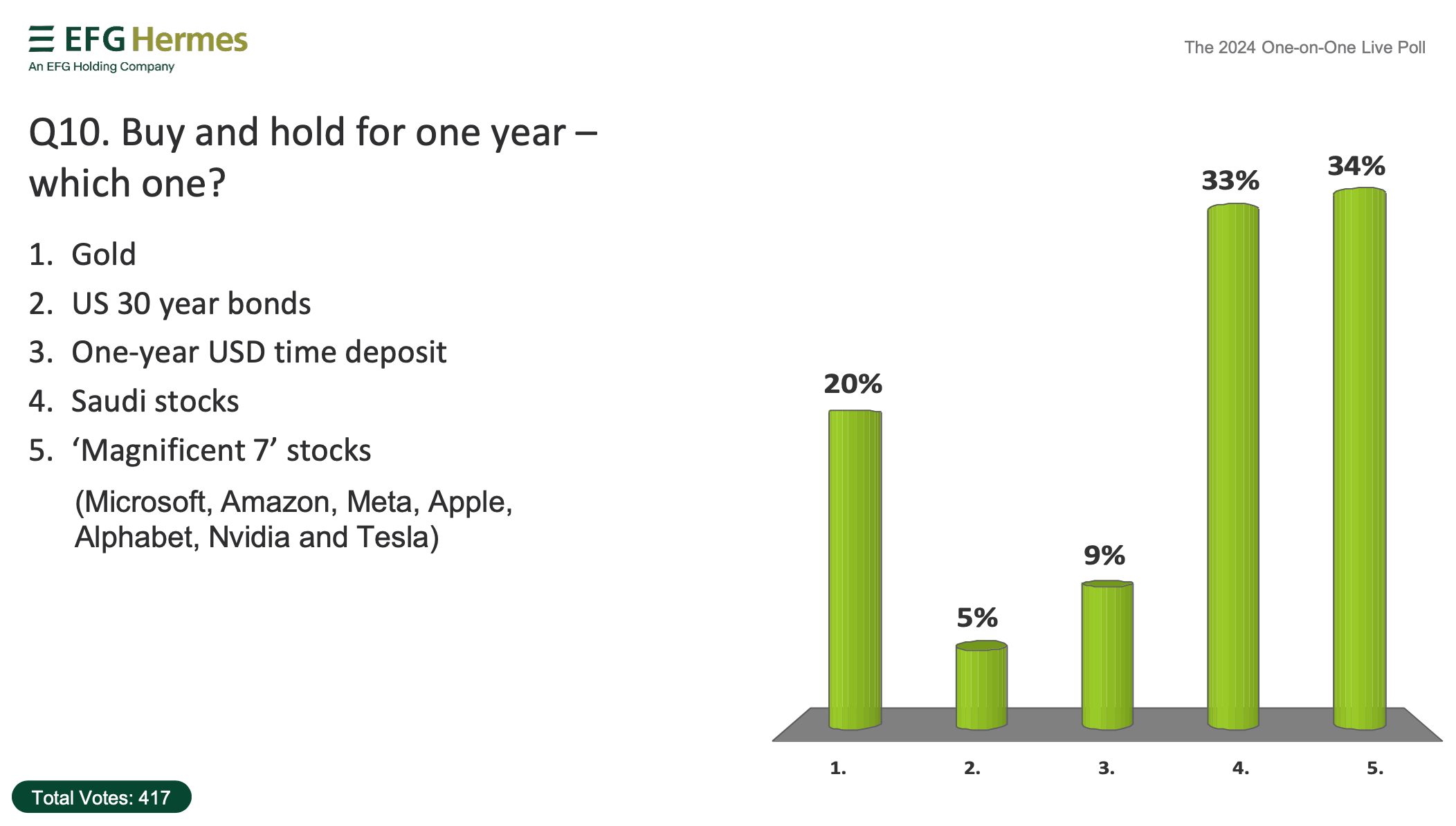

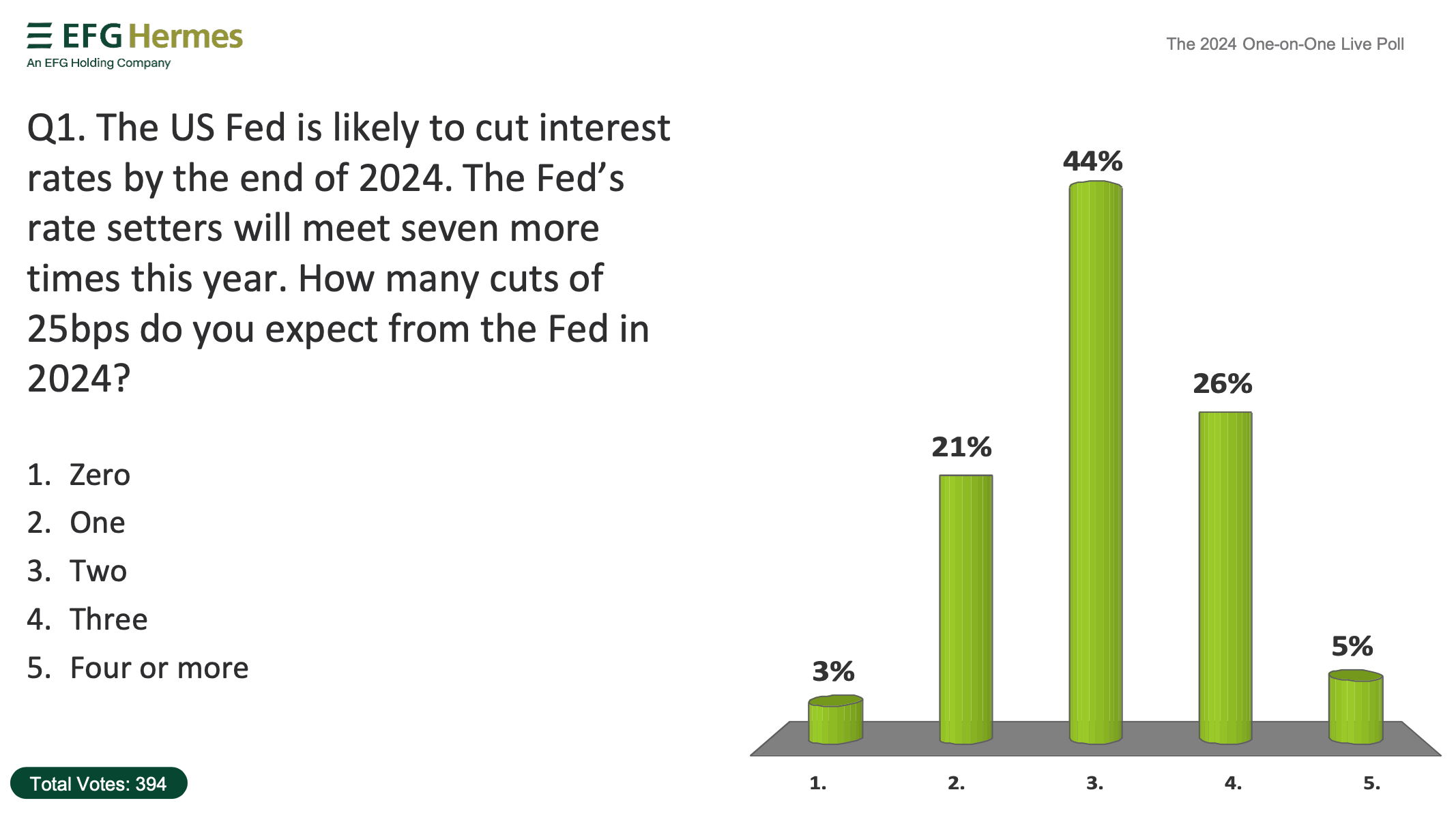

- The largest (and only live) Middle East and North Africa (MENA) research poll with a focus on the investment outlook.

Key takeaways from Karim Awad

- The company has undergone a remarkable transformation in the past decade, a transformation that I am incredibly proud of, from an investment bank with a stake in a Lebanese commercial bank to a fully-fledged financial institution that focuses on three divisions; our core business, the investment bank, our non-bank financial institutions vertical, EFG Finance, and our Egyptian commercial banking arm, aiBANK, that we hope will have an exciting announcement soon to reflect the institution’s significant turnaround and its future direction.

- While continuing to face stiff competition from global and regional banks, EFG Hermes has become the region’s leading investment bank with significant market shares as a broker and advisor in our key markets of Egypt, Saudi Arabia, UAE, and Kuwait.

- In addition to the geographic diversity, we are counterbalancing the sell side’s inherent cyclicality through a very ambitious plan to grow our public and private asset management businesses into bigger annuity businesses in the coming five years.

- EFG Finance expects to continue delivering very strong bottom-line growth in 2024, driven by its leading provider of financial services in Egypt with a concerted focus on the micro and small enterprise segments, Tanmeyah, its universal financial technology powerhouse subsidiary Valu, and a new concept SME license that we should be launching during the course of this year.

- Our bank, which was a pure restructuring play when we purchased it in 2021, has delivered a 20 percent return on equity in its second year of operation under our ownership.

- We have built a solid, well-diversified business model that has withstood multiple black swan events.

- Our continued bullishness on the GCC has been combined with the knowledge that our home market in Egypt could be turning a corner soon.

Dr. Mahmoud Mohieldin

From his part, Dr. Mahmoud Mohieldin, U.N. special envoy on Financing the 2030 Agenda for Sustainable Development, said, “A few days ago, in preparation for the G20 meetings in Brazil, growth projections remained unchanged for the first time in three quarters. However, it’s uncertain whether we should celebrate this soft landing or mention that growth at 3.1 percent globally is one of the lowest indicators. The U.S. economy is faring well, it’s progressing. The U.S. is one of the first to be hit and the first to recover. Market dynamism, largely, and better coordination between monetary and fiscal policy contribute to this resilience.

He added, “In contrast, Europe, particularly in the Eurozone, struggles to achieve even 1 percent growth this year.”

Mohieldin further stated that China faces similar challenges akin to Japan in the 1980s and 1990’s, both big Asian economies, notably aging demographics constraints in the labor market and potential bubbles, particularly asset and real estate. “China aims to transition its growth model from manufacturing to services, a shift requiring talents, skills, and patience. Drawing lessons from Japan’s experience in the late 1980s and 1990s is crucial.”

He noted, “The constraints we face are undeniably global. It’s disheartening to note the existence of over 3,000 trade restrictions. China, once heavily reliant on a globalized economy, finds itself in a different landscape today. It’s an uphill struggle, not just for China but for other emerging markets as well. We witness the typical tensions between rising powers and established ones. According to economist Paul Krugman, regarding the comparison between China and Japan, China’s trajectory may even be worse than Japan’s decline. Moreover, we cannot overlook the burgeoning force of India. The economic center of gravity is unmistakably shifting towards the East.”

“While we may not be seeing another global financial crisis, we will be seeing a development crisis and scattered fires in different places. The Global Sovereign Debt roundtable, established at the G20, hasn’t proven effective. There’s minimal support from the global financial system for the developing world.”

Moreover, Mohieldin said, “Many nations in Africa and South Asia allocate more funds to debt servicing than to essential sectors like education and healthcare. Access to finance remains a significant challenge. The cost of borrowing is still high. Foreign Direct Investment isn’t flowing as expected. Domestic savings aren’t enough for fueling your needs for investment and growth. Furthermore, global debt markets haven’t sufficiently recovered to provide developing markets with the necessary finance to meet their development goals.”

Other key takeaways from Dr. Mahmoud Mohieldin

- We must be more specific in our approach. The broad grouping of countries as Emerging Market and Developing Economies (EMDEs) is not conducive to effective analysis. Instead, we need to delve deeper and avoid lumping them into a single asset class. We should consider the basic factors such as the business environment, good coordination between fiscal and monetary policy, and the progress towards green transformation.

- It’s essential to evaluate the impact of efficiency on the Fourth Industrial Revolution related activities, the readiness of infrastructure for AI integration, and investments in human capital. I am heartened to see the UAE, our gracious host country, acknowledging the importance of AI by establishing a dedicated ministry for it.

- It’s important to acknowledge the sad reality of the global crisis. It signifies that we are not on track to achieve the Sustainable Development Goals. These aren’t just numbers, they are opportunities for education, poverty alleviation, women’s empowerment, better health systems and overall productivity. Out of the 17 goals and 169 targets, we are only on track to achieve 15 percent of them.

- “While inflation in the U.S. has decreased, there are still some areas of concern, such as non-residential real estate, but overall, the situation is on track. Anticipate some cuts as the Fed adheres to predictable targets. Whatever happens in the U.S.will be reflected in the interest rate policies in the GCC. This can be positive for capital flows. However, there has been a great deal of excessive borrowing, indicating the need for more equity-based investment.

- I don’t foresee a period of recession on the horizon. Perhaps some economies in Europe may experience low growth, but not a recession. Countries like Germany have historically relied on factors such as cheap energy, open markets with China, and a strong friendship with the U.S.. However, they can no longer depend on all these factors as the economic landscape evolves. These risks are well-identified, they are not uncertainties. On the other hand, the U.S. is poised to perform very well. In emerging markets there are a few countries that will do very well such as India.

- In Africa, there are promising opportunities for investment in relation to green transformation, but we need investment in human capital development. We must ensure that climate change does not compromise these prospects.

- The Middle East continues to be an intriguing region for investment. In GCC countries, we’ve witnessed notable performance in the non-oil sectors. Diversification is key, with some nations expanding into services and making high-tech investments domestically and internationally.

- Some countries have great infrastructure plans as we have seen in Saudi Arabia. They have also ventured into tourism and services, reaping the rewards of their investments in high-caliber education for their citizens. The UAE is doing very well. Qatar is following a similar path of diversification. Oman is actively diversifying its economy, while Bahrain boasts a small yet vibrant economic landscape. Kuwait has some ambitious reforms under the new Emir. Morocco has particularly stood out with its impressive efforts in diversifying its markets. Egypt holds great potential, provided it can overcome the hurdles it’s currently facing in the coming days and weeks.

- The growth performance of the Middle East before COVID, and after, as well as before Ukraine and after, and before Gaza and after, has left much to be desired. Economies in the region should ideally surpass the 2.5 percent growth range. We must address problems beyond external shocks. There’s a pressing need for more investment in human capital, investments in digital infrastructure, increased Foreign Direct Investment (FDI), and a better business environment.

- To work towards achieving the Sustainable Development Goals (SDGs), it’s imperative to prevent the detrimental effects of debt. Countries prioritizing debt repayment over healthcare and education expenditure must reassess their priorities. China’s success in celebrating zero extreme poverty underscores the importance of investing in human capital.

- We must sustain our growth efforts, avoiding one-off achievements. To truly make an impact, we need sustained growth of no less than 7 percent over a significant period. It’s this sustained and inclusive growth that will truly drive progress towards the SDGs.

- For Egypt, addressing challenges hindering progress is a priority. It is essential to emphasize policy effectiveness beyond transactions. A comprehensive inflation targeting framework involving various components, with a flexible exchange rate, is desirable from the Ministry of Finance and the Central Bank. Policies should prioritize inflation management and economic discipline for sustainable growth. A shift towards a holistic economic policy approach, focusing on development and growth, rather than excessive fixation on the exchange rate, is crucial for long-term success.

Key takeaways from the AI panel

- Will humanity go extinct because of artificial intelligence? Not at this stage.

- Will people in the finance sector have jobs tomorrow? According to Rennier, many will not or those who succeed you will not. The more forward-looking firms already have AI investment committee members participating in their decision-making meetings. If you are not on a personal journey for discovery with AI, you will not be on the forefront of capturing opportunities.

- AI is legal performance-enhancing drugs. There will be people who will fall off the bandwagon and people who will be more efficient, according to Fakharany.

- What does AI mean to frontier emerging markets? How will it change the economies of the Middle East and other emerging markets? According to Fakharany, in emerging markets it will bring better opportunities for financial inclusion and access to financial services.

- “If you are in a line of work that is significantly impacted, you may find yourself out of work. Call center workers, for instance, are being replaced by chatbots. Over a generation, we’ll witness the disappearance of jobs that once existed. In some cases, machines are already demonstrably better than human beings. I’m witnessing the displacement of human activity with machines, and its still early days.” – Renier Lemmens

- “Look under the hood of these technologies, don’t just rely on newspaper articles. Understand them well enough so that you can have a BS detector. The world of AI is fascinating; it’s evolving rapidly, and it’s a full-time job to keep track of it.” – Renier Lemmens

- “Industry has historically been ahead of regulation, and AI remains largely unregulated. We will inevitably find ourselves playing catch-up. Fortunately, in the GCC and Egypt, there’s a wealth of young energy and potential. This presents opportunities to generate revenue in USD while maintaining cost structures in EGP.” – Wael Fakharany

- “The combination of man and machine is incredibly useful. This relationship will never go away. I’m an optimist.” – Wael Fakharany

For more news on banking & finance, click here.