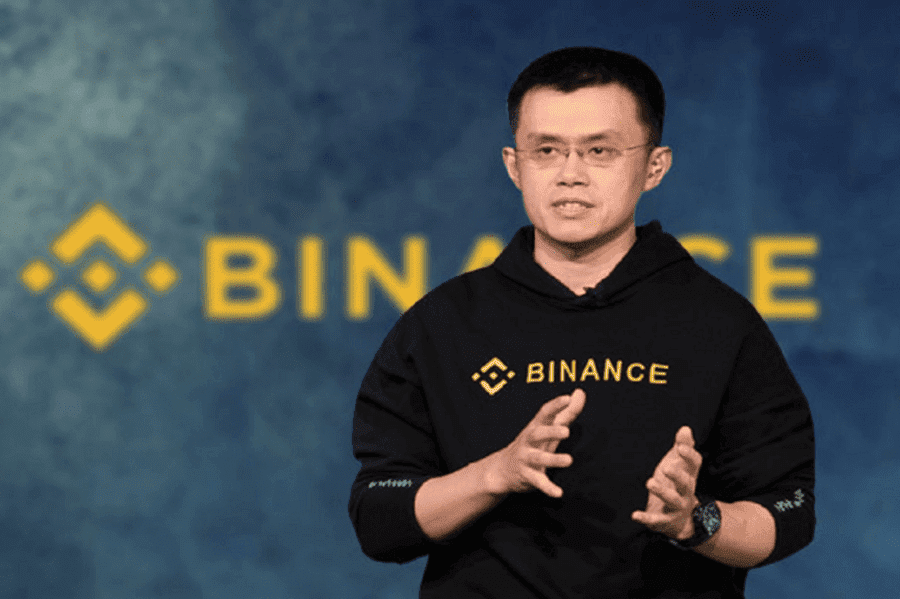

Binance’s CEO Changpeng Zhao has described a new civil complaint filed by the Commodity Futures Trading Commission (CFTC) as “unexpected and disappointing.”

The regulator has claimed that the exchange broke U.S. derivatives rules and should have been registered with the agency years ago.

Zhao has said the complaint “appears to contain an incomplete recitation of facts” — and he disagrees with how many of the issues have been characterized.

The CFTC alleges that Binance’s compliance program has been “ineffective” — but CZ says his trading platform is the first global, non-U.S. exchange to implement a mandatory KYC program.

Read more: US takes most forceful move yet to crack down on Binance

CZ argued that the company has “one of the highest standards in KYC and AML.”

Zhao further said Binance employs 750 people across its compliance teams — many of whom have a background in law enforcement and regulation. He noted that the exchange has handled over 55,000 requests from the authorities — and has helped American detectives freeze $160 million so far in 2023.

CZ also denied that Binance engages in manipulating the market. He explained that, as the exchange’s revenues are in crypto, they sometimes need to be converted into fiat or other digital assets so expenses are covered. He wrote: “Personally, I have two accounts at Binance: one for Binance Card, one for my crypto holdings. I eat our own dog food and store my crypto on Binance.com. I also need to convert crypto from time to time to pay for my personal expenses or for the Card.”

(In case you’re wondering, “eat our own dog food” is a business term that refers to a company using its own products and services.)

CZ went on to stress that all staff is subjected to a rule that means they cannot sell a coin within 90 days of the most recent purchase — stopping employees from actively trading.

The CEO added that “Strict policies” are also in force for anyone with access to private information, such as intelligence on when coins will be listed

CZ concluded by saying that Binance looks to collaborate with regulators and government agencies — and that the business won’t shy away from challenges.

For more on Binance-related news, click here.