With economic uncertainty emerging on a global scale, Dubai remains the preferred choice for homeowners, establishing itself as an attractive residential market for long-term investors seeking to rent or buy property. Dubai’s residential market continues to experience growth as it offers residents enticing incentives and maintains its reputation as one of the safest places to live.

To briefly describe Dubai’s market landscape following its initial growth period, the city launched a secondary expansion that is still ongoing. This expansion has seen the launch of a large number of residential properties situated within Dubailand, including a mix of apartments, townhouses, and villas.

Based on the current preferences of Dubai’s consumers, there is a growing trend of end-users/tenants transitioning from smaller apartments to more efficient units that offer community elements like retail shops, F&B outlets, co-working spaces, schools, and healthcare facilities. This trend is expected to remain in demand.

Read: Updates to GCC real estate laws to spur market efficiency

The market’s performance displayed significant increases in average rent and sales rates. During Q4 2022, there was an increase of around 35.2 percent in apartment average rents compared to the average in 2021. Apartments with good build quality in secondary locations, such as JVC, Sports City, and developments near the Expo 2020 site, also gained popularity and, in turn, an increase in rental performance.

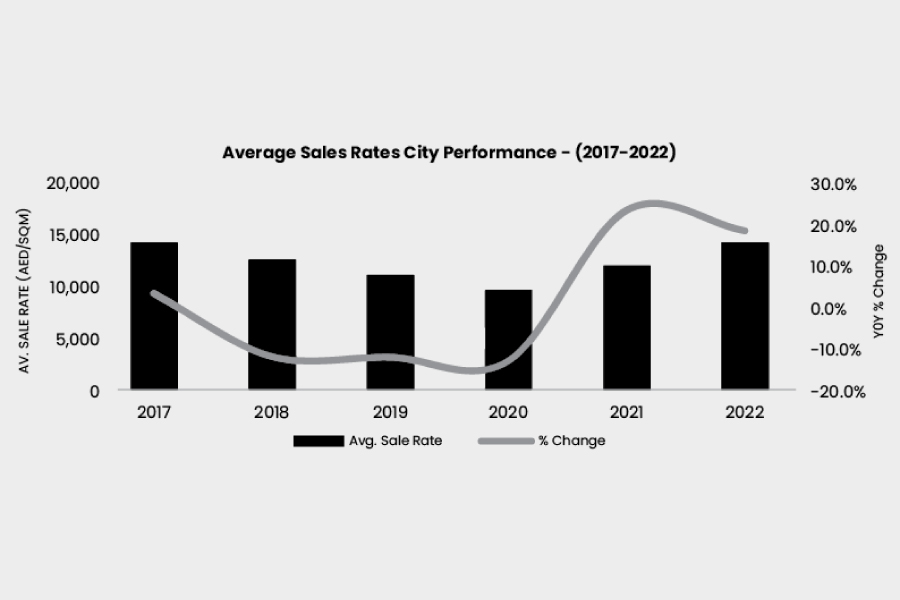

Looking at the average sales rates in the city, the last quarter of 2022 recorded an increase of 18.5 percent in sales rate compared to 2021, with the average such rate reaching AED14,500 per square meter. During Q4 2022, apartment sales rates in prime/high-end areas including Palm Jumeirah, Dubai Marina, and Downtown ranged between AED17,500 – AED19,800 per square meter.

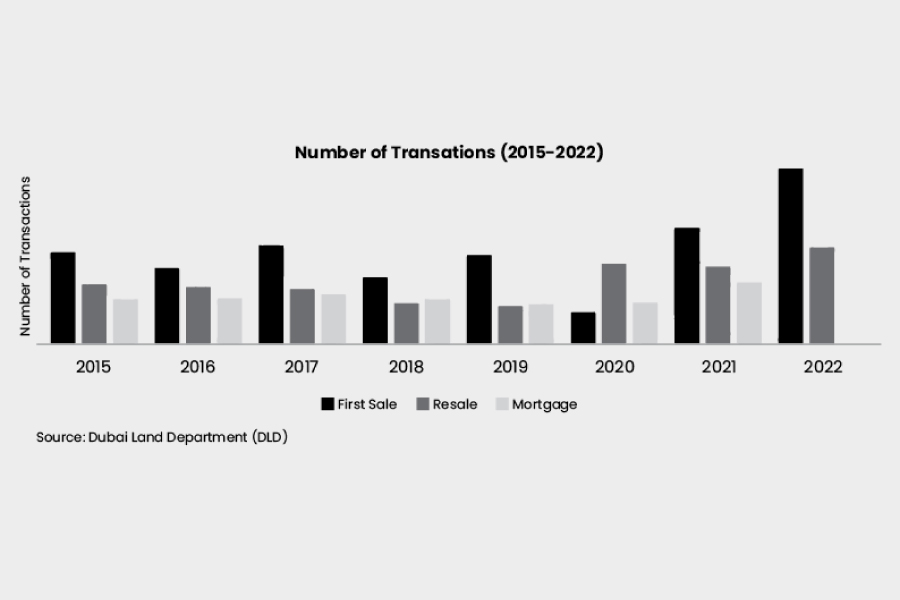

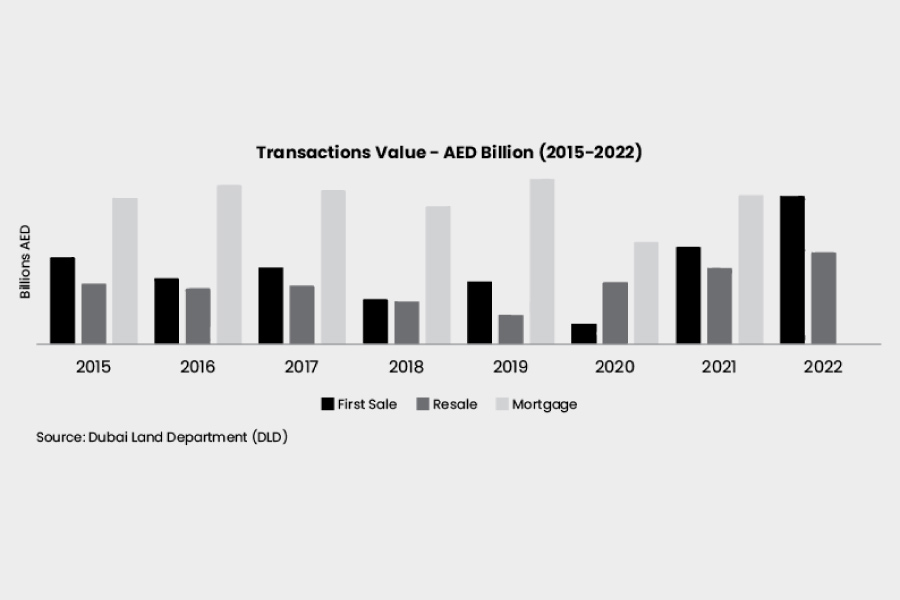

When we look at real estate transactions in the city, according to the latest published figures from Dubai Land Department (DLD), Dubai’s real estate market registered around 55,112 sales transactions worth AED 128 billion in 2022, in addition to 30,433 resale deals worth AED 79.2 billion. This represents an increase of 51 percent in the number of sale transactions compared to 2020 and a 25 percent increase in the number of resale deals. In 2022, the real estate sector showed growth, with massive demand seen from Russian, Asian, European, and American investors, particularly from High-Net-Worth Individuals (HNWIs).

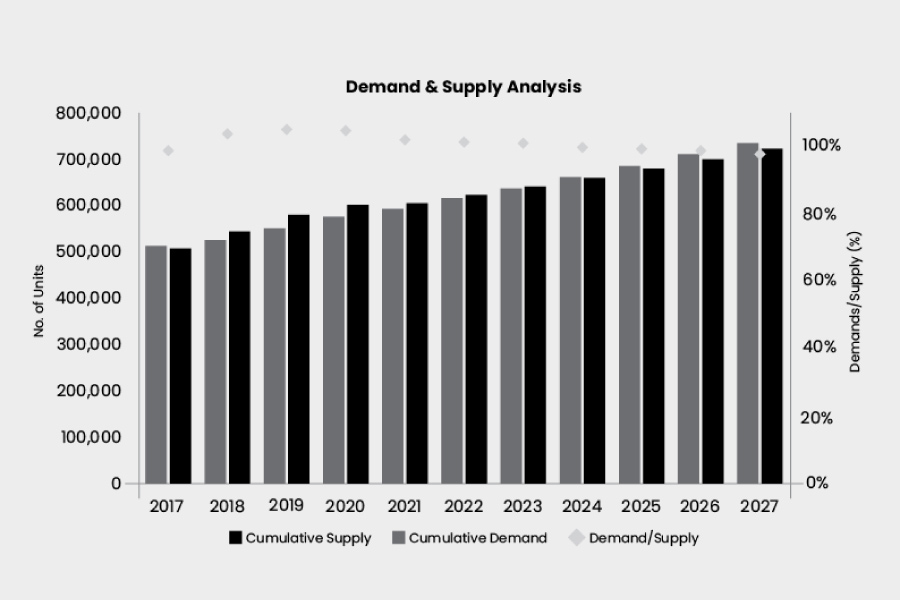

When analyzing demand and supply, we expect the cumulative residential supply to reach over 730,000 units by 2027, with demand almost at the same level. This indicates an opportunity to develop more units at the right price points in the market.

A main driver of demand for residential housing stems from the number of households in the city and its growth momentum, which can be used as an indicator to forecast future movements. With recent initiatives and regulations, including the flexible Golden Visa laws and the Dubai Land Department’s decision to improve transparency in the sector, demand and interest from foreign buyers and expats are also growing.

For more on real estate, click here.