As Dubai’s real estate market continues to grow, the rise in property supply is likely to provide some relief to rent prices in the market. In its latest Dubai residential market note, CBRE expects rent prices in Dubai to continue to increase but not at the same pace. Several key prime residential neighborhoods are heading towards single-digit growth in 2024 as affordability constraints begin to catch up.

Demand continues to rise

According to data from the Dubai Land Department, the number of rental registrations in the year to date to May 2024 reached a total of 255,178, marking an annual increase of 5.9 percent. A 12.2 percent growth in rental registration renewals drove this increase. Meanwhile, new contract registrations declined by 3.7 percent. Tenants in Dubai are preferring to renew their rent registrations as the rate of rental growth in certain areas has continued to rise.

Rents to increase in 2024, but not as quickly

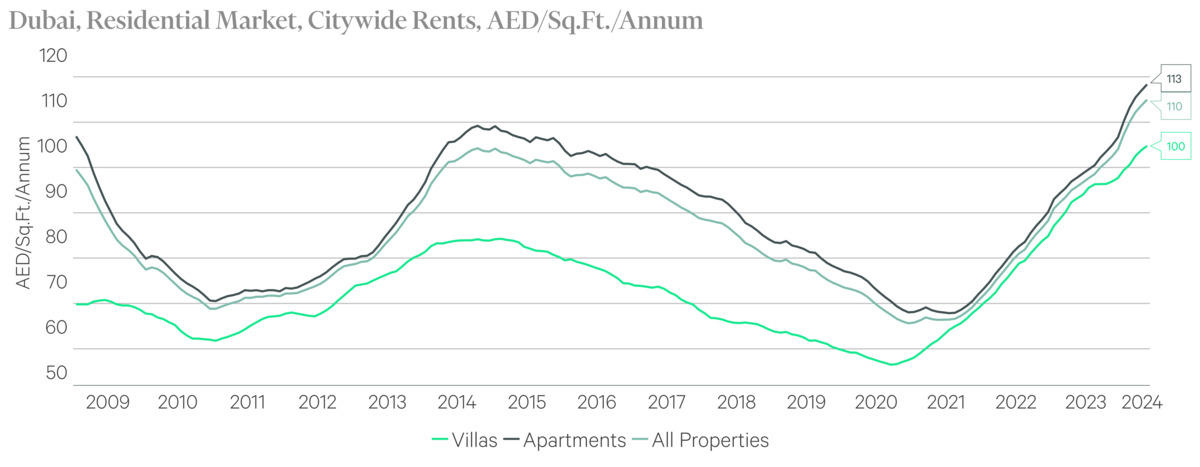

The robust levels of demand continue to drive performance in Dubai’s rent market. From the beginning of 2024 to May, average residential rent prices in Dubai increased by 21.1 percent, up from 20.8 percent growth in April. CBRE attributes this increase to a 22.2 percent rise in average apartment rent prices and a 13.1 percent increase in average villa rent prices.

In May 2024, the average apartment and villa rent stood at AED126,598 and AED352,572 per annum, respectively. The report reveals that the highest annual apartment rents were in Palm Jumeirah, where asking rents reached an average of AED272,867. Meanwhile, Al Barari recorded the highest villa rent prices, where rent reached an average of AED1,391,242.

Higher rent prices in Dubai’s core and prime residential areas have led to a spillover into secondary communities, which are now recording considerable increases in rents on an annual basis.

Looking ahead, CBRE expects that rental rates will continue to increase but not at the same pace. The report noted that rent price growth rates in Dubai are heading towards single-digit growth.

Transaction volumes hit record-high

In addition to the rise in rent demand, Dubai’s residential market continues to showcase remarkable levels of demand. In May 2024, the total volume of transactions stood at 15,766, the highest monthly figure on record to date. Transactions marked a 44.2 percent increase compared to May 2023. In May, secondary market transactions rose by 5.7 percent to 5,065 transactions. Meanwhile, off-plan properties increased by 74.3 percent to 10,701.

From the beginning of the year to May, the total volume of sales transactions reached 62,180, a 384.3 percent increase compared to 2019 when the total was just 12,838.

The volume of sales transactions in Dubai also outperformed its 2023 record-high by 30 percent. CBRE attributes this annual growth to a 42.6 percent increase in off-plan sales and an 11.3 percent rise in secondary market sales.

For more news on real estate, click here.