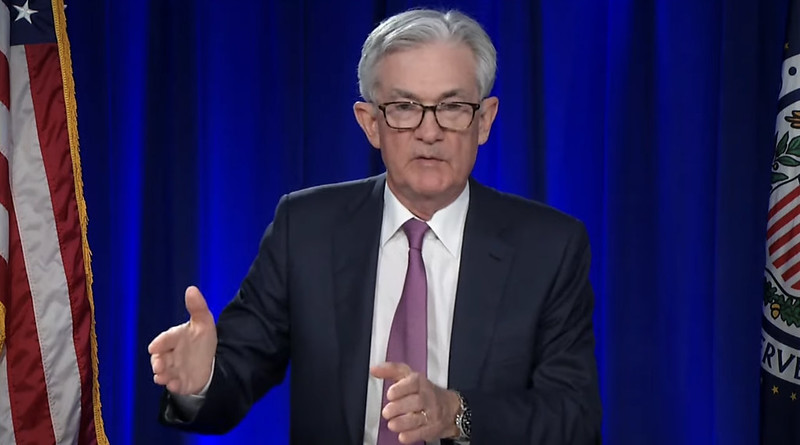

Federal Reserve Chairman Jerome Powell acknowledged that raising interest rates could cause a recession. But he stressed the US central bank’s commitment to “strongly” reducing inflation, which reached its highest level in 40 years.

Speaking at a hearing at the US Senate Banking Committee, Powell said, “It is imperative that we bring down inflation if we are to have a sustained period of strong labor market conditions that benefit everyone,” adding that the central bank would look in the coming months for “compelling evidence” that price pressures recede. “The US economy is very strong and in a good position to deal with monetary tightening,” Powell said.

Powell acknowledged that the severity of inflation “clearly surprised” the monetary authorities, and warned of the possibility of “other surprises”.

He believed that the neutral level of interest rates in the long term is about 2.5 percent.

In response to a question from a member of the Senate Banking Committee, the Federal Reserve Chairman Powell said that US central bank officials are not trying to cause a recession in their quest to control inflation.

“We’re not trying, and I don’t think we need to trigger a recession,” he said.