UAE’s non-oil foreign trade hit a new high in 2023, topping AED3.5 trillion ($953 billion), it was revealed on Sunday.

During the period, non-oil exports exceeded AED441 billion ($120 billion), up 16.7 percent compared to 2022, and contributed 17.1 percent to the country’s overall foreign trade, up from 14.1 percent in 2019 and 13 percent in 2018.

The exports in 2023 were more than double the exports in 2018 and are close to achieving double the exports of 2019.

Read: UAE’s outlook soars as S&P predicts 5.3 percent GDP growth in 2024

“We indicated at the beginning of 2023 that it would be a record economic year. The UAE has established new bridges of cooperation through comprehensive partnership agreements. Thus, our foreign trade with the top 10 trading partners jumped by 26 percent, with Türkiye by more than 103 percent, with Hong Kong-China by 47 percent, and with the USA by 20 percent,” His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, said.

Gold, aluminum, oils, cigarettes, jewelry, copper wire and ethylene polymers topped the list of the country’s most important exports of goods.

Re-exports climb

The record growth in both total foreign trade and non-oil exports was accompanied by a similar increase in re-exports, which hit AED690 billion, a growth of 6.9 percent compared to 2022 and 27.7 percent compared to 2021. Re-exports continued their upward trend of growth over the recent years, except 2020, when the Covid-19 pandemic struck.

Imports increase

Imports also increased to AED1.4 trillion, a growth of 14.2 percent compared to 2022. The top 10 imported commodities achieved a growth of 20.9 percent in 2023 compared to 2022, and the rest of the commodities grew by 6.3 percent. The most important imported commodities are gold, telephones, petroleum oils, cars and diamonds.

Trade growth with top 10 partners

In 2023, trade with Türkiye, which contributed 5.1 percent to the total, grew by 103.7 percent, the highest among the top 10. This followed the September implementation of the Comprehensive Economic Partnership Agreement between the two countries. Other notable increases were with Hong Kong-China (47.9 percent), which now ranks eighth among the UAE’s top 10 trading partners, the US (20.1 percent), and China (4.2 percent). Trade with India, which has a similar agreement since May 2022, grew by 3.9 percent, accounting for over 7.6 percent of the total trade.

Non-oil exports to the top 10 partners grew by 26.9 percent, with Türkiye accounting for nearly 60 percent of UAE’s exports in the last five months of 2023. India was the second-largest recipient of UAE exports.

China remained the UAE’s leading trading partner, followed by India, the US, Saudi Arabia, and Türkiye. The next five were Iraq, Switzerland, Hong Kong, Japan, and Oman.

Recovery of UAE trade in services

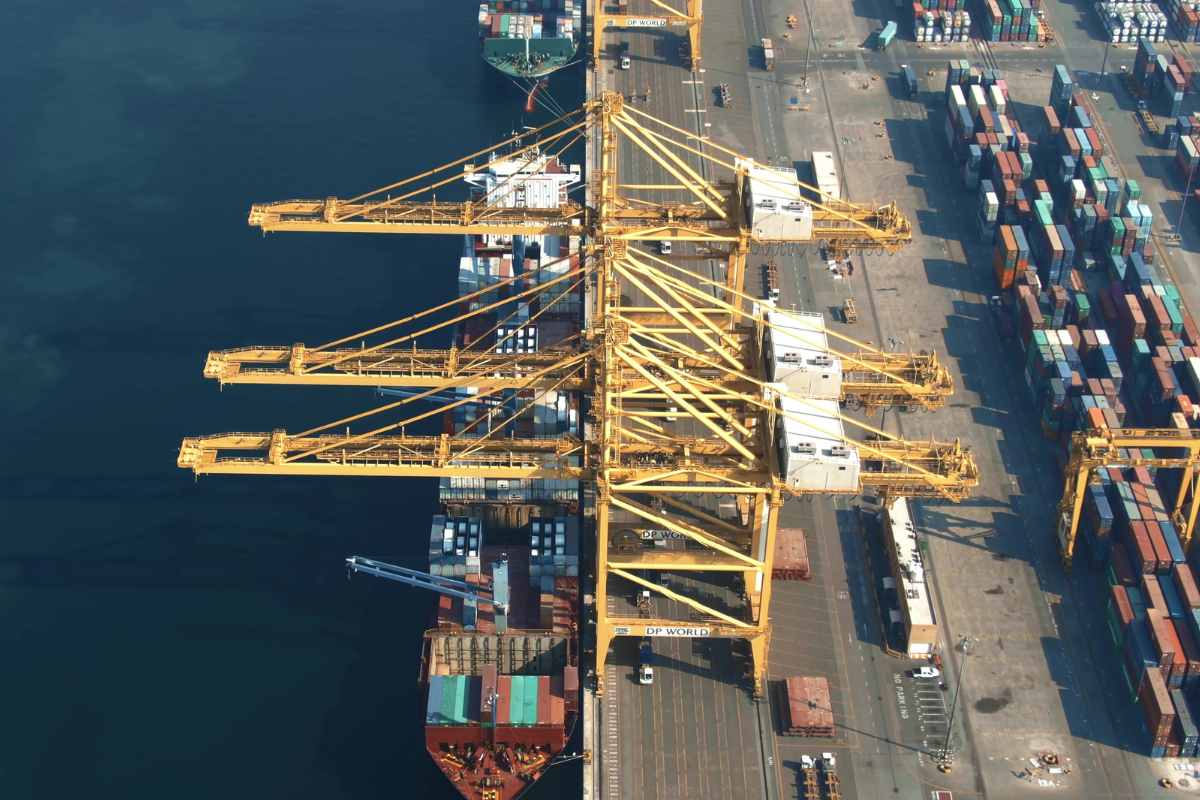

In 2023, the UAE’s services trade surplus grew to AED207 billion, up from AED96.26 billion in 2021, indicating a continued increase in its share of global service exports. Key sectors such as travel and tourism, ICT, professional and financial services, education, medical tourism, Islamic financial services, the creative economy, and logistics saw a significant contribution to this growth.

Quarterly performance promises further growth

In Q4 2023, the UAE’s non-oil foreign trade of goods reached a record AED710 billion, a 16.3 percent YoY and 12.4 percent QoQ growth. This marked the first time non-oil trade exceeded AED700 billion in a quarter. Non-oil exports of goods amounted to AED132.2 billion, a 39.3 percent YoY and 26.9 percent QoQ increase. Since Q1 2023, non-oil exports have consistently surpassed AED100 billion.