During the first nine months of 2024, sovereign wealth funds in the GCC region deployed $55 billion in 126 different transactions. This represents 40 percent of all dealmaking done by sovereign investors globally – the same level as in 2023, and much higher than previous years.

The latest report from Global SWF reveals that most of this capital came from the ‘Oil Five’ sovereign wealth funds: Abu Dhabi’s ADIA, ADQ, and Mubadala, Saudi’s PIF, and Qatar’s QIA. A significant share of investments targeted the U.S. and U.K. but also China – which, in the last 12 months, attracted $9.5 billion from GCC funds.

Macroeconomic landscape boosts GCC markets

The macroeconomic landscape of the GCC is evolving as economies mature and governments seek sustainability and resilience to market shocks and to exhaustion of oil reserves in the long term. Some Gulf states enjoy low debt levels which provides them with ample financing options, allowing them to increasingly tap local and international debt markets.

In addition, some GCC governments have introduced important tax policy reforms for the introduction of value-add tax, corporate income tax, and even personal income tax. Lastly, Global SWF notes that there has been increasing use of the domestic equity markets, not only to attract foreign investors but also to recycle capital within each territory.

The region now has seven active stock exchanges that host 877 listed companies with an aggregate market capitalization of $4.3 trillion.

Read: Abu Dhabi reports new record GDP of $80.86 billion, 4.1 percent increase in Q2 2024

GCC sovereign wealth funds grow

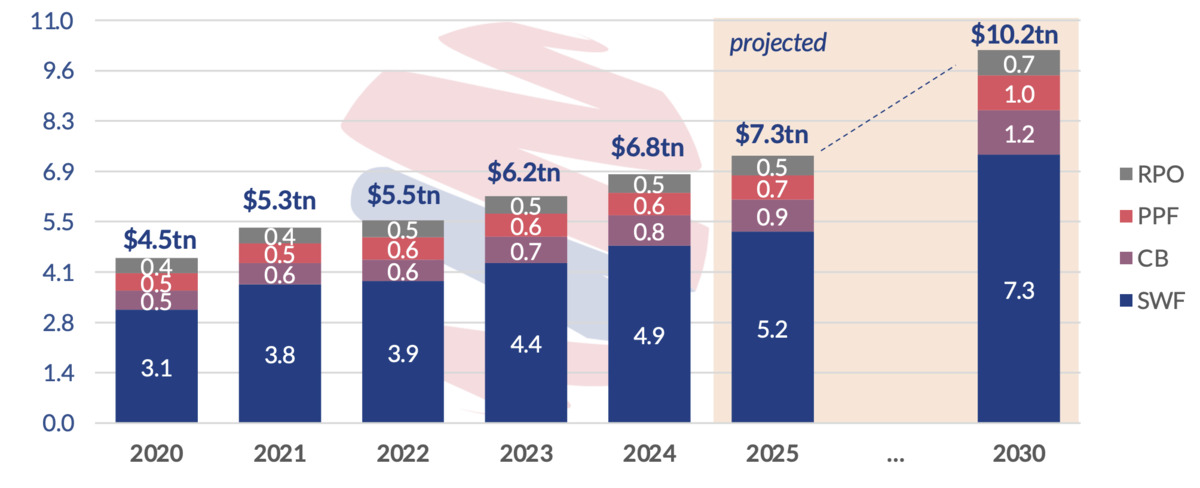

The sovereign wealth funds of the six GCC countries are increasing their depth and breadth, witnessing both organic and inorganic growth. Central banks have also grown their reserves in the past two years, and that excess capital could eventually flow into the sovereign wealth funds seeking higher risk appetite and investment yields.

In addition, the region’s public pension funds (PPF) are also expanding due to ongoing reforms that are incentivizing greater participation in the private sector, extending retirement age, and increasing contributions. Most governments have consolidated the various existing schemes into single PPFs, which are also becoming active dealmakers.

For more economy news, click here.