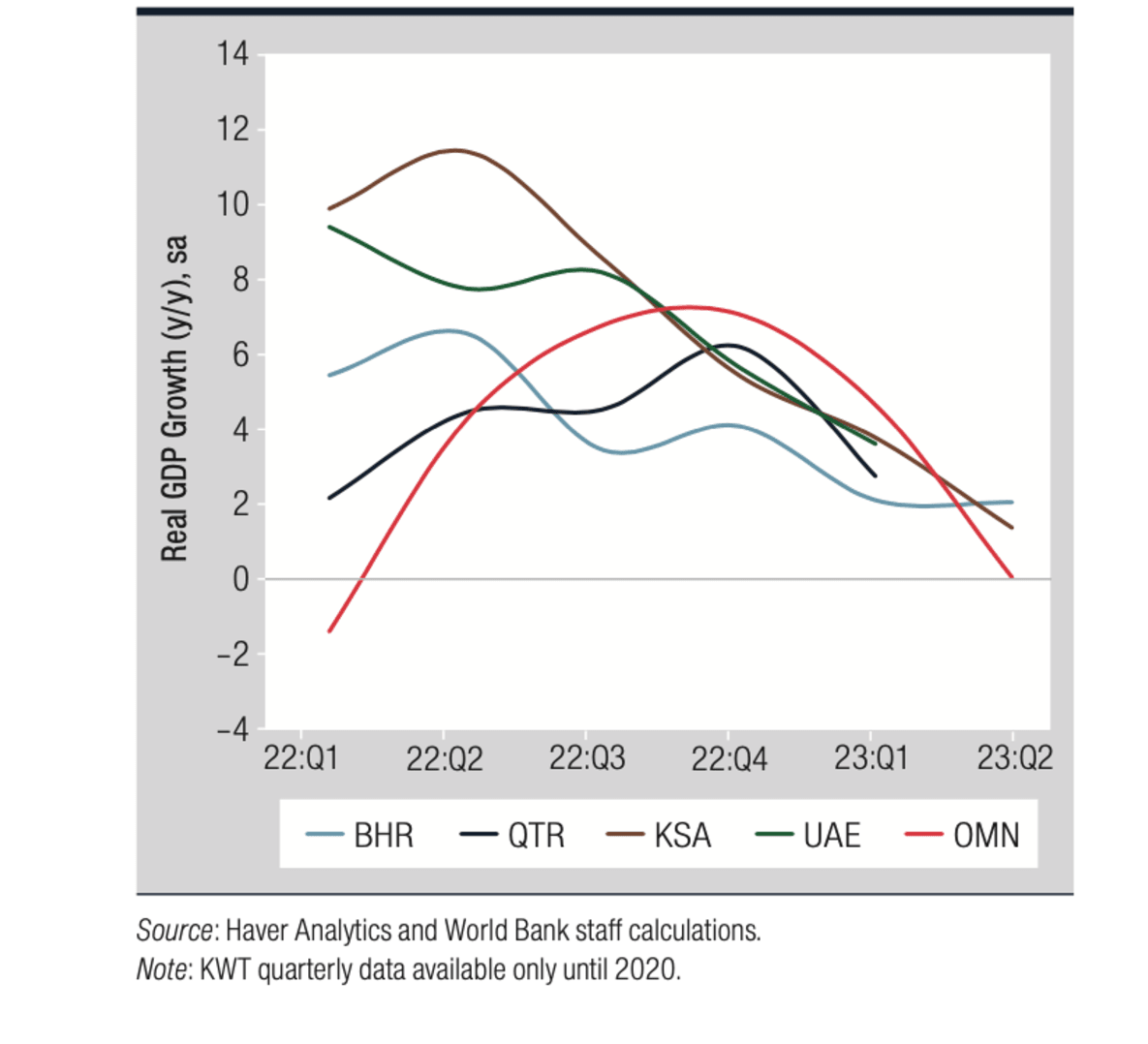

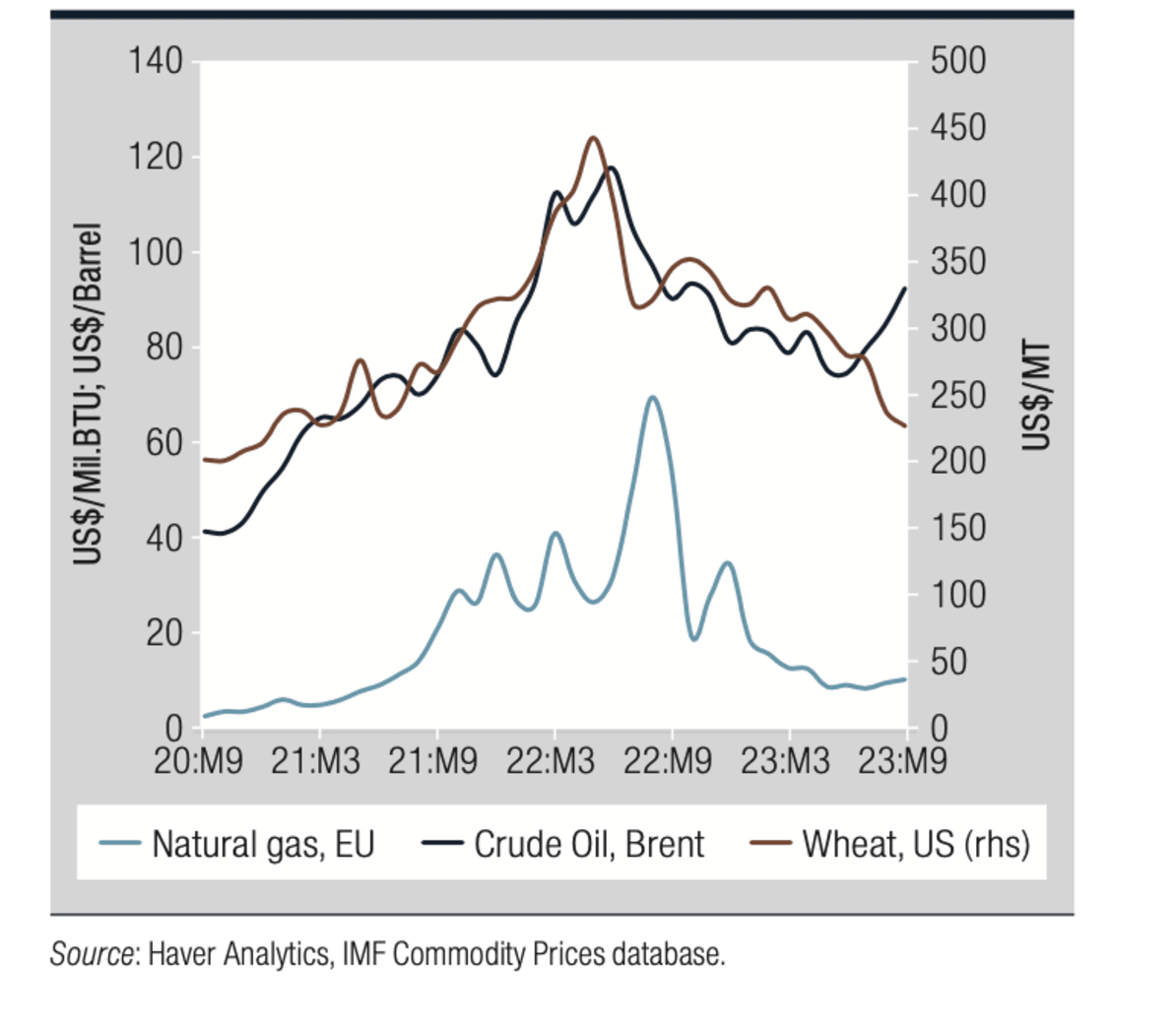

According to the recently published Gulf Economic Update (GEU) report by the World Bank Group (WBG), the Gulf Cooperation Council (GCC) region is projected to experience a growth rate of 1 percent in 2023. Subsequently, the region is expected to accelerate its growth, reaching 3.6 percent and 3.7 percent in 2024 and 2025, respectively.

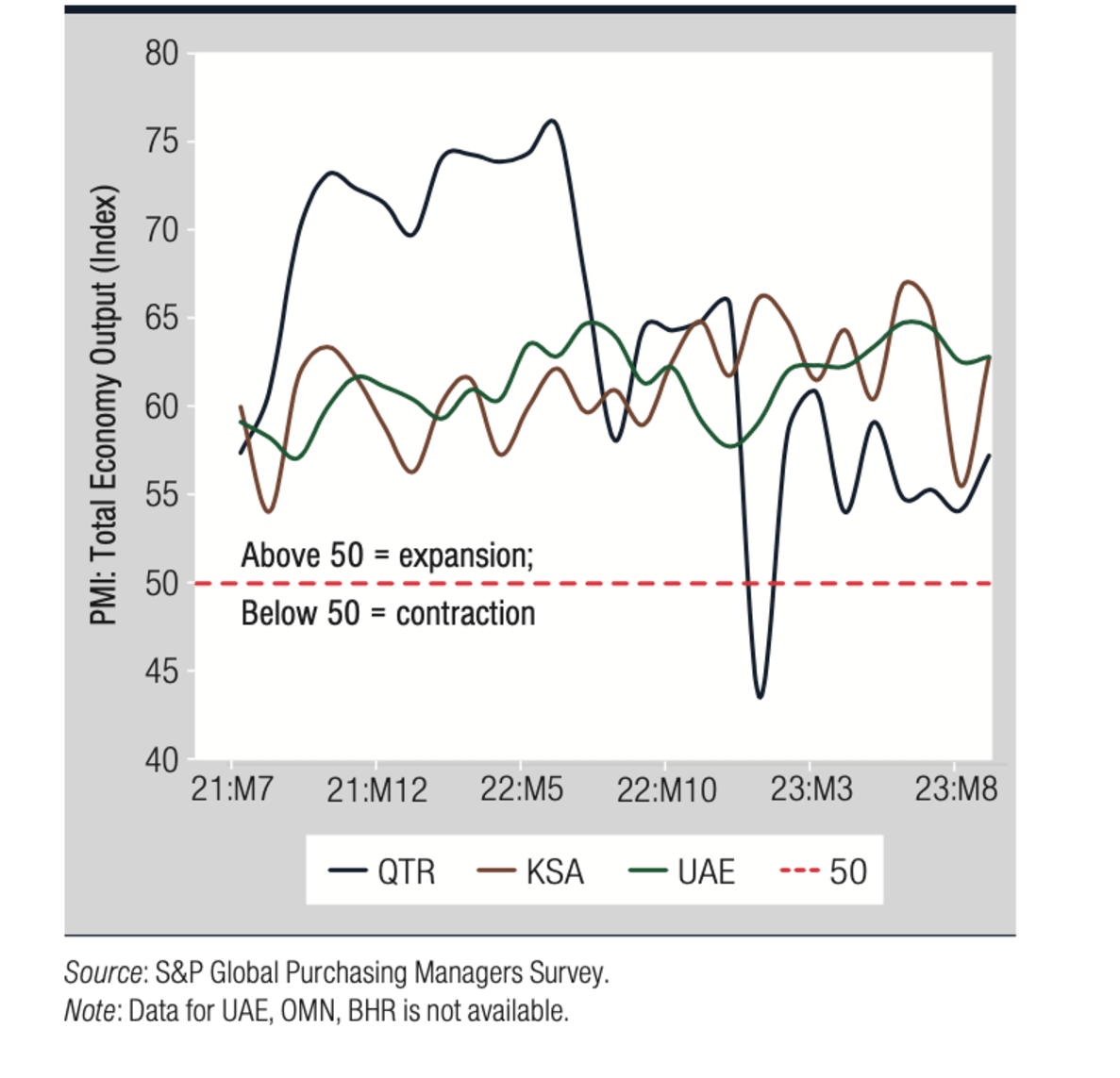

The report obtained by Economy Middle East indicates that although there will be a decline in oil sector activities, the growth of non-oil sectors is expected to compensate for this decline. The non-oil sectors are projected to grow by 3.9 percent in 2023 and maintain a growth rate of 3.4 percent in the medium term. This growth is anticipated to be supported by sustainable private consumption, sustained strategic investments, and a accommodative fiscal policy.

Read more: GCC sovereign wealth funds among world’s top 15

“To maintain this positive trajectory, GCC countries must continue to exercise prudent macroeconomic management, stay committed to structural reforms, and focus on increasing non-oil exports” said Safaa El Tayeb El-Kogali, World Bank country director for the GCC. “However, it is important to acknowledge the downside risks that persist. The current conflict in the Middle East poses significant risks to the region and the GCC outlook, especially if it extends or involves other regional players. As a result, global oil markets are already witnessing higher volatility.”

In the most recent edition of the GEU report titled “Structural Reforms and Shifting Social Norms to Increase Women’s Labor Force Participation,” it is highlighted that the diversification efforts in the GCC region have yielded positive results. However, the report also emphasizes the need for further reforms to continue progressing in this area.

“The region has shown notable improvements in the performance of the non-oil sectors despite the downturn in oil production during most of 2023” said Khaled Alhmoud, senior economist at the World Bank. “Diversification and the development of nonoil sectors has a positive impact on the creation of employment opportunities across sectors and geographic regions within the GCC.”

Labor force and women’s participation

As per the findings of the GEU report, the private sector workforce in Saudi Arabia has exhibited consistent growth, reaching a figure of 2.6 million in early 2023. Moreover, the labor force participation rate of Saudi women has more than doubled within a span of six years, increasing from 17.4 percent in early 2017 to 36 percent in the first quarter of 2023.

“GCC countries have witnessed a remarkable increase in female labor force participation” said Johannes Koettl, senior economist at the World Bank. “Saudi Arabia’s achievements in advancing women’s economic empowerment in just a few years is impressive and offers lessons for the MENA region and the world.”

GCC country outlooks

The report by the World Bank on the economic prospects of the GCC outlines the following:

Bahrain: Growth is projected to moderate to 2.8 percent in 2023, primarily due to a subdued performance of the oil sector. However, the non-oil sector will remain the primary driver of growth. The hydrocarbon sector is expected to experience a slight growth of 0.1 percent during 2023-24, while the non-hydrocarbon sectors, including tourism, service sectors, and ongoing infrastructure projects, are anticipated to expand at a rate of approximately 4 percent.

Kuwait: Economic growth for the year 2023, with an estimated rate of 0.8 percent. This deceleration can be attributed to several factors, including a decline in oil production, tightening of monetary policies, and sluggish global economic conditions. The implementation of stricter production quotas by OPEC+ and a decrease in global demand are expected to cause a contraction of 3.8 percent in oil GDP growth in 2023. However, it is anticipated that there will be a recovery in 2024 as production quotas are relaxed, particularly due to increased activity from the AlZour refinery. On the other hand, the non-oil sector is projected to experience growth of 5.2 percent in 2023. This growth will be supported by factors such as private consumption and a more lenient fiscal policy.

Oman: The economy of Oman is expected to experience a slowdown in 2023 due to the impact of OPEC+ production cuts and sluggish global economic conditions. However, over the medium-term, the economy is anticipated to strengthen, driven by increased energy production and comprehensive structural reforms. The projected overall growth rate for 2023 is estimated to decelerate to 1.4 percent as a result of declining oil output. However, growth in the non-oil sectors is expected to support the economy, with a rise of over 2 percent. This growth will be driven by the recovery of the construction sector, investments in renewable energy, and the tourism industry.

Qatar: A deceleration in real GDP growth, with a rate of 2.8 percent expected for 2023. This growth rate is anticipated to continue in the medium term. Despite challenges faced by the construction sector and the implementation of tighter monetary policies, there is robust growth expected in the non-hydrocarbon sectors. It is projected that these sectors will experience growth of 3.6 percent, driven by thriving tourist arrivals and the hosting of large events. Furthermore, Qatar’s reputation as a global sporting hub will be further strengthened with the addition of 14 major sporting events scheduled for 2023. On the other hand, the hydrocarbon sector is estimated to grow by 1.3 percent in 2023.

Saudi Arabia: The oil sector is projected to experience a contraction of 8.4 percent in 2023, reflecting the agreed oil production curbs within the OPEC+ alliance. However, the non-oil sectors are expected to mitigate this contraction by growing at a rate of 4.3 percent. This growth will be supported by looser fiscal policies, robust private consumption, and increased public investments. As a result, the overall GDP is estimated to contract by 0.5 percent in 2023. However, there is anticipation of a recovery in 2024, with GDP expected to expand by 4.1 percent. This recovery will be driven by expansions in both the oil and non-oil sectors.

United Arab Emirates: The pace of economic activity is expected to decelerate in 2023, with a growth rate of 3.4 percent, influenced by factors such as sluggish global activity, stagnant oil output, and tighter financial conditions. As a result of the implementation of stricter OPEC+ production quotas, the growth of the oil GDP is projected to be 0.7 percent in 2023. However, there is an anticipation of a strong recovery in 2024 as production quotas are relaxed. On the other hand, non-oil output is forecasted to support economic activity in 2023, with a growth rate of 4.5 percent. This growth will be driven by the robust performance of sectors such as tourism, real estate, construction, transportation, manufacturing, and a surge in capital expenditure.

For more news on the economy, click here.