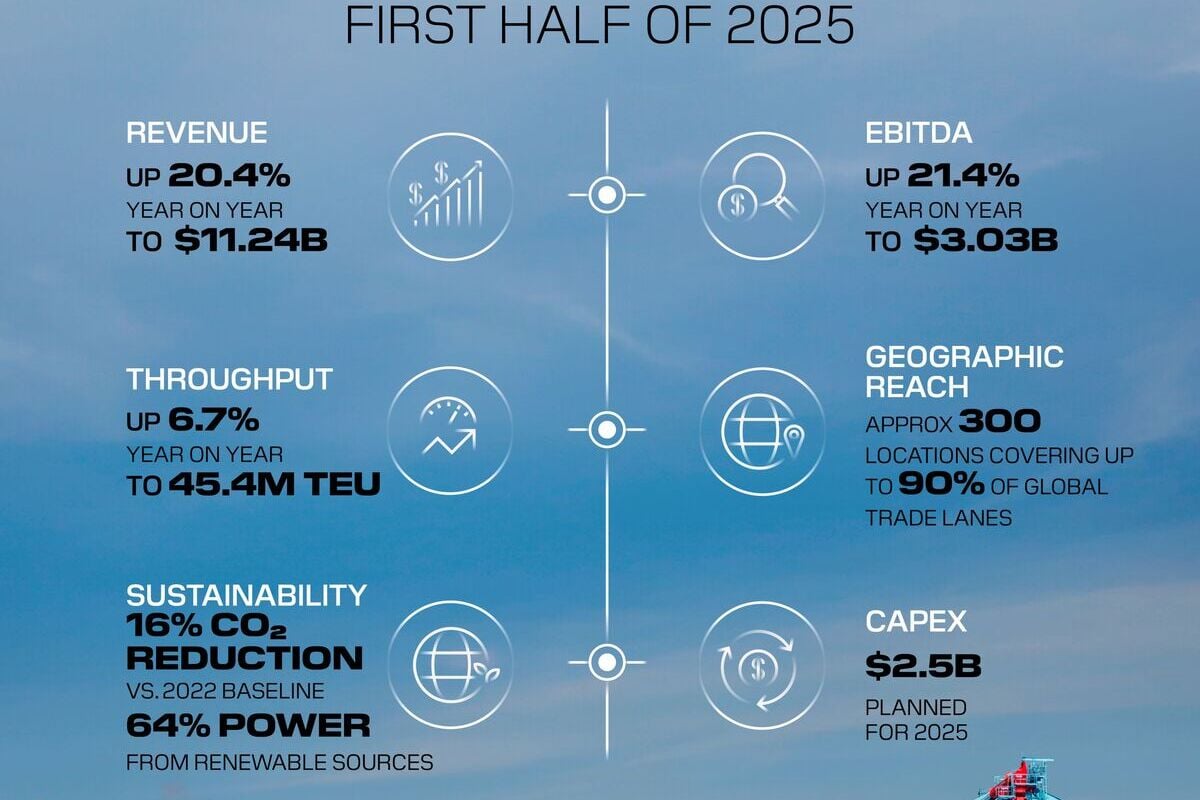

DP World’s revenue for the first half of 2025 rose by 20.4 percent year-on-year to $11.244 billion, driven by strong performance across Ports & Terminals and recent acquisitions.

The group announced strong financial and operational results for the first half of 2025, underlining the resilience of its integrated global trade platform amid ongoing geopolitical and economic uncertainty.

Adjusted EBITDA rose 21.4 percent to $3.033 billion, while container volumes increased 5.6 percent on a like-for-like basis, reaching 45.4 million TEU (twenty-foot equivalent units) across the global portfolio.

Commenting on the results, DP World group chairman and CEO, Sultan Ahmed bin Sulayem, said: “We are pleased to report strong first-half results, with both revenue and EBITDA growing by over 20 percent. Ongoing geopolitical tensions, the continued closure of the Red Sea route, and rising uncertainty around global trade tariffs have caused significant disruption across the industry. Despite these challenges, our strategy of delivering integrated end-to-end solutions and operating critical infrastructure in key markets has allowed us to continue supporting cargo owners to move their freight and to deliver a strong set of results.”

Strategic investments in growth markets

DP World continues to invest in strategic growth markets, with $1.08 billion in capital expenditure during the first half of the year. The full-year capex target of $2.5 billion will support expansion in Jebel Ali Port, Drydocks World, Tuna Tekra (India), London Gateway (U.K.), and Dakar (Senegal), along with DP World Logistics and P&O Maritime Logistics. These investments are focused on enhancing terminal capacity, supply chain integration, and digital capabilities to support long-term trade resilience.

Moreover, across terminals where DP World has operational control, the company handled 27.4 million TEU, an increase of 7.5 percent year-on-year.

Yuvraj Narayan, group deputy CEO & CFO, commented: “This performance was underpinned by continued momentum in Ports & Terminals and Marine Services, supported by strong cash generation and a disciplined balance sheet. We remain well-positioned to fund strategic growth, maintain our credit strength, and respond to evolving market conditions.”

Through Unifeeder, DP World offers efficient and sustainable multimodal transport solutions that ensure connectivity for global shipping lines and cargo owners. This has been particularly important amid recent disruptions to global supply chains, where our extensive network has played a crucial role in helping customers maintain cargo flows and delivery reliability.

Enhancing logistics capabilities

DP World’s freight forwarding platform now spans approximately 300 locations and covers more than 90 percent of global trade lanes.

“We continue to enhance our logistics capabilities, allowing us to serve customers seamlessly across the world’s major trade lanes. Recent bolt-on acquisitions have expanded our offerings and introduced specialized capabilities aligned with the evolving needs of cargo owners. These investments address supply chain inefficiencies and strengthen connectivity across key corridors, enabling us to deliver more resilient, efficient, and tailored solutions,” the chairman said.

Despite ongoing macroeconomic headwinds and continued pressure on key shipping corridors, DP World expects to deliver a strong full-year EBITDA performance, supported by sustained throughput growth, operational leverage in Ports & Terminals, strengthening balance sheet, and strategic capex and global integration.

“Looking ahead, we remain optimistic about the medium- to long-term outlook for global trade and logistics. As supply chains evolve, DP World is well-positioned to lead the industry in delivering efficient, resilient, and sustainable trade solutions that create long-term value,” further added Sultan Ahmed bin Sulayem.