Dubai now holds the 12th spot in the Global Wealth and Lifestyle Report and is the 6th most expensive city in EMEA, a new report suggests.

According to the Julius Baer Global Wealth and Lifestyle Report 2024, the emirate has long been one of the most attractive economic hubs and a symbol of opulence in the Middle East region. Although the impact of the global pandemic has now settled into a ‘new normal’, inflation, rising living costs, and increased geopolitical tensions have not had as much of an impact on Dubai as on other markets, which have contributed even more to its appeal for wealthy residents.

A key advantage is that the UAE, situated at the crossroads of the East and the West, boasts some of the busiest airports and prominent ports.

The paper noted that the unique geographical advantage of Dubai attracts businesses from all over, making it an ideal market for global expansion. The report reflects that spending on business (65 percent) and leisure (67 percent) travel have increased significantly over the past 12 months in the Middle East. Its strategic location has also made it attractive for investors looking to access lucrative markets across multiple continents.

Booming real estate market

The report highlights that the real estate sector accounts for a substantial 8.9 percent of the economy and is exhibiting impressive dynamism. According to the index and survey data, real estate is a key asset class in the Middle East, with property prices in Dubai surging 16 percent in U.S. dollar terms. Dubai’s real estate is undoubtedly a hot commodity. In 2023, the city hosted the world’s most active housing market for properties valued at over $10 million, as per Knight Frank’s findings. This strong demand is driven by both global and local investors, as the region’s wealthy are currently spending the highest on luxury residential properties compared to any other part of the world, buoyed by robust economic growth and world-class infrastructure.

Even though residential prices have sustained an upward trajectory, property in Dubai remains relatively affordable compared to many other cities in the region. Sophisticated and savvy investors are flocking to Dubai to acquire luxury and branded real estate, given the city’s competitive advantages over its global and regional peers. This growing trend will ensure that Dubai remains firmly on the radar of global investors.

More than half of wealthy Middle Easterners surveyed reported having spent more on residential property in the past 12 months, and planned spending is equally high, with 58 percent saying they will allocate more funds towards this asset class in the coming year. No other region comes close to matching this level of activity and enthusiasm.

Regional findings

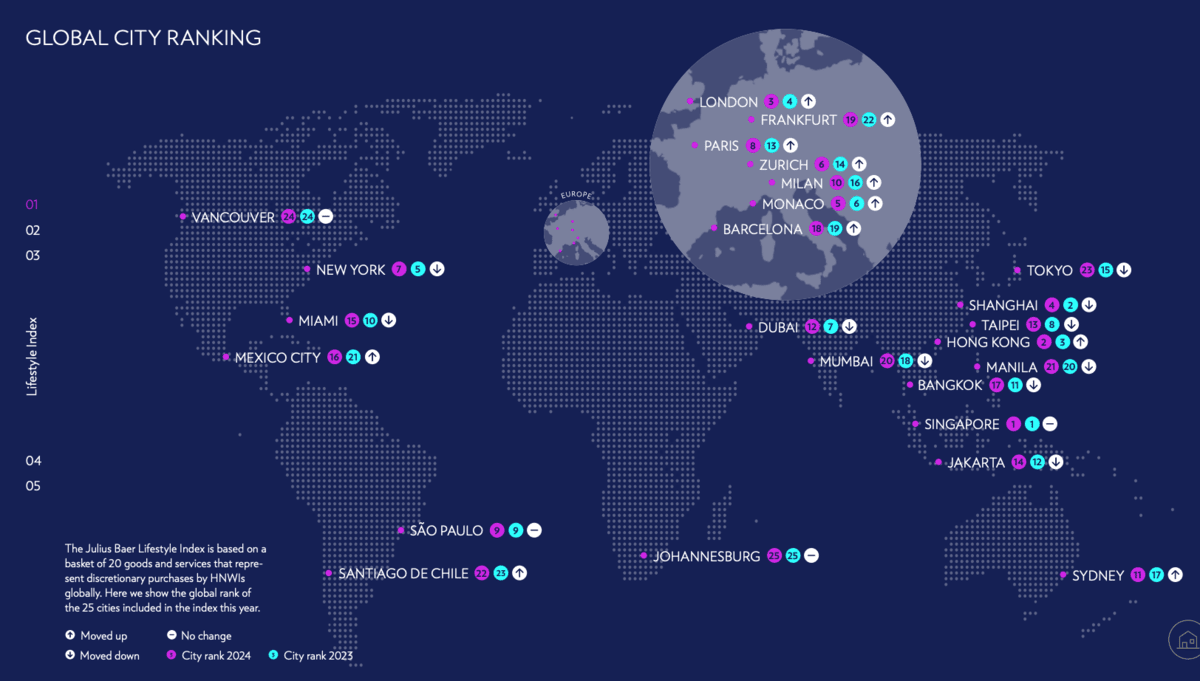

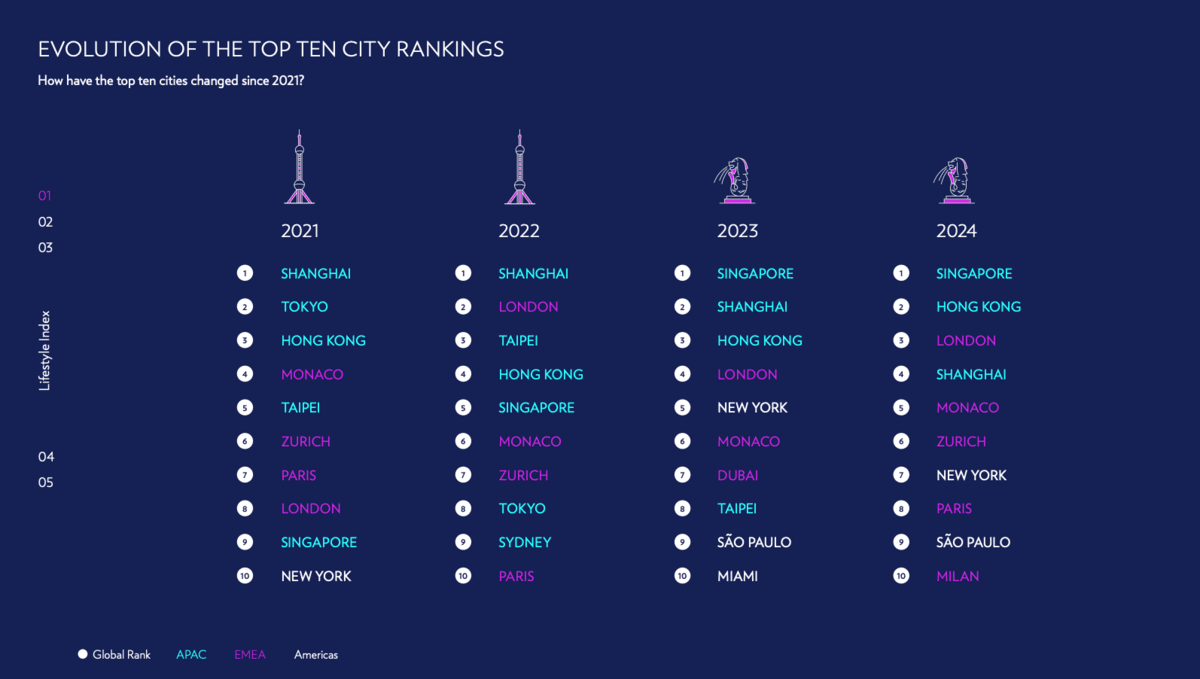

While Singapore (1st, unchanged) and Hong Kong (2nd, up from 3rd) still dominate the top spots, the Asia-Pacific (APAC) region has dropped to 2nd place in the regional ranking for the first time. This is due to lower rankings for cities like Tokyo and a very strong resurgence of the Europe, Middle East, and Africa (EMEA) region.

Last year, EMEA was the cheapest region to live well. This year, driven by London taking the 3rd spot (up from 4th) and every single European city moving up the ranking, as well as strong exchange rates versus the U.S. dollar (Euro +4 percent, Swiss franc +8 percent), EMEA is now the most expensive region to live well. Within EMEA, Dubai is the 6th most expensive city and 12th globally (down from 7th) in the Lifestyle index, owing to inflation and currency fluctuations.

Despite the Americas falling to last place, both New York and São Paulo remain in the top ten. In the Middle East, spending was concentrated on luxury goods like clothing and watches, as well as a significant demand for luxury residential properties. In contrast, Europe and APAC focus more on hospitality (five-star hotels, top restaurants), while spending in the Americas seems to be spread across all categories.

All regions saw an increase in spending by high-net-worth individuals (HNWIs) on travel and hospitality in the past year, with the Middle East and APAC showing the highest growth. The Middle East has witnessed a significant increase in both business (65 percent) and leisure travel (67 percent).

Investing for wealth creation remains top priority

Despite some financial turmoil in the past 12 months, HNWIs are still willing to take risks to realize higher returns. Supported by their financial expertise and increased asset values, HNWIs from APAC, the Middle East, and Latin America have increased their investment risk levels, although Europe and North America remain more conservative.

As in previous years, the primary financial goal among respondents is wealth creation and increasing assets. In all regions, HNWIs invested more in the past 12 months than in the year before, with the Middle East leading the charge with 72 percent investing more and 68 percent of those in APAC investing more. Regional investment levels seem to mirror regional risk levels, with Europe and North America being the most conservative once again.

What products and services have HNWIs in the Middle East spent more on over the past year?

According to the report, high-net-worth individuals (HNWIs) in the Middle East have increased their spending on several products and services over the past 12 months. Notably, Dubai has emerged as the most expensive city in the EMEA region for men’s suits and ladies’ handbags.

The steep prices for these discretionary luxury items have not deterred affluent customers, as the report finds that 65 percent and 52 percent of those surveyed intend to spend more on suits and handbags, respectively, in the coming year. This reflects the continued strong appetite for luxury goods among the region’s wealthy, presenting a significant opportunity for luxury brands.

Beyond luxury goods, the report also highlights that the Middle East, particularly Dubai, is becoming an attractive wealth hub for many entrepreneurs and affluent families. This is driven by the favorable tax environment in Dubai, which has no income tax, capital gains tax, or inheritance tax. As a result, the ultra-rich in Dubai and across the region are bullish in their investment outlook, with a primary focus on wealth creation, asset growth, and portfolio expansion.

How has the total value of Middle East’s HNWI’s assets changed in the past 12 months?

Dubai has solidified its status as a global financial hub, with prominent hedge funds, asset managers, fintech firms, and family offices establishing regional offices in the city. This influx of leading financial institutions has cemented Dubai’s position as a premier destination for the global elite. The city continues to emerge as a new financial powerhouse on the world stage.

Fahd Abdullah, executive director, Investment Advisory, Julius Baer (Middle East) Ltd., said: “Gulf Cooperation Council (GCC) states remain robust despite the conflict in the region, as it is expected to remain relatively contained. GDP forecasts have been revised downwards on account of uncertainty around the impact on activity. Growth is nevertheless anticipated to pick up in 2025. Non-oil activities continue to be the key focus in 2024 as production cuts hamper oil-GDP. In the UAE, for instance, Abu Dhabi’s non-oil economy grew 9.1 percent in 2023, bringing the sector’s total GDP contribution over 53 percent.

Rebounding dramatically following Covid-19, growth in the tourism sector especially for Dubai, was strong, seeing an 11 percent increase year-on-year, with overnight visitors on track to exceed 20 million visitors in 2024, contributing about 12 percent to overall GDP. Dubai is also continuing to position itself as a new capital for global finance acting as a bridge between east and west with a traditional banking model as well as a digitally powered economy.

Transport and storage represent the other large piece of the non-oil GDP component for the UAE showing exponential growth. In summary, the Middle East led by the GCC countries should continue to enjoy surpluses on the fiscal and current accounts in the interim. Inflation, albeit higher than before, is still among the lowest in the emerging markets.”

Lifestyle survey findings

The Lifestyle Survey examines the lives and consumption patterns of high-net-worth individuals (HNWIs) across 15 countries in Europe, Asia-Pacific, the Middle East, Latin America, and North America. The survey analyzes shifts in consumption behaviors and investigates the reasons behind these changes. In doing so, it paints a broader picture and provides insights and data that significantly supplement the Lifestyle Index.

As noted in last year’s Global Wealth and Lifestyle Report, the trend of health as the new wealth continues to gain momentum. Health spending was among the top five spending intentions for the next 12 months across all regions, remaining a key focus globally. HNWIs, particularly in Asia-Pacific, will focus their investments on healthcare.

Supported by their financial expertise and increased asset values, HNWIs from Asia-Pacific, the Middle East, and Latin America have increased the risk level of their investments, while conservatism and fragility prevail in Europe and North America.

Sustainability rises in prominence

While personal enjoyment remains a key pursuit, sustainability plays a greater role in investment strategies for almost all HNWIs in Asia-Pacific, the Middle East, and Latin America in 2024. More responsible investments have been made in these three regions, with the majority of HNWIs reviewing their portfolios to understand the environmental, social, and governance (ESG) impact of their investments, with a significantly higher ESG orientation than in Europe and North America. However, sustainability still plays a minor role in actual purchasing habits.

HNWIs still want to indulge themselves, but they are also seeking to empower themselves by prioritizing health, aesthetics, and the acquisition of cutting-edge technology. They want to make long-term bets by acquiring property, particularly HNWIs in the Middle East. With demand still outpacing ethics, the challenge will be to encourage HNWIs to fully integrate sustainability into their life and investment decisions across all markets.

For more miscellaneous news, click here.