The European Central Bank (ECB) surprised markets with a larger-than-expected rate hike, the first in 11 years.

It raised the key interest rate by half a basis point, at a time when the eurozone faces accelerating inflation and the specter of an energy crisis.

The central bank was expected to raise the key interest rate by a quarter point.

The ECB rate hike decision brings the eurozone out of negative interest for the first time in eight years to zero percent.

The interest on the main refinancing operations rises to 0.5 percent, and on the marginal cost of lending to 0.75 percent. The bank said that decisions to raise interest rates in the future will be “depending on the data.”

“The Governing Council considered it appropriate to take a larger first step on the path to normalizing its policy rates than it indicated at its previous meeting,” the ECB said in a statement.

The euro rose to the highest level in the session on the news of a further interest rate hike, to trade at 1.0257 dollars. The yield on Italian 10-year bonds also jumped after the news, extending gains after the reaction to the resignation of Prime Minister Mario Draghi earlier on Thursday.

The ECB also said that the move in interest rates “would support the return of inflation to the medium-term target of the Governing Council by further cementing inflation expectations and ensuring that demand conditions are adjusted to achieve the medium-term inflation target”.

The central bank’s inflation target is 2 percent.

The ECB had previously indicated that it would raise rates in July and September as consumer prices continued to rise, but it was unclear whether it would go so far as to bring rates back to zero.

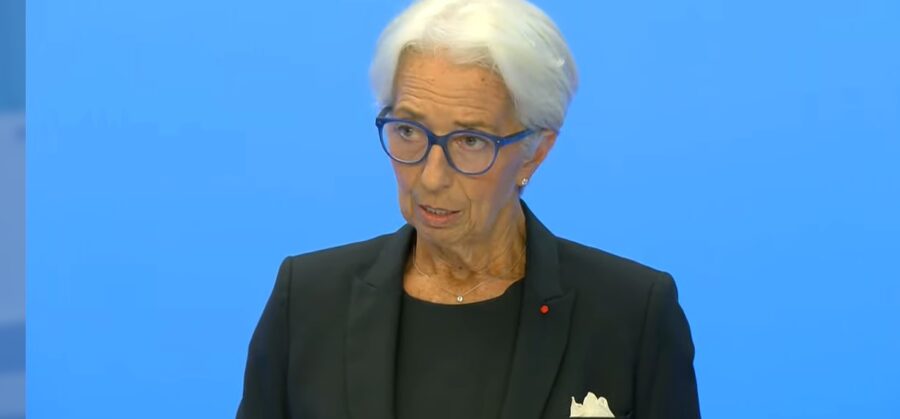

In a press conference after the meeting, ECB President Christine Lagarde stressed that the repercussions of the Russian war in Ukraine and high inflation cast a bleak shadow on the economic prospects in the eurozone.

She said that “the unjustified Russian aggression against Ukraine represents a continuing impediment to growth. The repercussions of high inflation … and growing confusion are weakening the economy,” adding that these factors “cast a shadow over the prospects for the second half of 2022.” She added that inflation in the euro area “remains undesirably high… and is expected to remain above our target for a considerable time”.

The rate hike came in response to an unprecedented rise in prices, driven by disrupted supply chains and rising energy costs in the wake of Russia’s invasion of Ukraine.

The inflation rate in the euro area reached 8.6 percent in June, the highest level in the history of the region that uses the single currency. It is well above the ECB 2 percent target.

The ECB had forecast an inflation rate of 6.8 percent for the entire year, and 3.5 percent in 2023.

In terms of growth, the Central Bank estimates the GDP growth rate at 2.1 percent for this year and next.

Anti-fragmentation tool

The ECB unveiled a new tool dedicated to crises, aimed at controlling the costs of lending to debt-burdened governments in the eurozone such as Italy.

The instrument, called the Policy Mainstreaming Protection Tool, is a share-buying program that “can be activated in the face of unexplained and turbulent market dynamics that represent a serious threat to monetary policy mainstreaming across the