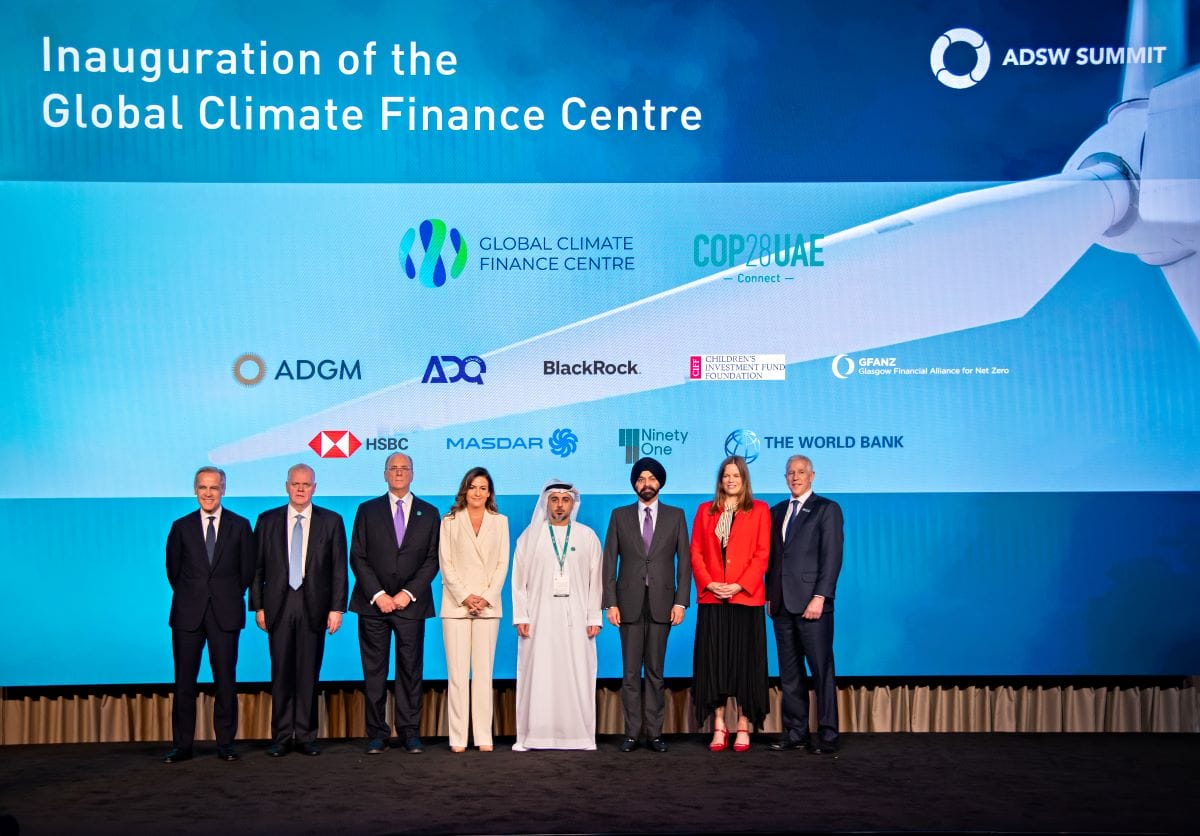

The Global Climate Finance Center (GCFC) has been formally launched at COP28. The independent, private-sector focused think tank and research hub aims to scale the design and creation of green financial markets.

GCFC will be headquartered at the Abu Dhabi Global Market (ADGM). The center is a collaborative initiative between ADGM, ADQ, BlackRock, CIFF, GFANZ, HSBC, Masdar, NinetyOne and the World Bank. The founding members will provide strategic direction to the GCFC, drawing on their deep expertise, experience, and networks. Additionally, the GCFC will seek to work with peer institutions and knowledge partners to build on sustainable finance leadership. Moreover, it will help develop expertise in-house and deliver maximum impact.

In addition, GCFC aims to address the root causes currently preventing investment, through cutting-edge research. With the help of leading experts, it will develop fit-for-purpose financial frameworks that are increasingly aligned internationally. Furthermore, GCFC will help create an enabling environment for investments into low-carbon, sustainable and resilient projects.

Core functions

In his speech at the special edition of the Abu Dhabi Sustainability Week (ADSW) at COP28, Chairman of Abu Dhabi Global Market (ADGM) and Abu Dhabi Department of Economic Development (ADDED), H.E. Ahmed Jasim Al Zaabi outlined the core functions of the GCFC.

Research, Policy and Innovation

As an independent and private-sector-focused global climate finance think-tank, the GCFC will conduct cutting-edge research and share best practices. Moreover, it will define principles and create solutions to align frameworks and build financial markets. In doing so, GCFC will enable investments to flow into low-carbon and sustainable investments.

Read: COP28 gains global acclaim, sets ambitious goals to tackle climate crisis

Advisory and stakeholder engagement

The GCFC will convene private and public stakeholders on developing recommendations and actions targeted towards deploying funds. It will also seek to incentivize the creation of strong pipelines of bankable investment opportunities. Coalitions and partnerships of relevant actors will be at the core of the GCFC’s work.

Climate Finance Academy

The GCFC will first and foremost develop a strong knowledge base on the back of Abu Dhabi’s experience on green finance markets. These include providing training modules and tailored courses to build expertise and capacity in the UAE. This will establish the academy as a global thought leader. In turn, this will help open up opportunities to engage with other jurisdictions in supporting the development of tailored financial frameworks well aligned with Abu Dhabi.

Together these initiatives will build capacity in the UAE and global financial institutions; scale up green finance market activity and ecosystems; and catalyze international investment into low and zero-carbon initiatives.

Innovation and rapid progress

“Abu Dhabi knows how to deliver rapid progress, which is increasingly critical as we respond to global economic and environmental challenges. It is now time for Abu Dhabi to build a new pioneer for global climate finance. This new GCFC will unlock new capital flows into the region as the Emirate becomes a key marketplace for sustainable finance, building upon ADGM’s progressive Sustainable Finance Regulatory Framework. Our ambition is for the benefits of this world-leading facility to touch every corner of our planet,” Al Zaabi continued.

GCFC will be led by Mercedes Vela Monserrate as its chief executive officer. Monserrate brings a wealth of experience and expertise to lead the center towards driving global change in sustainable finance. She said, “I am honored to lead the GCFC in transforming the financial markets towards a greener and more sustainable future. Together with our global partners, we aim to create a positive legacy by making climate finance more accessible and facilitating the transition to a low-carbon economy.”

For more sustainability stories, click here.