The “private credit umbrella” covers a wide range of strategies – practically any debt investment from a non-bank institution outside of public debt markets. While many headlines focus on the vanilla segments of this market (such as buy-out or mezzanine lending), a handful of specialized sub-segments often offer higher risk-adjusted returns. Opportunistic Credit is one such sub-segment that focuses on either special situations or distressed companies requiring more creative and flexible capital solutions.

Understanding opportunistic credit

Opportunistic credit involves investing in situations where traditional sources of debt financing are unavailable for borrowers, resulting in pricing dislocations where investors can generate equity-like returns with strong downside protection. This is achieved either by directly lending to companies that need alternative financing or by acquiring existing debt from original lenders. Often, buying existing bank debt at significant discounts creates the most attractive entry point, and allows the new lender and borrower to align and implement holistic solutions that address balance sheet issues.

While investing in these types of special situations might seem riskier to the uninitiated, in practice, the investor has a better position to structure deals offering capital protection. An opportunistic credit investor creates attractive pricing and stronger structures to mitigate downside risks. In scenarios where rescue financing is needed, a super senior facility providing a liquidity lifeline for the business, allowing it to operate as a going concern, could result in better stakeholder outcomes. In return, a rescue lender receives a priority in the distribution waterfall and a share of the incremental value created by such a new money loan. Investments are made via secondary loan purchases, the opportunistic credit investor could initially mitigate downside risks through the purchase price, which is often based on expected recoveries.

Upon transfer of the loan to a new lender, stakeholders can start a fresh restructuring dialogue, without the baggage of historical actions by prior lenders. Often a distressed investor will look for creative ways to work with existing shareholders to identify optimal solutions for the problems the company is facing. This may include the provision of new money, a sale of non-core assets, or partial equitization of existing debt to align the interests of stakeholders and allow the company some breathing room. If both parties act in good faith, restructuring talks will result in a “win-win” outcome – the shareholders remain invested in a much healthier and prosperous company, and the debt investor will generate its returns through a turnaround of the business and partial repayment of its debt.

Contrast the above scenarios to private credit associated with financing buy-out transactions which tend to be sponsor-driven and include equity-friendly terms, keeping most of the upside with shareholders while leaving creditors with any potential downside. While these transactions do fall into the private credit landscape, they tend to carry greater market risk versus opportunistic credit due to the high leverage multiples that the investment is underwritten against. A compression in equity multiples or a downturn in borrower profitability could easily destroy the equity cushion below the debt, impacting the recoverability of such new loans.

Role of opportunistic credit in a portfolio

Opportunistic credit allows investors to diversify away from public market volatility and generate high returns without taking high risks. It often offers more robust security structures than public fixed income, helping portfolios to create downside protection. Additionally, investments in opportunistic credit tend to be a mix of performing and non-performing credit, combining higher cash yields with capital appreciation. Lastly, opportunistic investments in distressed debt could result in ‘multi-bagger’ returns in certain situations, creating a different profile than most credit instruments. Including opportunistic credit investments within a portfolio alongside traditional credit and private credit acts as a natural diversifier and return catalyst without increasing the overall risk profile.

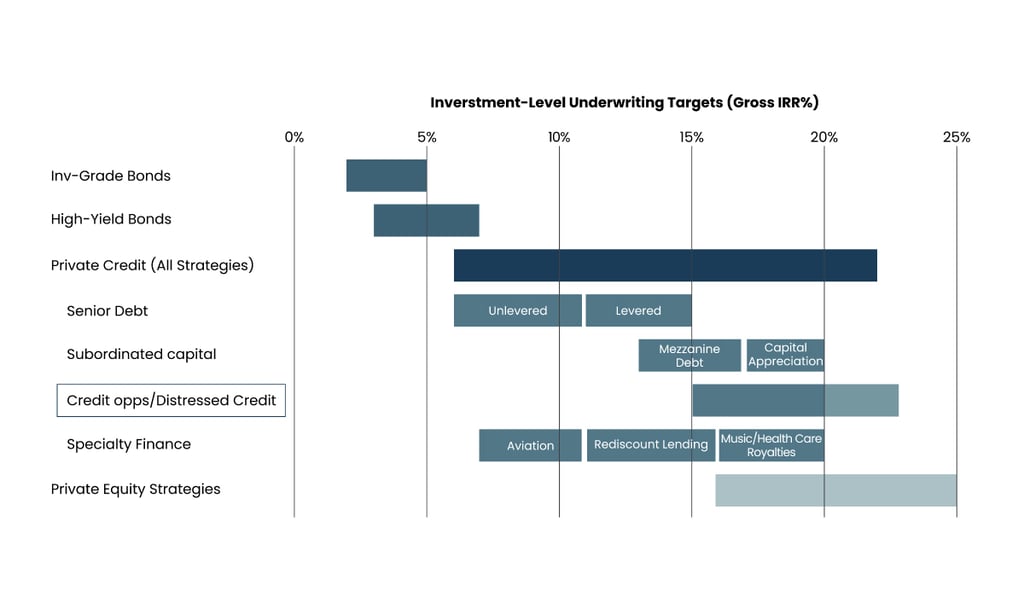

Return Profile of Credit Strategies (Source: Cambridge Associates)

The risks of this style of investing are often idiosyncratic and driven by the underlying dynamics of each investment. Opportunistic credit is generally low-beta and market-independent, although, in rare circumstances, a significant global shock could cause challenges. Liquidity could also be an issue as negotiations and restructurings could take a year or longer. Closed-end drawdown vehicles often offer the ideal structure, allowing fund managers flexibility to enter and exit investments as opportunities arise while allowing investors to fund their commitments only when investments are being made. Finally, opportunistic credit investments can be structured in a shariah-compliant manner, whether during origination or as a part of the restructured instruments. This can create an alternative to sukuk instruments for high-yielding debt allocation.

Read: UAE national banks offer credit facilities worth AED745.6 bn in H1

Trends in developed markets

The United States has been the market leader and the birthplace of all aspects of private credit investing, including opportunistic and distressed strategies. US Bankruptcy Law, including Chapter 11, which allows restructuring of troubled companies (versus sole liquidations), is commonly regarded as the benchmark of global best practices and allows a large degree of flexibility in finding tailor-made solutions for companies. As a result, and unsurprisingly, US private credit managers have the largest pool of capital allocated globally (close to $1 trillion) and opportunistic funds make up a considerable portion of it. With the ending of low rates and the retrenchment of commercial banks and CLO lenders, the opportunity set is growing but the market remains very crowded with quite a bit of dry powder.

The European market started developing in the 1990s, although a large degree of separation exists among different nations regarding the sophistication of insolvency regimes. For example, the United Kingdom and the Netherlands have world-class court processes, while resolving disputes in countries like Italy and Greece can become long-winded affairs. Despite these jurisdictional differences, the private credit and distressed debt markets in Europe remain large and liquid. However, as macro conditions are tightening and economies are facing headwinds, ample availability of liquidity in the banking sector is keeping the opportunity set tighter in Europe versus the US.

Trends in Asia

Perhaps one of the most exciting regions for opportunistic credit investors lies within APAC: the asset class is growing rapidly, particularly in India and the more developed economies of the region including primarily Australia and South Korea. Despite the growing market, the capital flows into the region have not matched the full extent of the opportunity, with only 6% of global private credit allocations dedicated to the region.

Special situations investing in the region generally dates to the Asian Financial Crisis of the late 1990s with debt eventually restructured en masse in its aftermath. Insolvency regimes have improved since the early days and are well-tested in jurisdictions like India, South Korea, Australia, Hong Kong, and Singapore. While it makes up a large portion of the region’s GDP, China presents a challenge for private credit managers for a variety of reasons including the government’s tight control over the economy, unpredictability, difficulties in enforcing security, and the inefficiency of the country’s insolvency regime.

Trends in the Middle East

The Middle Eastern distressed debt market truly began after the Global Financial Crisis of 2007-2008 (GFC) via several high-profile restructuring cases (Dubai World, Arcapita, etc.) Investors mainly got involved through secondary loan purchases from international banks looking to exit the region. Most of these restructuring cases either had to be done on a fully consensual basis via special decrees or using more established international jurisdictions as bankruptcy laws and courts were underdeveloped. For instance, some cases in Saudi Arabia dragged on for over a decade, as the country did not have an insolvency law that allowed for in-court implementation of restructurings, leaving only enforcement action for creditors seeking recovery via liquidation. As a result, the special situations direct lending market did not progress in the region for many years, as outcomes in downside scenarios remained highly uncertain.

Over the last several years, however, improvements to the insolvency regimes in GCC countries drastically changed the picture. In-court restructuring can now be utilized to save stressed businesses for the benefit of all stakeholders. Sophisticated concepts such as DIP financing (i.e., a form of rescue lending) and debt/equity swaps are increasingly common. Furthermore, local banks are becoming more proactive in selling down their distressed exposures, resulting in a growing set of opportunities for special situations investors. The UAE and Abu Dhabi are increasingly recognizing restructuring as a specialized segment that requires the expertise as well as the opportunities for applying such expertise within a holistic ecosystem. For example, Abu Dhabi Global Market (ADGM) has enabled a robust ecosystem including insolvency and restructuring regimes, attracting globally established restructuring firms, funds and consultancies that invest in special situations and provide bespoke solutions.

Outside of the GCC, in Egypt and Turkey, in special situations, direct lending is becoming a necessity for capital-starved corporates. Despite this attractive opportunity set, there is still very little capital allocated in the region to this strategy resulting in a general lack of competition. This is a positive for those focused on the region as it keeps returns more attractive compared to developed markets.

Arvind Ramamurthy, Chief of Market Development at Abu Dhabi Global Market said, “Restructuring and insolvency ecosystems in the Middle East and specifically the UAE, have evolved drastically in the last couple of decades. This is a specialised segment that requires the expertise as well as the opportunities for applying such expertise within a holistic ecosystem. As the international financial centre based in UAE’s capital city, Abu Dhabi Global Market (ADGM) has recognised both factors and has enabled a robust ecosystem, attracting globally established investment companies and consultancies that invest in special situations and provide bespoke solutions. Specialist players in this space, including Funds, such as SC Lowy, and Fidera, restructuring firms such as Alvarez and Marsal, FTI, and Rothschild, together with specialist law firms such as DLA Piper, Quinn Emanuel, Cleary Gottlieb, call ADGM their home and focus on restructuring and the opportunities the region presents.”

Arvind added, “The Financial Services Regulatory Authority and ADGM Courts are both important authorities within ADGM that have become facilitators of a rescue and rehabilitation culture. They have brought the much-needed certainty and stability that top investors and businesses are increasingly looking for. From regulations for insolvency and private credit funds to resolving cross-border insolvency disputes, ADGM has built end-to-end support providing a strong, progressive and sustainable business environment. The recent enhancement by ADGM to its regulatory framework to permit Private Credit Funds enabled ADGM-based collective investment funds to invest in credit by originating and participating in credit facilities. One of the key objectives to enhance this framework is to foster a conducive regulatory environment, that allows distressed businesses to explore effective solutions, benefiting both the alternative financing firms as well as affected businesses within ADGM’s jurisdiction.”

Berkay Oncel is head of MENAT Investments at SC Lowy.

For more banking and finance articles, click here.