The GCC region has witnessed substantial shifts in its economy in the last few years. With a noticeable slowdown in 2023, countries in the Gulf are expected to make a gradual recovery in 2024.

With that said, economic outlook remains optimistic as GCC countries are supported by robust financial fundamentals, a strong demographic profile, and ongoing economic reforms.

This was highlighted by the Swiss international wealth manager, Bank Lombard Odier, at its Investment Day event in Dubai recently. It hosted financial experts and industry leaders who delved into the critical intersections of sustainability and economic transition.

Important but temporary economic slowdown

“The evolving landscape of the oil sector, coupled with monetary policy adjustments, hinted at a potential recovery in 2024. Robust fiscal surpluses and ample reserves continue to bolster stability and support ongoing public investment,” said Samy Chaar, chief economist at Lombard Odier.

GGC countries are now focusing on strategic flexibility due to their active intervention in the oil market. With Russia’s supply reduced in 2022, GCC countries witnessed immense growth in their GDP.

In 2023, global growth slowed leading OPEC+ to cut oil production. In addition to the sharp rise in interest rates, it is expected that growth will slow to 0.2 percent in all six GCC economies.

Lombard Odier expects a gradual increase in oil output in 2024 for some GCC economies and eventual rate cuts which will modestly increase growth. They also believe that the slowdown in activities will have minimal impact on the countries’ medium-term outlook.

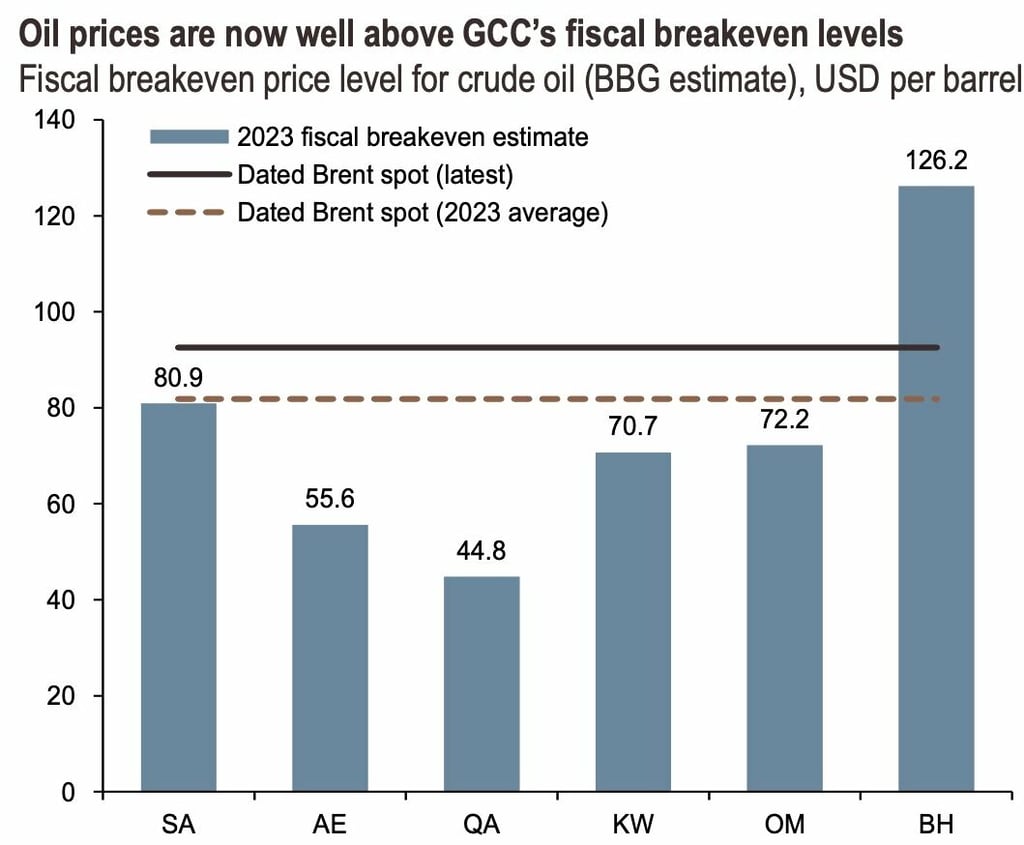

The prolonged output cuts have increased the possibility of crude oil prices remaining around $90 per barrel in the coming months. That level is above the needed to balance government books across the region.

Since the level of fiscal break-even prices are mostly higher than those required to balance the countries’ current accounts, GCC countries will be able to maintain either twin surpluses, such as the UAE and Qatar, or limit fiscal deficits arising from a slower economy in the case of Saudi Arabia and Kuwait.

Maintaining flexibility in a shifting economy

Despite their small populations, GCC countries like Saudi Arabia, the UAE, and Kuwait are economically powerful. They make up less than 1 percent of the global population but contribute around 2 percent of the global GDP. They produce more than 10 percent of the world’s natural gas and over 20 percent of its oil.

Due to recent restrictions on Russia’s hydrocarbon trade, they have become alternative suppliers in the energy market. Therefore, maintaining strategic flexibility is at the top of the GCC’s priorities.

This was stressed in The Dubai Investment Day which offered distinct viewpoints on how investors can take advantage of the environmental transition while skillfully managing the concerns associated with shifting geopolitical dynamics, climate change, and technological advances.

Essential role of sustainability

Dr. Michael Urban, chief sustainability strategist at Lombard Odier, emphasized the essential role of sustainability in light of economic transitions. The focus has strictly been on Dubai as it is hosting the United Nations Climate Change Conference (COP28) this year.

“The integration of climate goals with food and energy security imperatives presents a compelling landscape for financial markets, ripe with both risks and opportunities” added Dr. Urban. “The future of investment lies in aligning with sustainability.”

Read: Dubai’s first half witnesses record FDI inflows of AED 20.87 bn

National visions and economic diversification

The Investment Day event highlighted the essential role of economic diversification in the region. All six GCC countries have committed to long-term economic plans that focus on diversification, human capital development, and sustainability. Commitments to these plans and visions are promising as the region faces the move towards electric vehicles and clean energy.

In light of the expected peak in oil demand in the next decade, the GCC region faces a need to commit to their national vision strategies. For example, projects like NEOM and AlUla accelerate Saudi Arabia’s investments in tourism and entertainment sectors.

Moreover, public sector investments in solar energy have significantly increased in the UAE over the last two years. Meanwhile, dependence on oil has been decreasing due to the introduction of value-added and corporate income taxes in Saudi Arabia

In addition, there is a significant increase in Female labor force participation in Saudi Arabia, the UAE, and Qatar. This uptrend in participation and human capital development will improve the long-term position of these countries.

Pegs will remain supported

Inflation in the region rapidly decreased from its high point in 2022 because interest rates increased quickly. GCC countries tie their monetary policy decisions to the U.S. dollar or a mix of currencies that include the dollar, like Kuwait.

This time, the economies of the United States and the GCC broadly overlapped. Therefore, the recent increase in interest rates in the GCC makes sense in light of inflation dynamics and growth. However, the GCC countries’ financial authorities might step in to control issues with money flow, as Saudi Arabia’s central bank did in 2022.

In the UAE, the government might change real estate rules instead of adjusting interest rates to prevent property prices in Dubai from going down due to rising interest rates. In Dubai, businesses connected to the government are often affected by big changes in the real estate market.

GCC countries have been trying to link their finances more with China and other emerging markets. However, they have been preserving substantial USD reserves to defend their pegs. While their international reserves have slightly decreased in the last few years, their levels surpass many other regions. The shift in policy will not create big risks, especially since the expectations are that U.S. rates have now peaked.

For more news on the economy, click here.