The recent escalation of the war in the Middle East has increased the risk of broader regional ramifications for the creditworthiness of sovereigns and banks. Against this backdrop, S&P Global created four stress scenarios to assess how risks could evolve and how it could affect banks in GCC countries.

Risk materialization

Those risks could materialize in the form of outflows of foreign funding, with non-resident investors exiting the GCC region as risks increase. They could also result in outflows of local funding, although the report assumes that this would materialize only in the case of severe stress. Finally, risks could result in a surge in default rates among banks’ corporates and retail clients as the geopolitical instability affects regional economies.

External funding outflows

To quantify the risk, S&P Global used data on local and external funding that was published by GCC central banks on June 30, 2024, and data on asset quality that were reported by the top 45 banks in the GCC region.

With this data, the agency says external funding outflows could reach about $221 billion, which translates into about 30 percent of the tested systems’ cumulative external liabilities. However, it notes that GCC banks have sufficient external liquidity to cover these outflows in most cases.

The highest loss will likely occur in Qatar and the UAE, followed by the offshore banking sector in Bahrain, because of the significant gross external debt of the banking systems in these countries. For the remaining banking systems, the report assumed that external funding outflows ranged from only $3.9 billion in Oman to a manageable $30 billion in Saudi Arabia.

Read: Emirates NBD redefines cross border payments in partnership with Partior

Deposit outflows may reach $275 billion

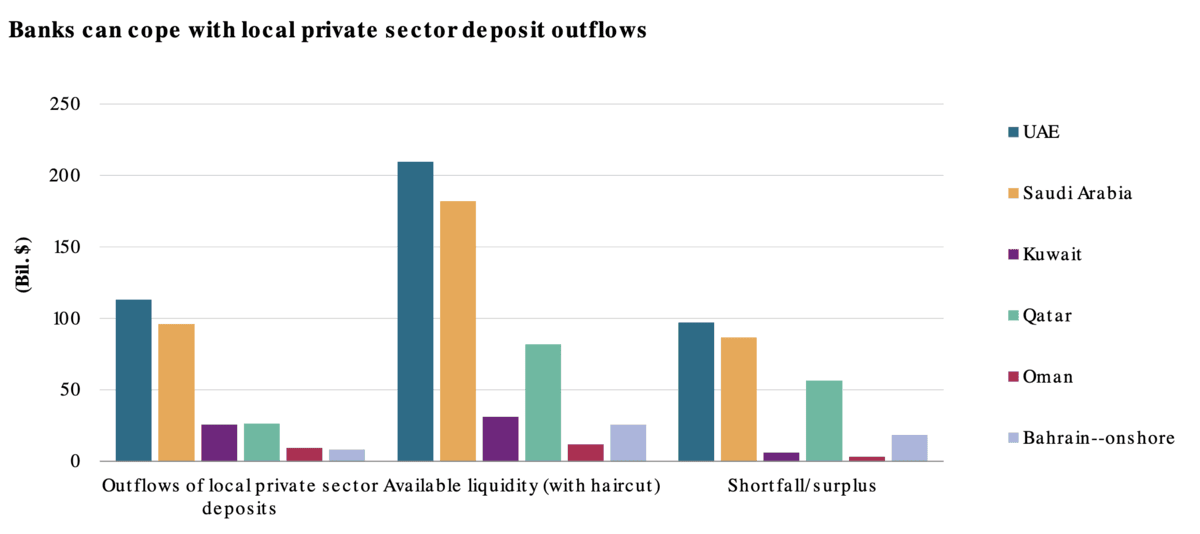

In the severe stress scenario, it expects a further $275 billion in deposit outflows from local private sector deposits. “We think banks can cope with this, thanks to their liquid assets and — if these prove to be less liquid than we assume — support from central banks,” S&P added.

Under the asset quality deterioration scenarios, 13 of the top 45 banks in the GCC region will likely display losses under the high-stress scenario, based on banks’ annualized reported net income as of June 30, 2024. This number increases to 25 for the severe stress scenario, with cumulative losses reaching $24.6 billion.

Most banking systems can manage these outflows by liquidating their external assets, with only Qatar showing a negligible deficit. However, GCC banks may need to liquidate some of their investment portfolios or park them at central banks against liquidity to cover withdrawals. Overall, the risk appears manageable. After liquidating their investment books, banks will still have about $264 billion that they can deploy.