A recent United Nations report has found that around half of the nations of the world are spending more on the interest of their debts than on education or healthcare. More than 3.3 billion people reside in nations with debt that is increasingly growing. The “crushing debt crisis” is affecting half of the global population.

The report titled, “UN Global Crisis Response Group: A world of debt. A growing burden to global prosperity, July 2023,” highlights the colossal levels of global public debt. From $17 trillion in 2002, to $92 trillion in 2022, global debt does not appear to show any signs of slowing. Nations across the world are not only struggling with crippling debt, but are facing inflation across several sectors.

Developing nations

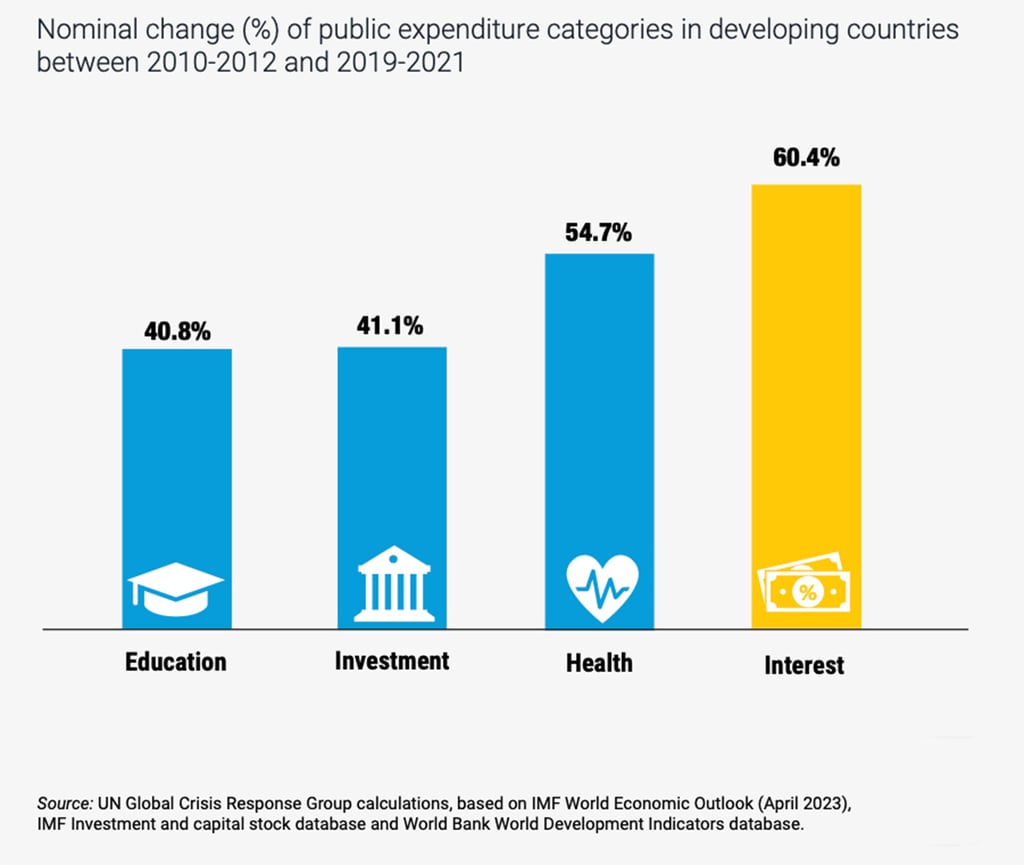

Developing countries are pooling their funds into interest on debt, with 60.4 percent of public expenditure going towards repaying private creditors and public funds. This is in contrast to 54.7 percent of public expenditure going towards healthcare. The report states that the number of nations with high debt levels increased from 22 nations in 2011 to 59 in 2022. 52 of which are considered to be facing extreme debt levels, while 36 are classified as being in, “debt row.”

Public debt is reaching crisis level due to two main factors. First of which was nations’ financial needs following the COVID-19 pandemic, inflation, and climate change. The second is the unequal international financial system that barres sustainable growth in developing countries. In fact, global debt growth has surpassed gross domestic product growth. Since 2000, public debt has increased fivefold.

Read more: Debt ceiling, recession uncertainty cast shadow on oil market

At a recent press conference, UN Secretary General Antonio Guterres stated, “In 2022, global public debt reached a record $92 trillion and developing countries shoulder a disproportionate amount.” Private creditors are known to charge extremely high interest rates to developing countries. This inhibits any sort of investment in sustainable development.

Reforms

The United Nations published recommendations for reforms that can alleviate major debt off of the shoulders of developing nations. First things first is creating a more inclusive global finance system. A more equal financial architecture would create effective growth in developing countries, allowing for governments to invest in the wellbeing in their people and nation. Further, scaling towards greater liquidity and long-term financing in times of crisis.

For more news on the economy, click here.