Gigaprojects are driving a resurgence in Saudi non-oil sectors such as construction and tourism as the kingdom ramps up efforts to diversify its petrodollar-reliant economy through foreign direct investment (FDI).

Earlier in January, Saudi Crown Prince Mohammed bin Salman designated Diriyah as the Public Investment Fund’s fifth gigaproject after the $500 billion smart city Neom; the Red Sea, comprising 92 islands across a 28,000 square-kilometer area; the 334 square-kilometer Qiddiya; and residential masterplan developer Roshn.

These developments are a critical component of Saudi Vision Realisation Programs (VRPs) to achieve the goals of the Vision 2030 diversification mandate launched in April 2016.

It is widely agreed that gigaproject development is good for the Saudi economy at large as well as the local construction sector, which faced a sustained slowdown following the oil price crash of 2014-15 and consequent budget cuts.

The projected 9 percent year-on-year increase in Riyadh’s budget could lead to an “acceleration in the execution of mega and giga projects, which in turn is likely to aid in the recovery of the construction segment,” Al-Rajhi Capital said in December.

“Consistent offtake of new residential loans, along with the softening of construction material prices has aided the recovery of the construction sector in the kingdom.”

Contract awards

Saudi Arabia’s construction contract awards touched SAR25.2 billion ($6.7 billion) during the third quarter of 2022 led by VRPs for tourism, housing, and physical infrastructure, the US-Saudi Business Council (USSBC) said in December.

Fifteen contracts worth SAR12.6 billion ($3.3 billion) were awarded during the period, reporting year-on-year growth of SAR9.7 billion ($2.6 billion) or 73 percent.

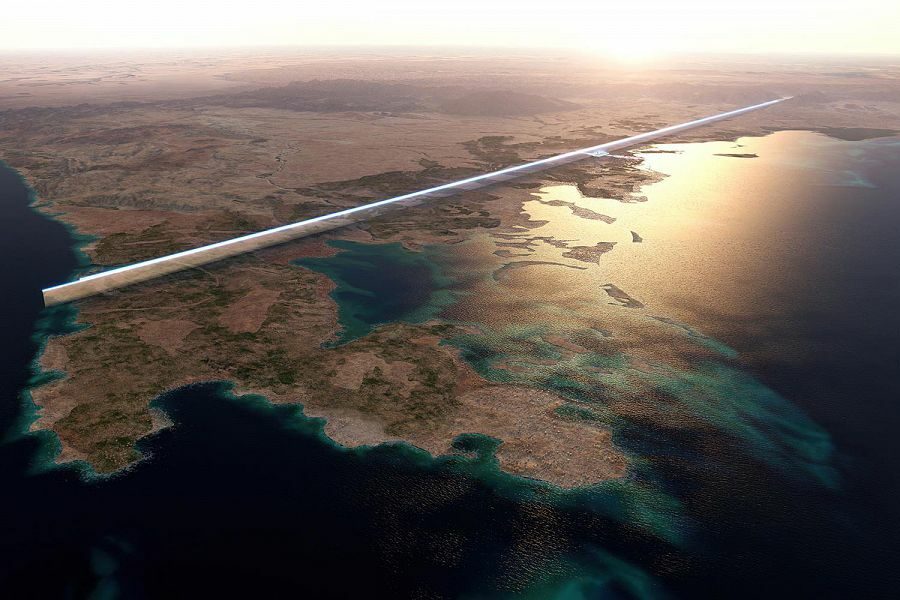

As of September 2022, Neom alone had awarded SAR23.7 billion ($6.3 billion) worth of contracts for projects including The Line and its railway network.

“The improved macroeconomic environment spurred by the kingdom’s oil revenues coupled with ongoing non-oil sector initiatives have helped propel project awards,” said Albara’a Alwazir, director of economic research at the USSBC.

FDI outlook

Gigaprojects are also providing a springboard for Saudi Arabia to rapidly ramp up its non-oil FDI inflows. Riyadh is targeting foreign investment to reach 5.7 percent of economic output, but the oil industry remains its most lucrative sector for now.

Most of the $19.3 billion of foreign investment drawn by the kingdom in 2021 – the highest since 2010 – came from state oil company Saudi Aramco selling part of its pipeline unit.

But the kingdom’s non-oil FDI efforts are undeterred and the kingdom has “so many enablers that can attract a lot of partners,” Saudi minister of economy and planning, Faisal Alibrahim, reportedly said on the sidelines of the World Economic Forum’s 2023 annual meeting in Davos.

Read more: Red Sea project, NEOM, to accelerate regenerative tourism to Saudi

“We have the right kind of incentive structures and governance and processes in order to attract the right kind of investors for the right kind of returns for them as partners.”

The Saudi government has introduced over 700 regulatory changes as it seeks to attract investors, Alibrahim said, adding: “We’re very serious about our diversification efforts.

“We’re open and we’re talking to all partners who’re interested in the Saudi story.”

Foreign construction companies are continuing to win work on schemes targeting the kingdom’s VRPs, including its gigaprojects, but there remains ample room for inflow growth.

The Lumina Cross-Border Insights report issued earlier in January states Saudi Arabia’s top seven infrastructure projects – Neom, Roshn, Diriyah Gate, Jeddah Central, the Red Sea project, AlUla, and Qiddiya – alone will cost $690 billion to construct.

FDI partners will be critical to achieving the ambitious economic contribution targets set for Saudi Arabia’s gigaprojects. Riyadh will count on its regulatory updates, combined with the business potential its gigaprojects are positioned to offer, to quickly raise its attractiveness to global investors.

To read more on Saudi’s latest projects, click here