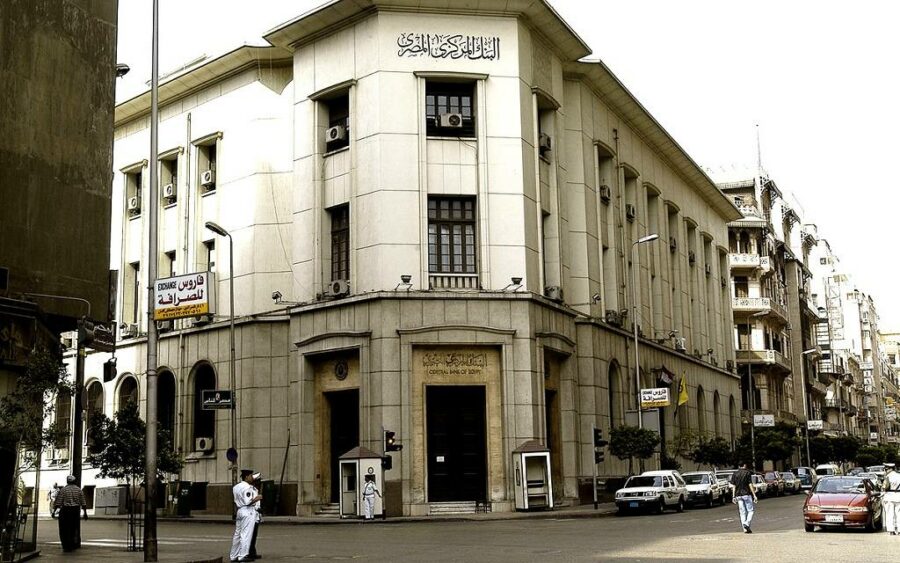

The Central Bank of Egypt (CBE) has taken preventative measures to secure the ongoing operation of the refineries’ diverse businesses and activities.

From July 1st through the end of the year, CBE requested banks to take the necessary steps to implement decisions pertaining to commissions and fees for particular financial services, specifically withdrawal, transfer, and payment through electronic cards and channels.

The bank agreed to raise the upper limit for cash withdrawals from automated teller machines (ATMs) in a single transaction to 4,000 pounds (EGP), noting that there is a 5-pound maximum commission for cash withdrawals from ATMs using cards from other banks.

It further recommended that all fees and costs associated with bank transfer services conducted in Egyptian pounds through electronic channels, including the Internet, mobile banking, and instant payments network applications, be waived for customers.

Since the pandemic outbreak, CBE has implemented a number of regulations with the goal of increasing electronic operations and minimizing direct banking transactions, including charge elimination for ATM withdrawals and related services.