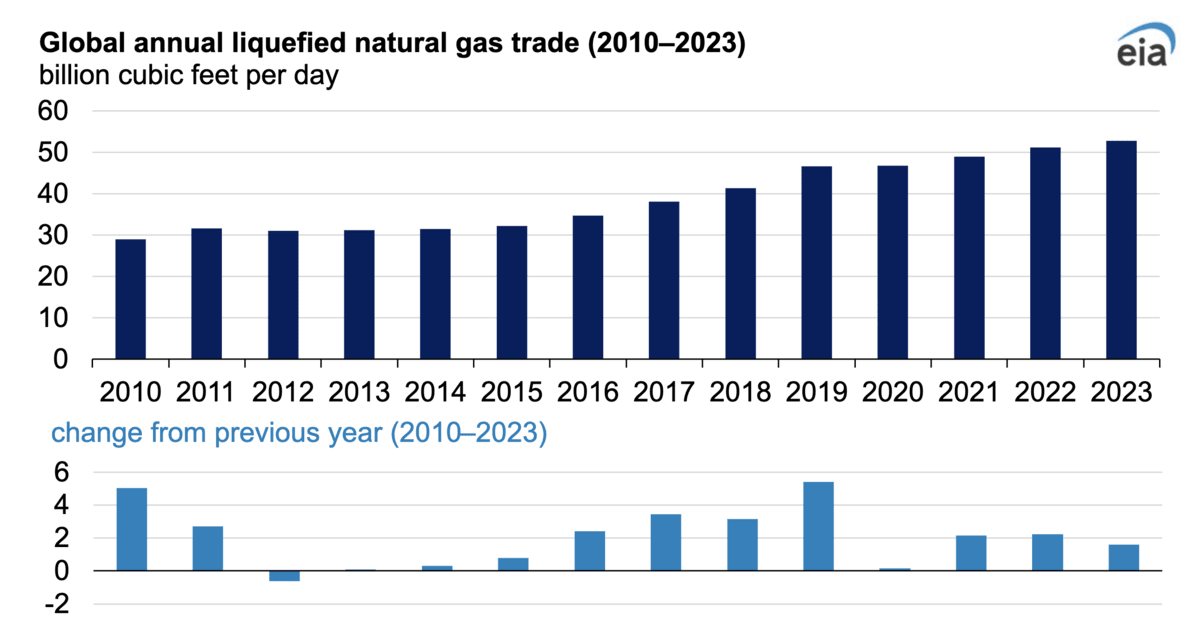

Global liquefied natural gas (LNG) trade rose 3.1 percent in 2023, averaging around 52.9 billion cubic feet per day (Bcf/d), a 1.6 Bcf/d increase from 2022, according to the latest report from the International Group of Liquefied Natural Gas Importers (GIIGNL).

The expansion in export and import capacity in addition to the rising demand for LNG drove trade growth last year.

Export capacity expands

The report, published by the U.S. Energy Information Administration (EIA), attributes the rise in LNG trade to the increase in LNG export capacity primarily in the United States, Mozambique, Russia, Indonesia, Norway and Oman.

In the U.S., Freeport LNG returned to service in February 2023 after halting operations in June 2022 and it was operating at full production capacity by April 2023.

In 2022, developers in both Mozambique and Russia commissioned new projects: The 0.4-Bcf/d Coral South Floating LNG in Mozambique and the 0.2-Bcf/d Portovaya LNG in Russia. The two projects reached full production capacity in 2023.

In Indonesia, the Tangguh LNG export facility added a third train. Meanwhile, Norway and Oman increased LNG production capacity by optimizing the operational efficiency of existing LNG plants.

World’s largest LNG exporter

Amid the rise in global LNG trade, the U.S. became the world’s largest LNG exporter in 2023, with exports rising 12 percent annually. In addition, exports from the three largest global LNG exporters, the U.S, Australia and Qatar, accounted for 60 percent of all LNG exports in 2023.

In addition, Algeria’s LNG exports increased by 0.4 Bcf/d as additional natural gas feedstock became available from the newly commissioned production fields. Exports also rose from Norway and Australia mainly due to the optimization of the export plants’ operational performance and from Indonesia after a capacity expansion at Tangguh LNG.

Asian countries lead LNG import growth

LNG import capacity saw an expansion primarily in Europe and Asia which contributed to the increase in global LNG trade. In Europe, operators placed several new Floating Storage and Regasification Units in service. In addition, they expanded regasification capacity at some existing terminals. Meanwhile, China, India, the Philippines, and Vietnam added new capacity in Asia.

Asian countries continued to lead LNG import growth globally, with imports increasing by 3.5 percent in 2023. LNG imports rose 12 percent in China, the most of any country in the world, making China the world’s largest LNG importer for the second year since 2021. Meanwhile, LNG imports in India rose 11 percent as new regasification terminals began operations and LNG prices declined. Lower LNG prices also contributed to increased imports into Thailand, Bangladesh and Singapore.

In Europe, LNG imports increased slightly by 1.4 percent. Germany, the newest LNG importer, imported 0.7 Bcf/d on average. Imports also increased to countries that expanded regasification capacity, such as the Netherlands, Italy and Finland. However, the United Kingdom, France and Spain saw a decline in imports by a total of 1.3 Bcf/d, mainly due to a decline in demand.

In Latin America, LNG imports increased mainly in Colombia. Colombia experienced drought and used LNG for natural gas-fired electric power plants to offset lower hydropower generation. In Brazil, LNG imports declined by 0.2 Bcf/d due to a rise in hydropower generation, reducing demand for LNG.

For more news on energy, click here.