I’m sure that by now, everyone around the world has become familiar with the term “Inflation” and/or “Hyperinflation”, and if you are not familiar with what these terms mean, well in plain English, it is higher prices. Which prices? Almost everything, from your daily cup of coffee all the way to your house price.

These terms are going to stay with us over the next years not just months, and this is all because of the covid-19 pandemic, which is here to stay, and its effect will continue to leave a clear mark, which is already being inked in history books.

In this article, we will discuss the reasons behind the recent inflation hikes, and why you should care about what’s coming because the effect will be on your daily life.

Why Inflation Soared in 2021

If we can understand why inflation has risen so quickly over the past few months, it could help clarify how long this hype might last, what policymakers might do about it, and what you should do about it as well.

The recent increase in inflation comes on the backdrop of the global supply chain, which saw a notable shortage of everything, due to the lockdowns the world witnessed back in 2020, and the ongoing restrictions around the world. It is not tied to the regular business cycle that we saw before. It was all about covid-19.

The continuing disruption in global supply chains amid the pandemic; turmoil in the labor markets; higher consumer demand after the reopening, are the main reasons behind the recent rise in inflation. To put it in simpler terms: Low supply with high demand lead to higher prices.

Until the date of writing this piece, Dec. 30th, the world was short on staff who would help in lowering inflation rates, including truck drivers, ports workers, handlers, and even customs and so far, no one is able to answer the 1-million-dollar question: Where are all the unemployed workers? Why are they not going back to work, while every company around the world has open vacancies? Only time will tell.

Therefore, until this is solved, and workers are back to work, it is hard to believe that inflation will peak anytime soon.

What Policymakers Will Do About Inflation

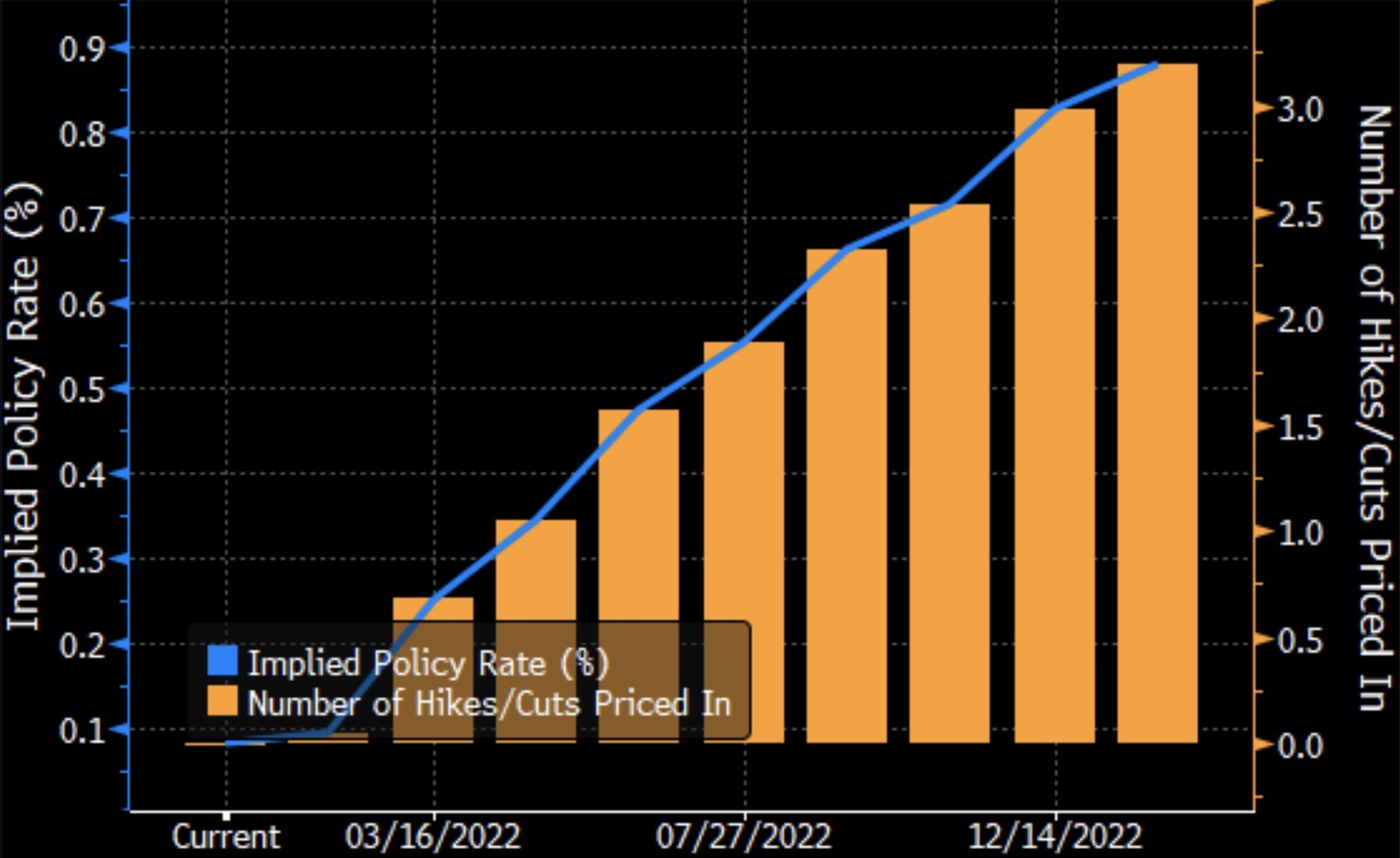

Central Banks around the world have already started to move in order to curb inflation. They might be a bit late, but better late than sorry, they say. We have seen several central banks already raising their interest rates and decreasing the stimulus packages that were announced during the lockdown. Such a shift in policy will have a long-term effect, depending on whether they will be able to continue with tapering the current stimulus packages and raise rates without putting a huge drag on growth. But we have seen this before, and central banks were able to handle it somehow, yet, this time, it might be different.

In 2022, central banks are expected to continue to increase rates, but the question remains: How fast and how high rates can go? The short answer is that it all depends on inflation and growth at the same time.

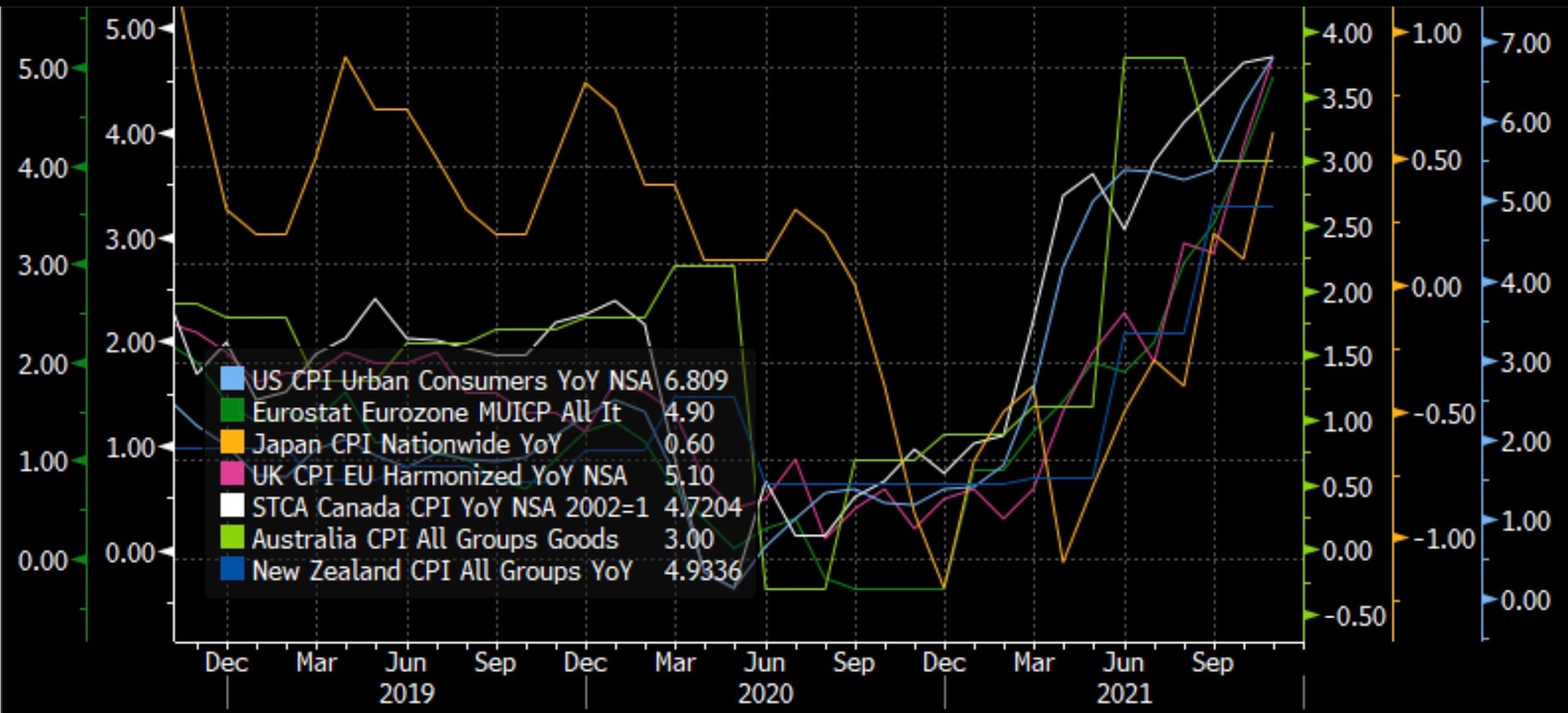

So far, inflation is considerably above the Federal Reserve’s target which is 2% and the average global inflation in 2021 is well above that, which means that central banks are well behind the curve.

With supply chain disruption and the fears of Omicron and some lockdown here and there, inflation may need more time before peaking, which increases the risk of faster rate hikes by central banks. And those central banks might need to ignore the effect of higher rates on growth, even if their respective economies or the global economy might slide back into a recession. This is the biggest risk that 2022 will hold.

How Higher Inflation Affects You?

If you are in debt, you should be concerned about higher rates, and you should start working on a plan to deal with it. Higher interest rates mean that soon you will have to pay higher premiums on your debt, whether if it’s a credit card, mortgage, student loan, personal loan, or any kind of debt.

Some might say, but a 2% rate is not that big of a difference, in reality, you will have to check your debt terms, there is a lot between the lines. The 2% might be worth hundreds of dollars a month.

Higher rates mean, higher monthly payments and if central banks decided to act faster, rates could go even higher and faster above 2%, which might lead to a recession. If so, a lot of jobs will be lost once again as companies will start restructuring in order to deal with a low business cycle.

What Can You Do About High Rates?

To start with, if you have a mortgage loan, it is prudent to lock in your mortgage at current rates before they rise. If you are eligible to refinance your house, this is probably the time to do so.

If you are able to pay off those small debts here and there, you should do so. Pay a visit to your bank and ask about your long-term debt rate if you are able to refinance these loans at the current rate such as your car loan is also a good idea.

If you are not investing in stocks, you should consider them as well, but not any stocks. During such a period, the price of raw material often remains stable or declines when the rate rise. This means that companies’ profit margins, which use these raw materials will rise as the costs drop, and those are companies that you should buy their stocks as they are generally seen as a hedge against inflation.

Finally, you have to look into reserving some precious metals. I know you might say, gold is at $1800, too expensive. Yes, that’s correct, but you can also diversify your purchases. Am not saying to go ahead and buy a full ounce for $1800. There are multiple options that you can choose from or you can do them all together.

- Gold coins: each coin is 8 grams, which would cost you less than a full ounce, and you have to think about buying these coins at least once every month. Set a side an amount to buy gold coins. Small purchases will add up and will protect your wealth amid declining purchasing power.

- ETF’s and mutual funds: you can buy gold as an ETF stock, and the main fund is GLD, and it’s around $168 a share.

- Gold Miners Stocks: There are multiple gold miners stocks that you can also start investing in, such as Newmont Corp. (NME), Barrick Gold Corp. (GOLD), and Franco-Nevada Corp. (FNV)

* Nour Eldeen Al-Hammoury is the Chief Market Strategist at FBS, and the owner of NourHammoury.com. He has decade of experience in monitoring and analyzing foreign exchange and global economic developments, as well as central bank policies and intermarket analysis (global markets).

* Nour Eldeen Al-Hammoury is the Chief Market Strategist at FBS, and the owner of NourHammoury.com. He has decade of experience in monitoring and analyzing foreign exchange and global economic developments, as well as central bank policies and intermarket analysis (global markets).