It is a well-established fact that property markets exhibit cyclical patterns, and Dubai’s property market is no different, with the city having undergone no less than 3 cycles in the last 2 decades.

What is a property cycle?

A property market cycle is a pattern that represents the economic changes within the real estate industry. The cycle consists of 4 phases, which follow a predictable sequence between peaks. The ‘downturn stage’ immediately follows the peak. After reaching the price ceiling during the peak, the market experiences a loss of interest from buyers, followed by declining prices. This phase is termed as a cautious market.

The next stage is the ‘trough stage’, also known as a buyers’ market, wherein there is a steady decline in prices and stable rents. The third stage is the recovery stage which is described as an equal market and typically sees increasing inquiries, a rise in sales and rents, as well as a return price progression.

The last stage in the cycle is the ‘upswing stage’, also known as a seller’s market; during this stage, there is an increase in interest, sales are quicker, rents peak, and there is strong price growth.

What phase is the Dubai property market cycle currently experiencing?

During the second quarter of 2023, the volume of ready properties increased by 11.8% YoY to 11,898 transactions, equating to investments worth AED 32 billion. The average ticket size of ready-to-move-in properties saw an annual increase of 4.2%, rising to AED 2.68 million.

Average villa valuations surpassed peaks seen in 2014 by 1.2%; villa prices increased 15.8% YoY and 4.3% QoQ. At the same time, the apartment submarket saw capital gains of 8.1% annually and 2.6% quarterly.

Read: Increasing diversity of nationalities investing in UAE property

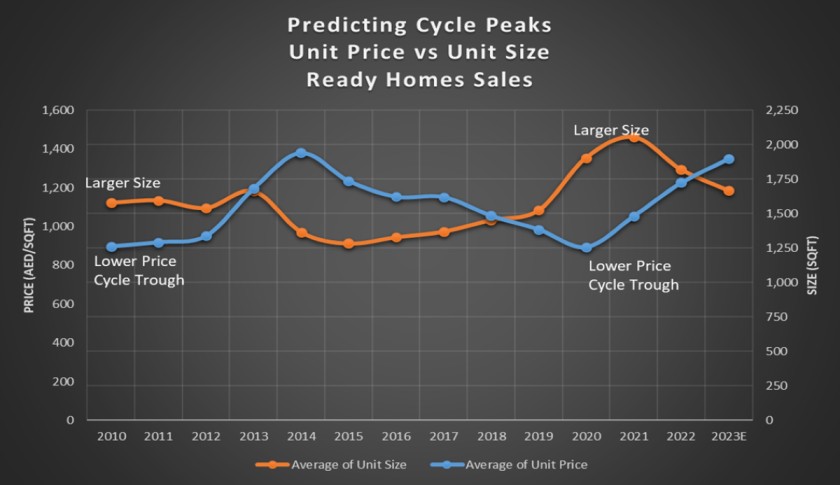

Dubai’s residential rental prices for new contracts experienced a remarkable surge, with an increase of 32.6% compared to the corresponding period last year and a growth of 3.5% since the previous quarter. Villas led the increase in new rents, recording a substantial annual increase of 52% and a quarterly increase of 3.7%, achieving an average asking rent of AED 394,500 per annum, marking the highest citywide average villa rent since 2014. This suggests that we are in the ‘upswing’ stage of the cycle, as can be seen in the graph below as well.

An interesting observation is that the unit sizes appear to follow an opposite trend to the property cycle. As the property cycle reaches its peak, the unit sizes seem to enter their trough stage, and vice versa.

Property Cycle Trend and Unit Size Trend

Demand appears to primarily drive the inverse relationship between unit sizes and the property cycle, as potential homeowners enter the market with specific budget constraints. In 2010, investors could purchase a property of 1,580 square feet for an average ticket price of AED 1.46 million. However, during the market peak in 2014, the average unit size decreased to 1,370 square feet, while the ticket price for ready homes increased to AED 2 million.

During the more recent cycle, in 2020, the average price of units sold was AED 1.8 million, and the average unit size was 1,900 square feet. However, as the market moved towards an upswing, units of 1,820 square feet were being sold for approximately AED 2.5 million. This year, the disparity has further widened, with units of 1,670 square feet now costing AED 2.6 million.

Moreover, the graph illustrates the impact of global events, such as the pandemic, on the property market. It is evident from the graph that there is a notable increase in the gap between the price trough and the unit size peak in 2020. The increase in demand for larger units during the pandemic, as people started working from home, caused this.

This inverse relationship between price and unit size, coupled with exponential increases in ticket sizes, has led to evident capital gains in the affordable segment of the market for the first time since the pandemic. Lower-priced and high-yield areas, such as Discovery Gardens (4.5%), Motor City (4.3%), The Greens (3.9%), and Dubai Production City (3.4%), have observed notable quarterly growth.

Dubai property cycle dynamics

Buyers and sellers must understand these dynamics to make informed decisions in the property market. For buyers, timing is crucial, while for sellers, the duration of the investment and when to exit the cycle to maximize benefits matter. Monitoring the property cycle and anticipating the upswing stage, where prices are growing, and rents are peaking, is equally important for sellers.

Looking ahead, we can expect price stabilization in the medium term; as rental trends lag behind sales trends, we are likely to see more rental increases in the short term. By staying informed and considering these factors, both buyers and sellers can navigate the property market effectively.

Haider Tuaima is Director and Head of Real Estate Research, ValuStrat.

For more real estate stories, click here.