The precious metals sector experienced a decline in trading activity during the month, as gold and silver remained range-bound. This is according to a recently published report from Saxo Bank.

Speculation surrounding future rate cuts by the U.S. and E.U. led to uncertainties about their timing, pace, and depth. This uncertainty caused the market to sometimes anticipate rate cuts before they were actually implemented, which increased the risk of a price correction when expectations were not met. In December, gold prices were initially pushed lower by a stronger-than-expected U.S. inflation report, but they did not break through the key support level at $2010. Subsequently, gold prices rose again following a weaker-than-expected Producer Price Index (PPI) report.

Certain components of the PPI report, which are used in the calculation of the Personal Consumption Expenditures (PCE) inflation measure, showed weakness. This weakness could potentially lower the 3-month and 6-month annualized rates of PCE inflation below the Federal Reserve’s 2 percent target, as per Saxo. In addition to this, simmering geopolitical tensions also supported a temporary increase in gold prices due to short-covering and technical buying. However, gold prices faced resistance around $2060 and were rejected, indicating a potential upper limit for the range. As long as gold finds support near $2010, it is likely to remain within the range, but a break above $2060 may lead to a rally towards the late December high at $2088, the paper stated.

Influences on short-term direction

From a trading perspective, Ole Hansen, head of Commodity Strategy at Saxo Bank, mentioned that the short-term direction of gold and silver will be influenced by incoming economic data and its impact on the timing and pace of future rate cuts. On Monday, ECB member Holzmann’s comments pushed back against the market’s expectation of six quarter-percent rate cuts by the European Central Bank this year, citing concerns about inflation and geopolitical risks. However, another ECB member, Villeroy, contradicted those comments by stating that rate cuts are likely in 2024 but the timing remains uncertain. The conflicting statements resulted in selling from traders who had recently established long positions.

Read more: Gold prices dip with stronger dollar, cautious rate cut approach

Key market indicators to monitor

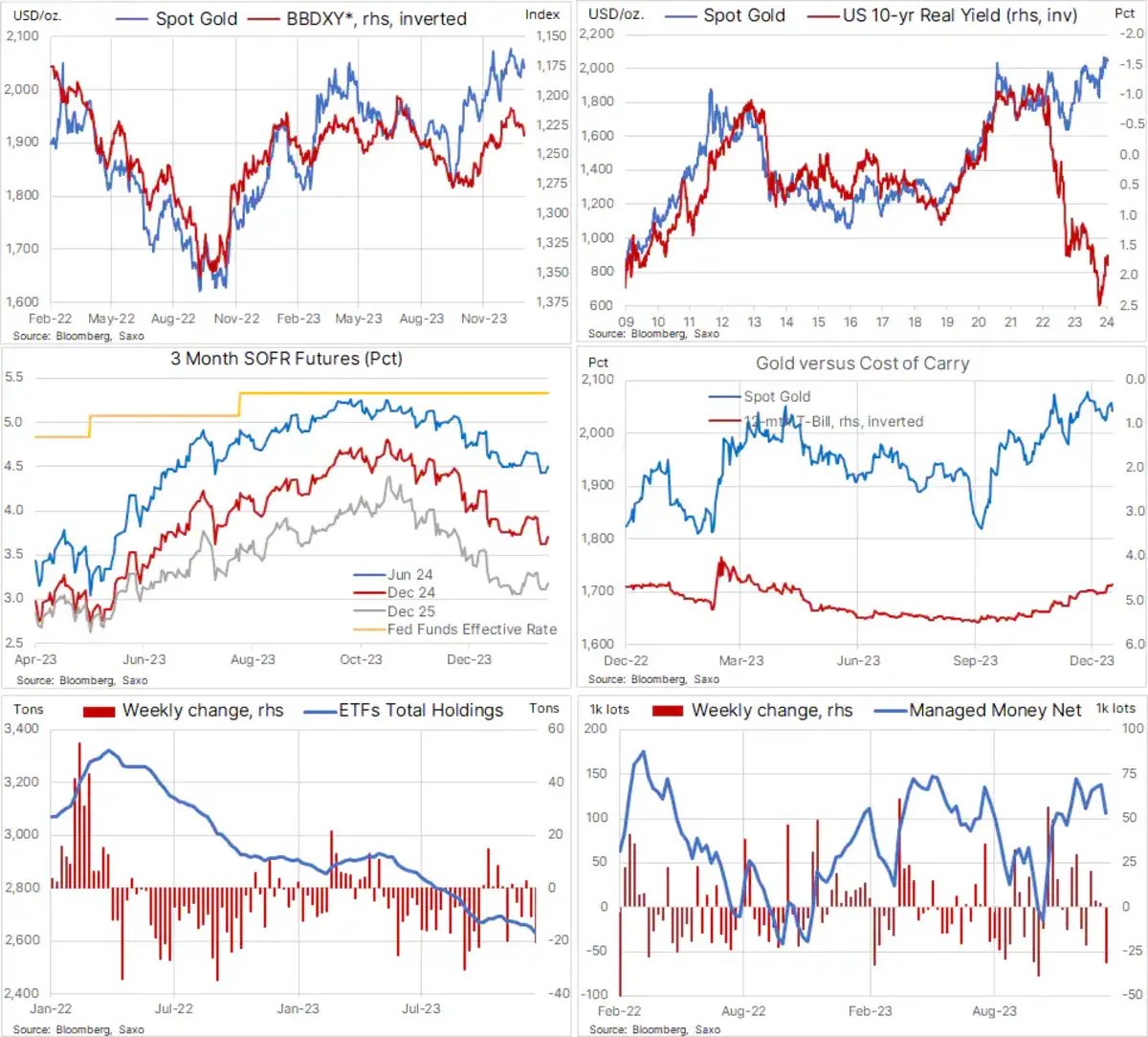

In terms of monitoring the market, Saxo noted that it is important to observe movements in the dollar, 10-year U.S. real yields, short-term interest rate futures, as well as trade flows in ETFs and futures. The weakness observed today was driven by the dollar, which had experienced eight weeks of selling from speculators in the futures market. This selling left the dollar vulnerable to short-covering, which gained momentum due to increased geopolitical tensions and reduced expectations of a rate cut by the Federal Reserve in March. However, the expectation of at least six quarter-percent cuts by the Fed throughout the year remained intact.

Lack of investor interest in ETFs hinders gold

According to the study, one of the challenges for gold is the lack of interest from investors in ETFs, as total holdings have reached a near four-year low. Until the cost of holding a gold position decreases, it is unlikely that there will be a significant increase in demand to support prices. Speculators in the futures market also contribute to market volatility by buying when prices are strong and reducing their exposure when prices weaken.

Factors affecting silver weak performance

Furthermore, Saxo said silver continues to trade near a ten-month low relative to gold due to weak performance in industrial metals at the start of the year, concerns about global economic growth, and a lack of strong stimulus initiatives in China. Additionally, there is strong resistance around $23.60 for XAGUSD, which attracts profit-taking from short-term swing traders. On the other hand, support at $22.50 is also strong, keeping the price of silver range-bound for now. Speculators in the futures market maintain a generally bearish outlook on silver prices, as evidenced by the latest Commitments of Traders (COT) report, which showed a 50 percent drop in net long positions to a two-month low of 8,000 contracts, below the average position held throughout the past year (12,000 contracts).

For more news on markets, click here.