In the Middle East, interest in investments that adhere to environmental, social, and governance (ESG) criteria is rising.

According to a 2020 poll by the global bank HSBC, 41 percent of regional investors wanted to implement an effective ESG investing policy.

The top three sustainability goals for Middle Eastern businesses are diversity and equality, climate change, and safety, according to a May 2022 PwC analysis, which also verified this trend.

Investments in ESG have long trailed in the region. For instance, the Gulf Cooperation Council (GCC) nations’ economic systems, which rely heavily on the export of non-renewable energy sources, have little use for ESG practices, particularly environmental ones.

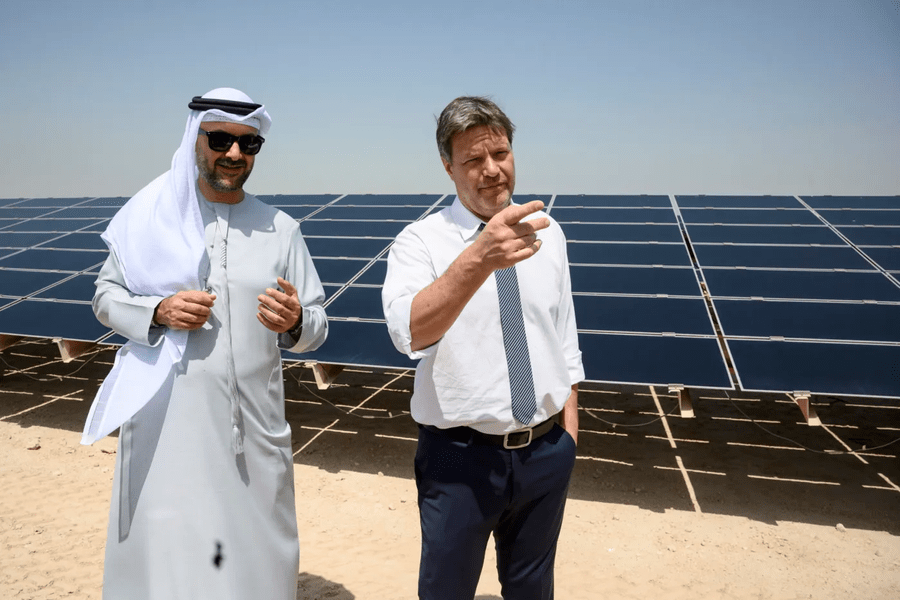

However, Saudi and the UAE have taken the lead in sustainable development in recent years, developing national strategies to limit their reliance on hydrocarbons, raise the proportion of renewable energy sources in their energy mix, and support the private sector.

ESG Insights Middle East, a regional ESG databank, was founded by Alena Dique.

“Since the pandemic, ESG investments have exploded in the Middle East, and this pattern is likely to continue through the year 2030,” Dique said.

She noted that investors aiming to leave behind lasting, sustainable contributions as their legacy are the main proponents of social investing. “At the same time, the Middle East has a great opportunity to invest in the environment because it is hosting COP27 and COP28. Even while the Middle East is no stranger to ethical practices, sharia-compliant tactics, or responsible investing, there is still a long way to go in terms of governance,” she added.

The Dubai Investment Fund (DIF) recently announced the establishment of an ESG investment department with the goal of monitoring the local and global market and identifying the most lucrative sustainability assets. DIF is one of the largest independent investment funds in the world in terms of assets under management.

ESGs are also gaining popularity in other GCC countries, like Kuwait. The National Bank of Kuwait (NBK) recently implemented a sustainable financing framework to aid in the implementation of the country’s climate change strategy and to include ESG criteria in all of the bank’s operations.