Donald Trump

The uncertainty surrounding tariffs has added to global market volatility, reinforcing gold's appeal as a safe-haven asset

Investors await key U.S. macroeconomic data and Federal Reserve meeting with rates expected to remain steady

A spike in the prices of certain items contributed to a 3.5 percent annualized rise in consumer inflation in June

This decision follows eight cuts since June last year as trade relations with the U.S. remain unclear

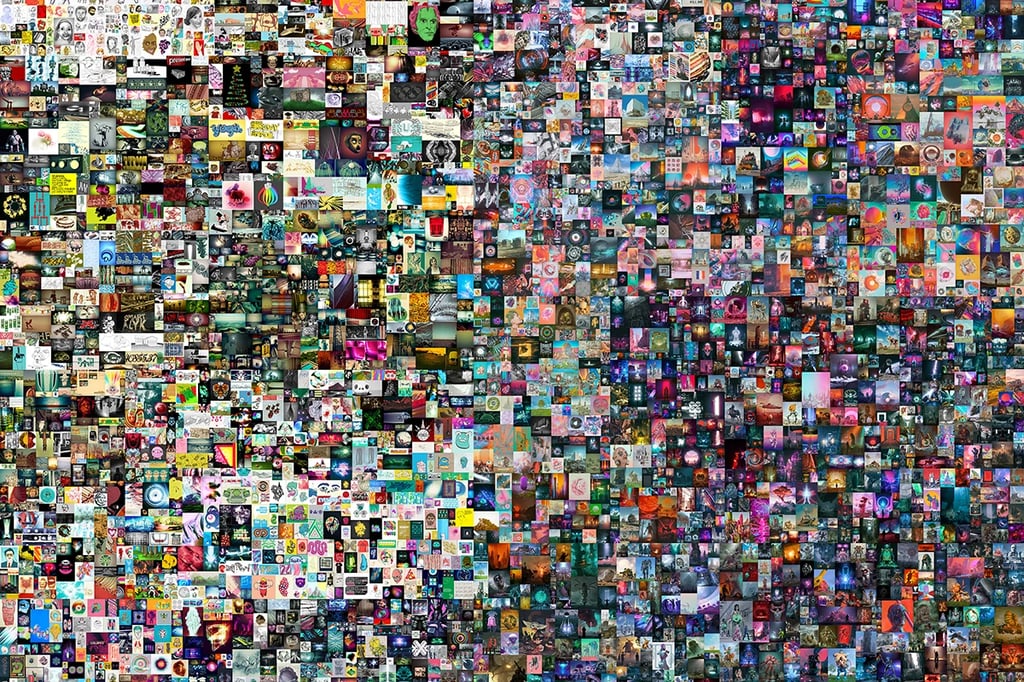

One of the most transformational changes in today’s creative industry is the democratization of artistic tools

Treasury Secretary hints at meeting with China, suggesting possible extension of August tariff deadlines