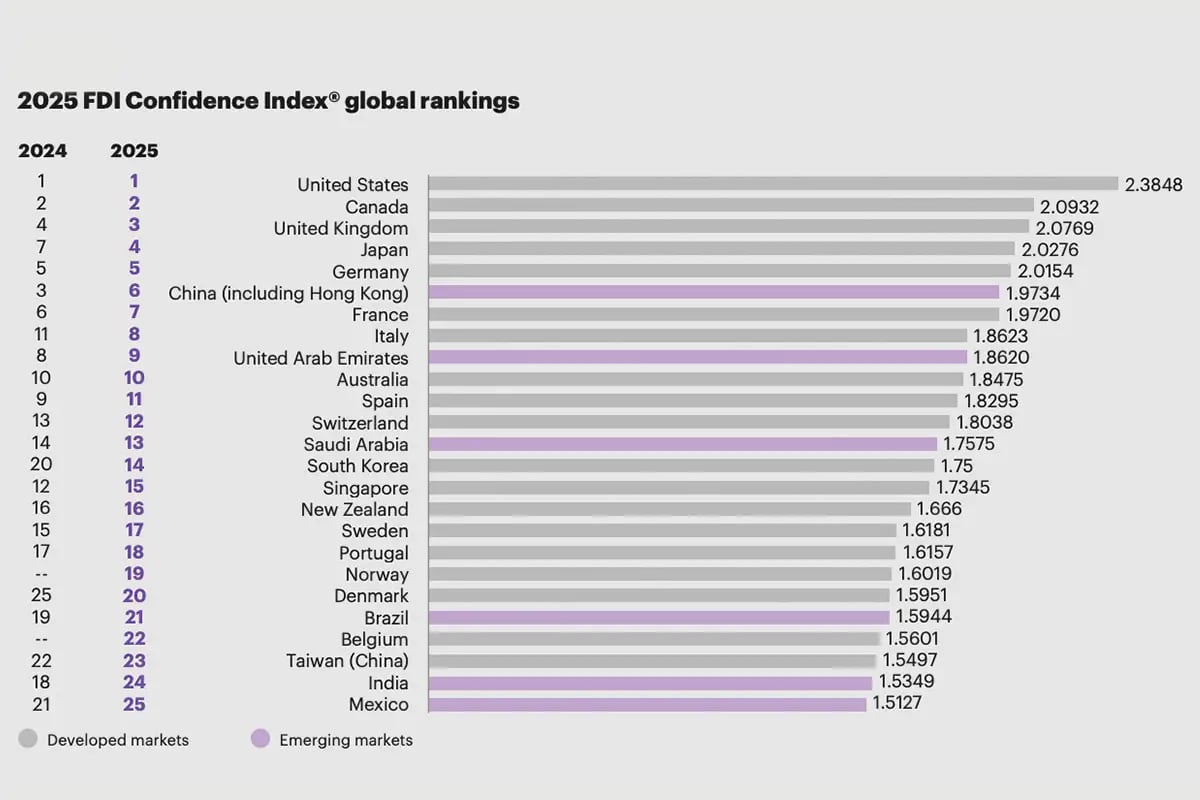

The United Arab Emirates (UAE) and Saudi Arabia have solidified their status as premier investment destinations, securing impressive positions in Kearney’s 2025 Foreign Direct Investment (FDI) Confidence Index. The UAE maintained its position at 9th globally, while Saudi Arabia climbed to 13th place, continuing the kingdom’s remarkable ascent in international investor confidence.

The annual survey, which polled 536 senior executives from leading global corporations in January 2025, arrives at a moment of significant global uncertainty. With 83 percent of investors anticipating increased geopolitical tensions to impact their investment decisions, the strong performance of both Gulf nations signals their growing importance as stable havens for international capital. Looking at the rankings just for emerging markets, UAE ranked 2nd followed by Saudi Arabia at 3rd, just behind China.

Read: UAE economy set to grow 4 percent annually through 2028: S&P Global

Economic fundamentals drive investor confidence

The UAE’s appeal to international investors stems from robust economic projections, with anticipated output growth of 4.8 and 6.2 percent in 2025 and 2026, respectively, according to the report. This economic dynamism ranked as the primary factor attracting investors to the Emirates, according to the survey data.

Beyond raw economic metrics, the UAE’s strategic focus on logistics infrastructure demonstrates forward-thinking planning. The Etihad Rail project, designed to connect major regional hubs, exemplifies the nation’s commitment to enhancing its position as a global commerce facilitator. This infrastructure development aligns perfectly with investor priorities, as infrastructure quality emerged as one of the most critical factors in FDI decision-making across all markets surveyed.

Saudi Arabia’s rise in the rankings reflects the kingdom’s aggressive economic transformation agenda. KSA’s Project Transcendence, a $100 billion initiative announced last year, aims to develop a comprehensive AI ecosystem. This ambitious programme encompasses data centres, startup support mechanisms, and robust talent recruitment strategies, positioning Saudi Arabia at the forefront of technological innovation in the region.

Regional resilience amid global uncertainty

The performance of both nations becomes particularly noteworthy when contextualized within broader global trends. According to the report, 38 percent of surveyed investors anticipate rising commodity prices, whilst 35 percent expect increased geopolitical tensions — a seven-point increase from the previous year.

“Taken collectively, the results of our 2025 FDI Confidence Index suggest a world at inflection,” noted Erik R. Peterson, partner and managing director of the Global Business Policy Council at Kearney, and a co-author of the report. This observation underscores the significance of the Gulf states’ strong showing amid such uncertainty.

Investor optimism remains strong

Despite global headwinds, investor sentiment towards both markets remains notably positive. The report states that the UAE achieved a net optimism score of 42 percent, representing a 4 percent year-on-year increase. Saudi Arabia, meanwhile, garnered a net optimism score of 32 percent, with investors particularly attracted to the kingdom’s natural resources and burgeoning technological capabilities.

The study revealed that only two markets from the Middle East and North Africa region made the global top 25, highlighting the exceptional performance of both the UAE and Saudi Arabia in attracting international investment interest.

Strategic implications for global investors

The strong performance of both Gulf nations reflects broader shifts in global investment patterns. With developed markets dominating 19 of the top 25 positions in the index, investors appear to be prioritizing stability and regulatory efficiency — areas where both the UAE and Saudi Arabia have made significant strides.

The emphasis on economic performance and technological innovation as primary investment drivers aligns perfectly with both nations’ strategic development plans. For Saudi Arabia, Vision 2030 continues to guide economic diversification efforts, whilst the UAE’s focus on becoming a global hub for innovation and logistics resonates with investor priorities.

Future outlook

As global businesses navigate an increasingly complex international landscape, the Gulf region’s combination of economic dynamism, strategic location, and commitment to innovation positions it as an attractive alternative to traditional investment destinations.

The continued strong performance of both the UAE and Saudi Arabia in attracting FDI confidence suggests that their economic transformation strategies are bearing fruit, even as global uncertainty mounts.

The 2025 index results indicate that despite challenges, international investors maintain faith in the Gulf’s economic potential, viewing these markets not merely as resource-rich nations but as dynamic, forward-looking economies capable of delivering sustainable returns in an uncertain world.