On the 21st of this month, the head of the IMF mission, Ernesto Ramirez, will return to Beirut, accompanied by the permanent resident representative in Beirut, to follow up on the implementation of the preliminary agreement that was made at the level of experts between the Lebanese government and the Fund, in the hope of reaching a final agreement with the organization.

At a time when the fund’s spokesman, Jerry Rice, did not reveal the name of the representative appointed by the fund, “Economy Middle East” learned that he would be Federico Lima. He is an economist who worked in the African Department of the International Monetary Fund and has extensive experience working in emerging and low-income market economies including Burkina Faso, Ghana, Lebanon, Peru and Zimbabwe.

Lima’s task will be to prepare a weekly report to the fund’s management on the developments in the file of the final agreement and the fate of the decrees that collectively constitute the preconditions for concluding the agreement between the two parties.

The resident representative of the fund

This is not the first time that the Fund has appointed a resident representative in Beirut. In 2008, it opened a representative office after the 2007 “Paris III” conference that followed the July 2006 war. Edward Gardner served as the resident representative from January 2008 until March 2009, followed by Eric Mutu from September 2009 to August 2011.

The importance of opening a representative office in Beirut is that it proves the insistence of the IMF and those behind it to rescue Lebanon from its complex economic crisis, which is soon entering its third year. However, the debates taking place in Beirut do not indicate that the agreement with the Fund will be achieved.

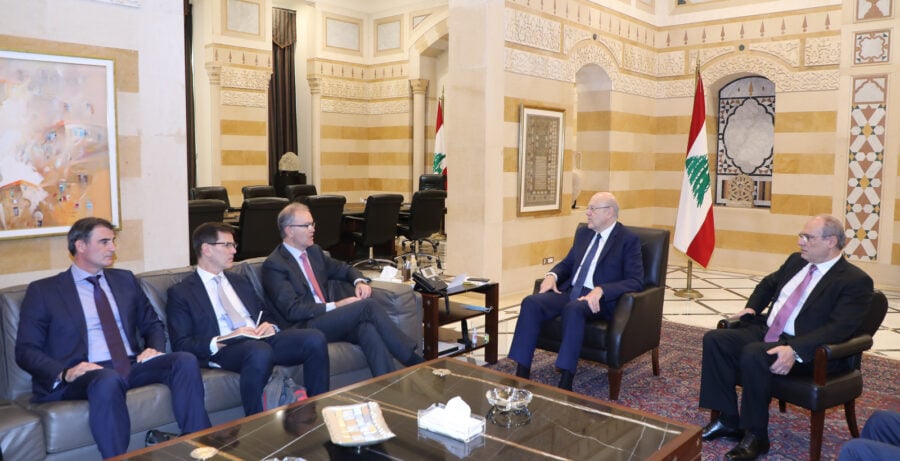

The financial and economic recovery plan approved by Prime Minister Najib Mikati’s government before it turned into a caretaker government following parliamentary elections does not receive local support. This is what the fund requires.

And as “Economy Middle East” mentioned earlier, the confrontation will return between the executive authority and the banking sector, which is preparing for a battle to “defend its existence”, according to banking sources.

The plan writes off $60 billion from Lebanese banks’ investments in the Central Bank, most of which are depositors’ money. It estimates losses in the banking sector at about $70 billion.

The return of escalation between the government and banks

Banking sources told Economy Middle East that the banks breathed a sigh of relief with the statement of the caretaker Prime Minister, Najib Mikati, that the plan could be reconsidered, explained and amended, despite its approval in the Cabinet, but the statements of his deputy head of the negotiation committee with the IMF, His Excellency Al-Shami, did not indicate this path. In his statements, he responded to calls to change the plan by saying that this matter was “illogical”, and he said decisively, not subject to discussion or modification for him, that banks “must start first in terms of bearing losses from their capital before touching any depositor.”

The private funds of banks currently amount to about 16 billion dollars on the basis of the official exchange rate, given that these private funds are recorded in Lebanese pounds in their balance sheets, while they will not exceed two billion if they are calculated on the basis of the parallel market exchange rate. Even if it was $16 billion, writing it off means that depositors will suffer the loss of the remaining $60 billion to be written off from the Banque du Liban’s budget. Also, writing off private funds means destroying a banking sector that is supposed, according to Mikati, to be “a mainstay in the economy, and should not be excluded from the solution and the recovery plan” in the country.

“This does not mean excluding the banking sector, but rather that each side bears its responsibility for the losses,” says an economic analyst for ‘Economy Middle’.

“Officials must distribute the losses fairly and open up to the Lebanese the truth about the financial reality,” he added.

This analyst does not see that Lebanon will succeed in passing the decrees required of it in light of this vertical division in the new parliament.

Projects awaiting approval by Parliament

Parliament has before it four fundamental bills to address IMF demands: the draft budget for the year 2022, which reached the General Assembly after completing its study in the Parliamentary Finance and Budget Committee, without knowing the reasons that prevented its approval; A draft law imposing restrictions on transfers, or what is known as capital control, for which a final draft was prepared after many proposals were put forward about it and the delay of more than two years for its approval, and which led to the transfer of large sums abroad; amending the Banking Secrecy Law; and the project to restructure the banking sector, which the resigned government was late in completing its final version, which keeps it suspended until a new government is formed.

It is already unlikely that parliament will accomplish all that is required of it before the annual recess into which the IMF will enter next August. In the intervening period, Lebanon must approve the reforms and the head of the mission submits a progress report to the Fund, which in turn invites the Board of Directors to meet to consider approving a financing program with Lebanon. It is a long path and dark tunnel that Lebanon may not be able to walk out of.