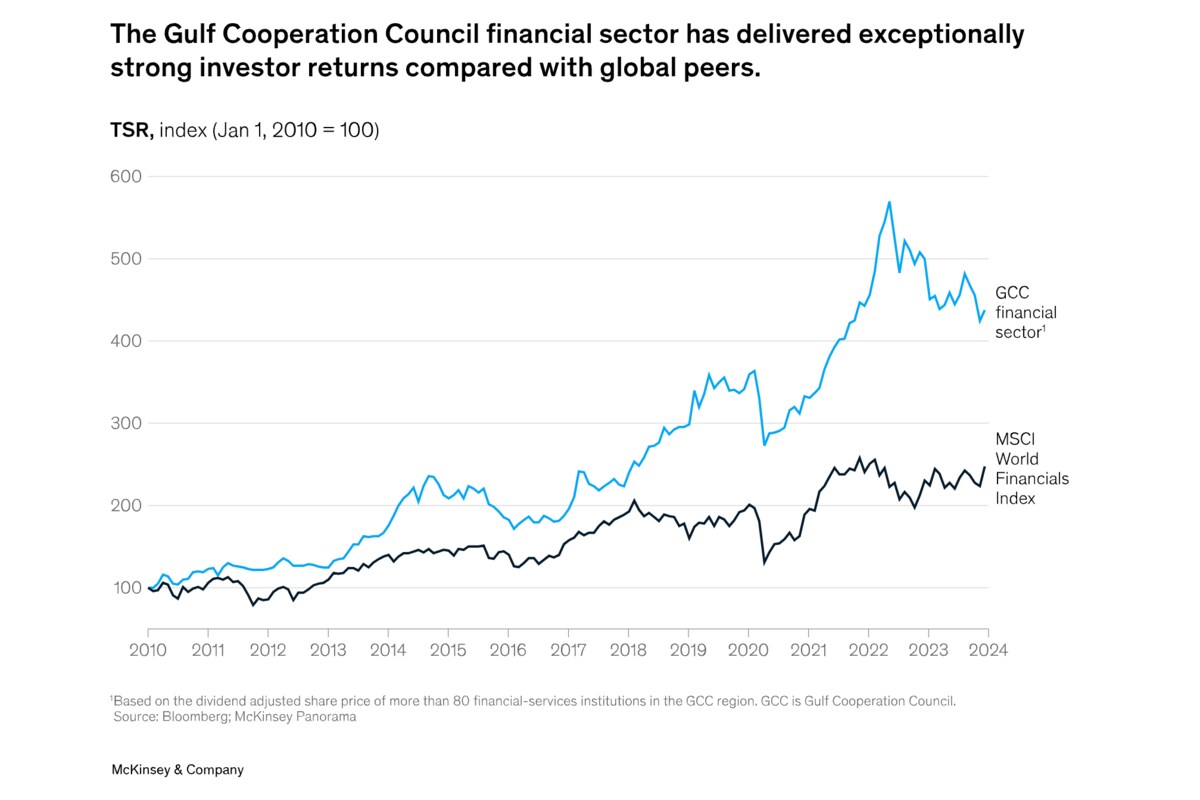

Banks in the Gulf Cooperation Council (GCC) region continue to outperform their global peers, boasting exceptionally high return on equity (ROE) and some of the largest multiples globally.

The latest McKinsey & Co. report reveals that the region’s financial sector has yielded healthy returns to shareholders over the past decade, outperforming the global average. While the gap has narrowed in recent years, ROE among GCC banks continued to exceed the global average by 3 to 4 percentage points during the 2022-23 period. Notably, higher interest rates have pushed profits of GCC banks and the banking sector globally to record highs.

GCC banks outperform

The McKinsey & Co. report reveals that GCC banks have maintained net interest margins that significantly exceed the global banking average. In addition, their revenue-to-assets ratio is 3.2 percent, well above the global average of 2.3 percent. This gap reflects both the region’s wider net interest margins and its superior net interest income of 2.3 percent compared with a global average of 1.4 percent.

While GCC banks have higher average impairment costs than their global counterparts, their operational costs are lower at 1.04 percent of total assets versus 1.17 percent globally. In addition, GCC banks are better capitalized than the global average, which puts downward pressure on ROE. The average ROE among GCC banks is 10.9 percent, significantly higher than the worldwide average of 9 percent. However, the elevated risk costs and greater capital positions of GCC banks only partially offset the positive impact of their larger margins on ROE.

Resilient oil and gas sector supports growth

In 2022, the average oil price exceeded $100 per barrel, pushing the GCC region’s aggregate real GDP growth rate to around 7.3 percent, more than twice the global average, McKinsey & Co. revealed.

In 2023, oil prices moderated but remained largely above the break-even point for all GCC countries except Saudi Arabia. Lower oil prices and OPEC production cuts contributed to a decline in the regional growth rate, which fell to an estimated 1.0 to 1.5 percent in 2023. However, escalating geopolitical tensions raised global oil futures by 4 percent since the fourth quarter of 2023. Therefore, aggregate growth in the GCC is expected to rebound to 3.6 percent in 2024.

Non-oil sector to grow

In addition, the GCC region’s non-oil sectors including construction, finance and consumer services continue to expand rapidly. That is due mainly to the large infrastructure programs and megaprojects currently underway across the region. McKinsey & Co. expects aggregate investment in these programs to peak around 2030.

Higher interest rates boost GCC banks’ profits

All GCC exchange rates are either directly or indirectly pegged to the U.S. dollar. Therefore, regional interest rates closely track movements in the Federal Reserve’s rates. With the rise of interest rates in the U.S., financing costs in the GCC region during 2023 surged, leading to a significant increase in bank profits. Meanwhile, headline inflation remained modest at around 2.6 percent in 2023 and should fall to 2.3 percent in 2024.

“The performance of GCC banks over the past several years could foster complacency among bank managers and sap their will to implement ambitious transformation agendas. Executives should not assume that the current high-interest-rate environment represents a new normal for bank profitability,” added the report.

Hence, if inflation in the U.S. continues to decline, the Fed will likely decrease interest rates, which will impact GCC banks’ profits. Therefore, banks that leverage short-term gains to reduce costs in the future while implementing their transformative agendas are likely to enjoy a significant advantage when interest rates decline.

GCC banks well-positioned for continued expansion

With strong domestic economies, favorable demographics, and supportive government agendas and regulatory frameworks, McKinsey & Co. sees that GCC banks are ready for expansion and diversification.

“While the global macroeconomic landscape remains uncertain, we believe GCC banks will emerge stronger if they continue to invest in the capabilities of the future while also building resilience against medium- and long-term risks,” added the report.

For more news on banking & finance, click here.