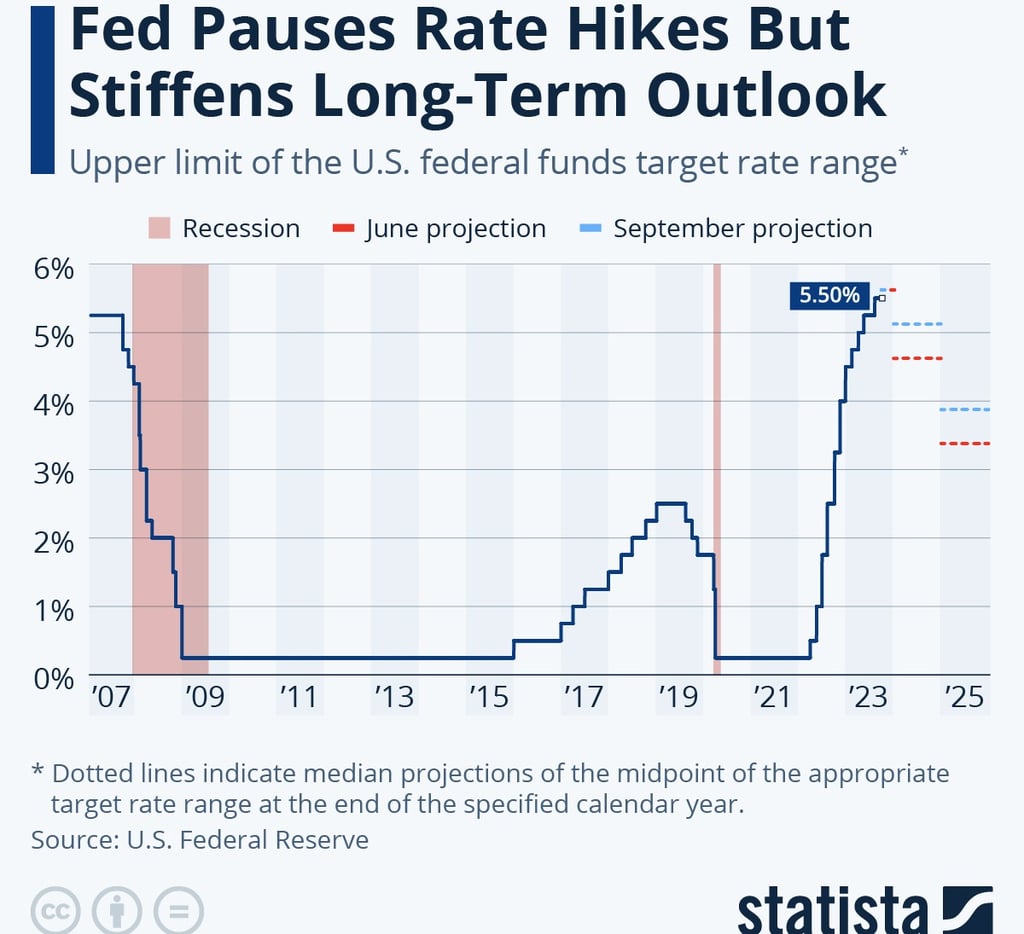

The Fed has decided to hit pause on further interest rate hikes this month, keeping them at 5.25 to 5.50, the second time it did so during the last 3 meetings. It signaled that it would prolong the state of high interest rates for longer than previously anticipated.

Following a two-day meeting of the Federal Open Market Committee (FOMC), the Fed hinted it was buying more time, to judge where inflation, the labor market and economic activity are heading.

There was a recent upward revision of expected U.S. GDP growth through 2025 and a downward revision of the projected unemployment rate.

Read: Türkiye hikes interest rate to 30 percent, reaching 20-year high

This places the latest median projection for the midpoint of the target rate range at the end of 2024 at 5.1, up from 4.6 in June.

The projection for the end of 2025 was also raised by 50 basis points, from 3.4 to 3.9. FOMC members now expect one more rate hike this year followed by two 25-point cuts in 2024.

In touch with the ceiling

FED Chair Jerome Powell said he would do whatever was necessary to rein in inflation but not yet know where the ceiling was. Now, 1.5 years into the most aggressive tightening cycle since the early 1980s, that ceiling appears to be in sight. Although its long-term goal of returning to 2 percent inflation remains elusive.

In August it stood at 3.7 percent in the U.S. and 5.2 percent in the euro zone.

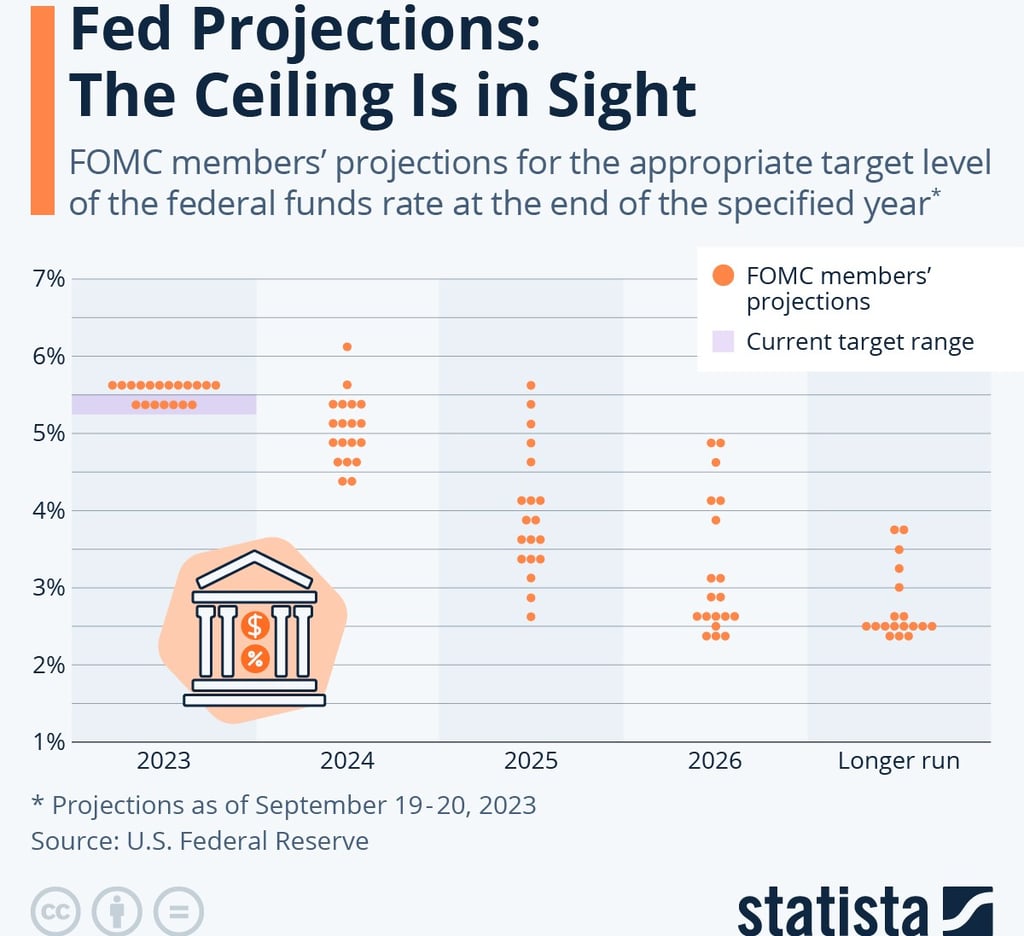

Following the latest FOMC meeting, 12 of the 19 meeting participants anticipate one more 25 basis point hike this year, while the remaining seven FOMC members expect the federal fund’s target rate range to remain at its current level until the end of the year.

For next year and beyond, the committee members expect interest rates to return to lower levels, albeit at a slower pace than previously anticipated. Predictions for the appropriate policy rate at the end of 2025 range from 2.625 to 5.625 and from 2.375 to 4.875 for the end of 2026.

Central Banks respond

Central banks for the world’s biggest economies said they would maintain high interest rates to tame inflation, even as policy tightening reaches a peak.

The so-called “higher for longer” mantra is now the official stance of the U.S. Federal Reserve, European Central Bank and the Bank of England.

“We will need to keep interest rates high enough for long enough to ensure that we get the job done,” Bank of England Governor Andrew Bailey said on Thursday after policymakers narrowly decided to hold its main interest rate at 5.25%.

In Europe, ECB President Christine Lagarde was resolute that further hikes for the 20-country euro zone are always a possibility.

Turkey’s central bank confirmed its hawkish turn with a recent 30 percent interest rate hike while in Asia, Taiwan’s central bank flagged continued tight policy.

Significantly detached from this picture are the Bank of Japan, which is expected to stick to negative rates today and the People’s Bank of China, where better economic prospects allowed it to keep rates on hold yesterday, September 21, 2023.

“By this time next year, we anticipate that 21 out of the world’s 30 major central banks will be cutting interest rates,” Capital Economics wrote in a commentary entitled “A tipping point for global monetary policy”.

For more on the economy, click here.